|

DaimlerChrysler tops 3Q

|

|

October 23, 2001: 1:10 p.m. ET

No. 3 automaker shaves losses at Chrysler to help it beat EPS forecasts.

|

NEW YORK (CNNmoney) - DaimlerChrysler posted better than expected third-quarter results Tuesday as it overcame a tough U.S. auto market to cut losses at its North American Chrysler unit, and reiterated a full-year earnings target that is well above current Wall Street expectations.

The German-American automaker, the world's third-largest in terms of revenue, posted net income of $258 million, or 26 cents a share, excluding special items. While that's down the $298 million, or 30 cents a share, it posted a year earlier, it's significantly better than the 23 cents a share forecast of analysts surveyed by earnings tracker First Call.

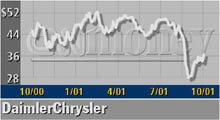

The earnings and outlook sent shares of DaimlerChrysler (DCX: up $1.49 to $36.52, Research, Estimates) about 5 percent higher in Frankfurt trading while also lifting its American depositary shares in New York.

The company said it now sees reaching the lower end of the earning guidance it gave in February, when it said it expected full-year earnings of about $1.1 billion to $1.5 billion, excluding special items. It also sees full-year revenue of $132 billion.

The lower end of that profit range translates to about $1.10 a share, which is well above First Call's forecast of 73 cents.

|

|

|

Stock prices are for DaimlerChrysler's American depository shares. | |

The company has posted EPS of 40 cents, excluding special charges, over the first three quarters, so reaching $1.10 for the year would be well nearly double current fourth-quarter EPS forecasts of 37 cents.

"Most analysts had consigned (the February earnings guidance) to the dustbin immediately after the events of (Sept. 11)," analyst John Lawson of Schroder Salomon Smith Barney told Reuters. "It would be quite an achievement if they still manage to produce a number within that range."

The outlook from DaimlerChrysler is more optimistic than at Ford Motor Co. (F: up $0.24 to $16.79, Research, Estimates), which warned last week that it will be difficult to make money in the fourth quarter. General Motors Corp. (GM: up $1.21 to $43.78, Research, Estimates) also warned that it saw a larger-than-expected drop in fourth-quarter profits.

Losses lessen at Chrysler

The company said its Chrysler unit shaved its operating loss by more than half to $243 million from $527 million a year earlier. The European Mercedes-Benz/smart car unit's operating profit climbed 9 percent to $734 million. Its commercial vehicle segment operating profit plunged 94 percent to $16 million, but its ability to stay in the black was better than some expectations.

Overall revenue a fell 3 percent to $32.7 billion. Mercedes-Benz/smart car revenue climbed 10 percent to $10.6 billion and commercial vehicle sales rose 6 percent to $6.5 billion. But Chrysler's revenue fell 4 percent to $13.3 billion and service revenue was off 15 percent to $3.7 billion.

Click here for a look at auto stocks

The company had a gain from its one-third holding in European Aeronautic Defense and Space Co. from the formation of Airbus SAS. Including that and other special items the company posted net income of $821 million, or 82 cents a share, down from $2.7 billion, or $2.74 a share, it earned a year earlier.

Reuters contributed to this report.

|

|

|

|

|

|

|