|

Liberty summer spinoff set

|

|

April 11, 2001: 2:59 p.m. ET

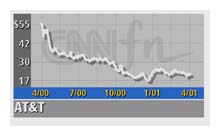

AT&T gets favorable tax ruling, to spin off Liberty this summer

|

NEW YORK (CNNfn) - AT&T on Wednesday won a favorable tax ruling that will allow it to spin off Liberty Media into a separate company this summer.

The Internal Revenue Service ruled that the proposed split-off qualifies for tax-free status. AT&T said it needs to complete certain reorganization steps before the split can be completed.

Liberty, which currently trades as a tracking stock for AT&T, will now convert to an asset-based security and trade separately from AT&T. The telecom company will redeem Liberty Class A and Class B shares for corresponding shares of Liberty common stock, AT&T said in a statement.

Liberty will then trade this summer on the New York Stock Exchange under the ticker symbols "LMC.A" and "LMC.B." Following the split, Liberty Chairman John Malone will retire from AT&T's board.

New York-based AT&T (T: down $0.19 to $21.53, Research, Estimates) is spinning off Liberty, its television programming unit, as part of its acquisition of Tele-Communications Inc. in March 1999. Englewood, Colo.-based Liberty has stakes in various cable channels, including the Discovery Channel, E! and USA Networks. New York-based AT&T (T: down $0.19 to $21.53, Research, Estimates) is spinning off Liberty, its television programming unit, as part of its acquisition of Tele-Communications Inc. in March 1999. Englewood, Colo.-based Liberty has stakes in various cable channels, including the Discovery Channel, E! and USA Networks.

AT&T announced its intention to spin off Liberty (LMG.A: up $0.62 to $13.99, Research, Estimates) on Nov. 15. But the company would not pursue the spinoff if it failed to convince the Internal Revenue Service that it had a material business reason for the sale, thus avoiding a tax penalty.

The split will allow Liberty to raise capital on its own, using its stock to buy, merge or partner with other companies, AT&T said.

Press reports had said that Liberty Chairman Malone would resign from the AT&T board even without the IRS ruling to ease regulatory pressures.

|

|

|

|

|

|

|