NEW YORK (CNN/Money) -

The Indianapolis 500 was once the premier event in U.S. auto racing. But as the race is run for the 86th time this weekend, it has become merely the second-most popular race held on that track.

The Brickyard 400, a Nascar race run at the venerable track in August, had higher ratings than the Indy 500 last year, a 6.2 for the Brickyard compared with a 5.8 for the 500. It's possible that this Sunday's race will see about half the viewers of Nascar's Daytona 500 held in February, which captured a record 10.9 rating.

Nascar, which races stock cars that outwardly look like general production cars, has become the second-highest rated sport in the nation after the National Football League. Indy car racing, also known as open wheel racing due to the vehicles' design, draws ratings more similar to the XFL if you exclude this weekend's race.

While the Indy 500 will draw between 350,000 and 400,000 fans, making it the largest spectator event in the nation, most other open wheel car races in the nation draw a small fraction of those crowds, leaving tens of thousands of empty seats in Nascar tracks around the nation where they're held.

|

|

| Last year's Indy 500 winner from Marlboro Team Penske couldn't display the sponsor's logo due to a split in the sport. |

Numerous reasons exist for the growing gap between the two types of racing. Nascar stock cars, while slower, are more sturdy than the open wheel cars, which don't have fenders. Nascar drivers can bang bumpers or doors and stay on the track, adding to the excitement for fans who prefer contact sports.

Nascar has developed the more charismatic and thus more popular drivers, many who grew up wanting to race Indy cars. Even Indy racing officials admit to a gap in current star power of their drivers.

And while a Nascar race car has less in common with your car than I do with Jason Giambi, the similarity in appearance and model name between what's in the Nascar pit and a dealer showroom allows fans to identify with their favorite drivers.

But the most unnecessary obstacle for Indy car racing is the continued split within the sport between Championship Auto Racing Teams Inc. (MPH: Research, Estimates), the publicly-traded company that sanctions a series of oval track, road and street races around the world, and the Indy Racing League, the privately held circuit that holds the Indy 500 and a series of other oval track races within the United States.

While both circuits have teams in this weekend's race, the two are completely separate the rest of the year. The six-year-old split has divided drivers, team owners and fans. Officials on both sides of the divide admit their sport would be stronger without competing circuits.

| |

SportsBiz

SportsBiz

| |

| | |

| | |

|

"Obviously it would be stronger; there's no doubt about it," said Chris Pook, the new CEO of CART. "But I think IRL is very aggressive and they want to continue. We're going to continue to run our business with a successful business model."

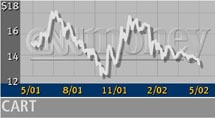

CART's earnings per share are expected to drop to 6 cents this year from 63 cents excluding special items in 2001, due to declines in sponsorship dollars and an increase in race distributions due to a participation fee paid to all teams. The circuit is changing its business model to depend more on sanction fees from race venues, to try to make up for the drop in sponsor revenue. Last year sponsor revenue fell 41 percent to $12.3 million, while sanction fee revenue gained 21 percent to $47.3 million.

The company's strongest financial measure is its healthy balance sheet with $121.4 million in cash, cash equivalents, and short-term investments and liabilities of $23.8 million on the most recent balance sheet.

Both Pook and IRL insist they have the formula for attracting fans and sponsor dollars to Indy car racing.

| |

Related stories

Related stories

| |

| | |

| | |

|

"The growth of Nascar has come at the expense of oval, open wheel racing, but I make a distinction with street and road open wheel racing which we offer," said Pook.

The Indy 500 gives IRL the clout to win a much better television contract than CART. IRL spokesman Fred Nation points to a number of CART teams switching to IRL, including the Marlboro Team Penske, which includes defending Indy 500 winner Helio Castroneves, as well as sponsors such as leading auto manufacturers.

Under the settlement with states' attorneys general, tobacco companies are only allowed to have their logos on the cars of one circuit, which meant that last year's Marlboro team car didn't have the sponsor's logo visible as it captured the checkered flag.

"They can't get the promotional marketing dollars and sponsorships we do," said Nation. "Ours is growing, CART is diminishing. "

Nation said that IRL's limiting itself to oval tracks gives it a chance to grow on Nascar tracks that sit unused for most of the year.

"So many tracks have been built because of Nascar's success," said Nation. "Those race tracks are the hardware. The IRL is the software. These tracks need more software, more events."

But Nation agrees that his part of the sport would be helped if CART wasn't also offering oval course races.

"There's room for a series that races on classic road courses in the United States," he said. "Perhaps they (CART) won't run ovals any more. But you're not going to get me to say we'll survive and they won't."

So as Nascar continues to zoom around the track, winning fans, viewers and sponsors, the open wheel portion of the sport remains stuck in the pits, with a crew working against each other rather than with each other. It's not a formula for capturing many checkered flags, no matter how many people watch the big race this Sunday.

|