NEW YORK (CNN/Money) -

U.S. stocks tumbled Monday, as amplified concerns about corporate governance, technology and international warfare triggered significant losses in both the Nasdaq and the Dow Jones industrial average.

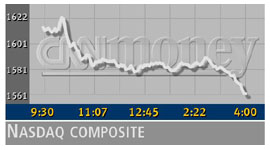

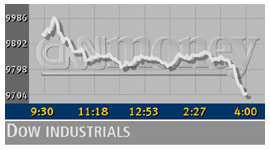

The Nasdaq composite index lost 53.17, or more than 3 percent, to close at 1562.56, a three-month low. The Dow lost 215.46, more than 2 percent, to close at 9,709.79, thus falling below 9,800, seen by many traders as a key technical level. The Standard & Poor's 500 index gave back 26.46, or 2.48 percent, to close at 1,040.68, its lowest level since October.

Stocks were under pressure all day, but saw their worst declines in the last hour.

"The headline news -- Tyco, El Paso and the threat of war out of India and Pakistan -- was ultimately just too much and stocks succumbed to the pressure," said Robert Bloom, president of LF Capital. "I think we're gonna need an air sickness bag before the week is over."

"The positive is that if we open down by at least 1 percent tomorrow (Tuesday), which I think we might, we could see a good rally off these lows," he added. "Its not random that the selling is at the point it's at. Technically, we could see a good short-term turnaround later in the week."

Concerns about corporate governance were revived following news that Dennis Kozlowski, Tyco International's (TYC: down $5.90 to $16.05, Research, Estimates) chairman and chief executive officer, resigned from the troubled conglomerate and gave up his board seat. Kozlowski reportedly is under criminal investigation for evading sales taxes in New York.

Following the news, Solomon Smith Barney downgraded the stock to "neutral" from "buy."

News of the apparent suicide of a high-level El Paso (EP: down $3.70 to $21.95, Research, Estimates) executive cast a pall over the natural gas pipeline and energy trading company -- and with it, the overall market.

"There's still a great deal of uncertainty. We've got a pretty worrying international situation," said Michelle Clayman, chief investment officer at New Amsterdam Partners. "There is a decline in confidence in business leadership based on a few bad apples, and a certain complacence about the economic data."

Also adding to investor wariness was Knight Trading Group (NITE: down $0.43 to $5.92, Research, Estimates), a U.S. stock dealer, which said a software glitch caused unusual activity in its stock. While the company's shares were lower, they were well above their price before hours, when trading was halted with the stock down 50 percent amid rumors of a potential federal investigation. The company said there were no corporate developments to explain the downturn.

Overall, "buyers remain on the sidelines with no catalyst to get back in," said Troy Nickerson, co-head of Nasdaq stock trading at Robertson Stephens. "The last time we had a recovery, people were more willing to move on hope and optimism, but this time around, they want proof."

Market breadth was negative. On the New York Stock Exchange, decliners topped advancers by almost 3-to-1 as 1.30 billion shares traded. On the Nasdaq, losers beat winners by more than 5-to-2 as 1.60 billion shares changed hands.

Software, chips, hurt techs

Hampering the tech sector was pressure on software stocks. Among them was Check Point Software Technologies (CHKP: down $0.66 to $15.60, Research, Estimates), following a negative note out of UBS Warburg that cited a slow recovery in information technology spending on a global level.

In addition, the Securities and Exchange Commission has settled its accounting probe into Microsoft (MSFT: down $1.49 to $49.42, Research, Estimates), saying the software maker understated revenue.

Semiconductors also were much lower after chipmaker Xilinx (XLNX: down $4.25 to $31.01, Research, Estimates) gave upside revenue guidance that was not as high as some analysts were expecting. Intel (INTC: down $1.00 to $26.62, Research, Estimates) also was lower ahead of its mid-quarter update Thursday.

In the day's biggest potential deal, media conglomerate USA Interactive (USAI: down $3.60 to $24.90, Research, Estimates) made an unsolicited $4.5 billion buyout offer to purchase the shares it doesn't already own of three publicly traded e-commerce names, Expedia (EXPE: up $2.13 to $73.63, Research, Estimates), Ticketmaster (TMCS: up $0.56 to $21.95, Research, Estimates), and Hotels.com (ROOM: up $1.16 to $49.05, Research, Estimates).

Offering some hope that recent signs of strength in the sector are no fluke, the Institute of Supply Management's monthly report on manufacturing showed a larger-than-expected gain. The ISM index rose to 55.7 in May from 53.9 in April; economists surveyed by Briefing.com forecast a rise to 55.

"The ISM news was positive, but the market is looking more to the non-economic factors, with people worried about Tyco and the action out of Pakistan and India," said Peter Cardillo, director of research at Global Partners Securities, referring to the increased tension between the two nuclear powers in south Asia.

In other economic news, the government's April reading on construction spending showed a gain of 0.2 percent. That was better than the forecast for an 0.1 percent drop and the revised 1.2 percent drop in March.

Treasurys were little changed, with the 10-year note yield at 5.04 percent.

European markets closed mixed, while Asian markets closed mostly higher. The dollar was weaker versus the euro and little changed versus the yen. Light crude oil futures fell 1 cent to $25.01 a barrel in New York, where gold was 50 cents higher at $327 an ounce.

"Wall Street tends to see the light switch as on or off," John Forelli, portfolio manager at Independence Investments, wrote in an afternoon note to clients. "The reality is that we're dealing with a dimmer switch and the lights are slowly coming up. The economy has picked up about as quickly as expected, but the market just isn't reacting to it."

|