NEW YORK (CNN/Money) -

General Motors Corp. said Tuesday that first-quarter earnings from operations more than doubled, as the world's largest automaker easily topped Wall Street expectations and raised its guidance for future results.

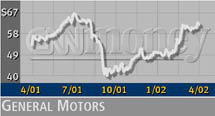

Shares of General Motors (GM: up $2.63 to $63.73, Research, Estimates), one of the components of the Dow Jones industrial average, gained about 4 percent in trading Tuesday following the pre-market report.

The company earned $645 million, or $1.29 a share, excluding special items but including the loss from Hughes Electronics (GMH: Research, Estimates), the satellite television provider the company is in the process of selling. Analysts surveyed by earnings tracker First Call expected earnings of $1.14 a share on that basis. The company reported adjusted earnings of $225 million, or 50 cents a share, a year earlier.

GM said it expects to earn $1.90 a share in the second quarter, including the loss from Hughes. First Call's forecast is for second quarter earnings of $1.59. GM also sees full-year earnings of $4.60 a share including Hughes, topping First Call's forecast of $4.17.

Excluding Hughes, GM said it should earn $2 a share in the second quarter and $5 a share for the year, up from its earlier guidance of $3.50 for the year on that basis.

The results topped even GM's raised guidance of Feb. 25, when it said it would earn $1.20 a share in the quarter excluding Hughes' 10-cent a share loss. The company at that time said it was aiming towards a $10 a share annual earnings level, excluding Hughes, in the middle of the decade, a target that has helped raise the stock nearly 20 percent since that time.

Chief Financial Officer John Devine said Tuesday that the new $5 a share target for the year should make that goal even more achievable.

| |

Related stories

Related stories

| |

| | |

| | |

|

"It's a good start on the $10 number, but we have a lot of work to do to reach it and then sustain it," Devine told analysts and reporters during the conference call Monday.

He even said the new full-year target for 2002 could be conservative. "We'd like people to be careful, not get too far in front of us given the uncertainty in this business and the fact it's early in the year," Devine said.

Revenue climbed 8.6 percent to $46.3 billion. Auto revenue climbed 9.4 percent, while sales in its core North American market were up 15.6 percent from a year earlier. Revenue from financing operations was little changed.

The company's North American automotive operations produced income of $625 million, almost equal to its overall earnings in the period. The company was helped by a better mix of vehicles sold, with higher-profit light trucks, such as pickups and sport/utility vehicles, reaching 57 percent of North American sales.

"These results are reminiscent of Ford's late 1990's performance -- driving earnings improvement with a richer truck mix," said John Casesa, auto analyst with Merrill Lynch & Co. "GM remains market-share driven and its North American pricing fell 1.0 percent. Fortunately, it was able to increase its mix of light trucks and decrease its fleet sales, offsetting partially the negative impact of lower prices."

"We expect the truck mix to gradually improve through the remainder of the year, but fleet sales will likely recover, offsetting some of the mix benefits," Casesa said.

GM's European auto operations lost $125 million, excluding the restructuring charge, more than the $86 million it lost a year earlier.

"Even excluding the charge, European auto operations continue to be a big drag," Casesa said.

Click here for a look at auto stocks

GM Asia-Pacific earned $7 million in the quarter, an improvement on the $20 million loss a year earlier. But GM's operations in Latin America, Africa and the Middle East saw losses of $40 million compared with $6 million in earnings a year earlier, as that division was hit by Argentina's currency devaluation and regional economic pressures.

GM took a first-quarter charge of $407 million, or 72 cents a share, to restructure its European auto operations, and had a number of special items related to settlements and disputes at Hughes. Including special items, the company posted net income for the quarter of $228 million, or 57 cents a share.

The company announced that a strong cash position allowed it to make a $2.2 billion contribution to its underfunded hourly employees' pension funds that it originally had not anticipated making until next year. Devine said that further contributions of $7.8 billion planned for the year should help reduce a drag that the pension funds' underfunding now places on earnings per share.

|