NEW YORK (CNN/Money) -

Xerox stock tumbled Thursday after Moody's Investors Service cut its debt rating to an even lower "junk bond" status on concerns about sales growth -- a move likely to make it more costly for the copier maker to borrow money.

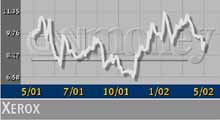

Xerox (XRX: down $0.95 to $8.12, Research, Estimates) shares sank 12 percent in midday trading Thursday. The stock is off 31 percent from its 52-week high of $11.45 set Jan. 29 when it reported a better-than-expected fourth-quarter profit.

Moody's late on Wednesday cut Stamford, Conn.-based Xerox's senior unsecured debt three notches to "B1," its fourth-highest junk grade, from "Ba1" junk status. It also cut Xerox's subordinated debt and its preferred stock.

Xerox CEO Anne Mulcahy said the ratings cut was inconsistent with the company's progress and momentum.

"Our performance demonstrates that we have significantly improved our operations and strengthened our liquidity," Mulcahy said in a statement. "We have consistently and effectively executed on every element of our turnaround plan and have clearly set the stage for a return to full-year operational profitability."

Mulcahy also noted the company's strong cash position, with about $4.7 billion on hand at the end of the first quarter. Xerox has also reduced debt net of cash by 28 percent, and has taken steps to reduce annual spending by more than $1.2 billion over the past year and a half.

One of the company's biggest concerns is its $7 billion revolving line of credit. But Xerox reiterated Wednesday that it expects to successfully complete negotiations for new terms on the credit line by the end of June. In a Securities and Exchange Commission filing last month, the company said failure to refinance the loan could threaten the company's survival.

Xerox has been struggling in recent years to catch up with competitors who pulled ahead with digital printing technology. The company has also been dealing with an SEC probe into its accounting practices.

The company agreed to pay a record $10 million fine last month to settle accounting fraud charges.

|