NEW YORK (CNN/Money) -

The Securities and Exchange Commission has informed two ex-Xerox executives and auditor KPMG that they are being investigated as part of a widening probe into the company, according to a published report Wednesday.

The Wall Street Journal, citing people familiar with the matter, reported that former Xerox chairman Paul Allaire, former chief financial officer Barry Romeril and KPMG partner Michael Conway are among a half-dozen individuals who have received notices giving them the opportunity to make a case against being charged.

An SEC spokeswoman declined to comment.

KPMG spokesman George Ledwith confirmed the accounting firm has been talking to the SEC about a possible proceeding against the accounting firm, adding, "We've told the SEC staff we cannot fathom the basis for any proceeding against us."

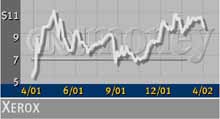

Xerox shares sank in Wednesday afternoon trading.

Last week, Xerox (XRX: Research, Estimates) agreed to pay a $10 million fine and restate results back to 1997 to settle charges of fraud. The latest SEC moves signal that the nation's top securities reguator is likely to broaden its case against the copier maker to hold top executives and auditors accountable for what agency staffers consider one of the most serious accounting cases in recent years, the paper said.

"Xerox has an agreement in principle with the SEC that effectively resolves Xerox's outstanding issues with the SEC," Xerox spokeswoman Christa Carone told CNN/Money Wednesday.

Xerox fired KPMG six months ago after it had audited the company's books for decades.

The SEC has been investigating questionable accounting practices at Xerox since June 2000. The probe initially focused on the company's Mexican unit. Last May, the company acknowledged it had uncovered some irregular accounting practices that did not comply with Generally Accepted Accounting Principles (GAAP) and that reduced shareholders' equity by $137 million and net worth by $76 million.

Xerox began settlement talks with the SEC's Division of Enforcement in March after the agency notified Xerox of plans to recommend action against the company for its alleged securities law violations.

Xerox, which analysts have said was slow to develop new printing technologies, causing it to fall behind competitors, has been trying to manage a turnaround plan launched in 2000 with job cuts and asset sales.

In last week's announcement, Xerox said its restatement could involve reallocating more than $2 billion of revenue recorded between 1997 and 2000. It didn't estimate the impact to earnings. The SEC's formal complaint will contain new information about the alleged fraud when it is filed, the Journal said, citing people familiar with the matter.

Last June, Xerox restated results for 1998 to 2000 after saying it had "misapplied" certain accounting rules. For instance, the company said it had used a $100 million reserve for costs in a way that made operating profits look better in later quarters.

|