NEW YORK (CNN/Money) -

Tyco International said Monday its CEO, Dennis Kozlowski, stepped down amid a criminal sales tax investigation as shares of the embattled manufacturing conglomerate fell nearly 27 percent.

Kozlowski told Tyco's board about the details of the investigation late Friday afternoon and resigned late Sunday night, according to Tyco spokesman Brad McGee.

The office of the district attorney for New York City's borough of Manhattan, Robert Morganthau, confirmed to CNNfn that it is conducting a sales tax investigation of Kozlowski and others, but a spokesperson declined further comment. McGee said the company is unaware of any other employees or board members being investigated.

Kozlowski has been replaced by John Fort, a 28-year Tyco veteran and former CEO who will act as interim CEO until a permanent replacement is found.

Kozlowski's contract, including his severence agreement, became void upon his resignation. "If he left for good cause then he would be entitled to provisions of the contract," said McGee.

|

|

| Dennis Kozlowski |

The contract had called for Kozlowski to receive a severance of three times the highest salary, cash and stock bonus he had received in any of the prior three years. "The board is committed to enter into good faith discussions with Dennis" regarding a severance package, McGee added.

As of November 30th, the company's latest proxy filing, Kozlowski held 13.4 million shares of Tyco, and in January he purchased an extra 500,000 shares, said McGee. A more recent tally compiled by Frist Call puts Kozlowski's holdings at 1.1 million shares, however.

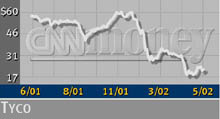

Shares of Bermuda-based Tyco (TYC: Research, Estimates) tumbled $5.90, or 26.88 percent, to $16.05 on volume of 127.2 million--the stocks fourth heaviest trading day, according to the New York Stock Exchange.

The firm is the nation's biggest manufacturer of fire extinguishers and also makes electronic components, bandages, crutches, undersea fiber-optic cable, security systems and other products.

Kozlowski helped build Tyco into a $36 billion manufacturer, making it one of the world's largest companies during the economic boom of the 1990s through a series of acquisitions.

However, the recent collapse of energy trader Enron Corp. has brought the accounting practices of such large and complex companies as Tyco and General Electric (GE: Research, Estimates) under intense scrutiny.

Tyco (TYC: down $5.90 to $16.05, Research, Estimates) shares are off about 66 percent since Dec. 5, a month before the company announced plans to split into four separate units in hopes of boosting its stock price and to address investor concerns over accounting at such diversified and complex firms.

On April 25, Tyco scrapped its break-up plan and announced it would cut 7,100 jobs. Kozlowski called the plan a "mistake" considering the sluggish economy, spending cutbacks and jitters on Wall Street over corporate accounting.

The company also said then that it planned to take its CIT financial services subsidiary public in an initial public offering, a move it reaffirmed Monday.

"We plan to complete the IPO of CIT by the end of June," Fort stated. "We will continue with our plans to make return on capital a key part of our compensation system along with earnings growth and cash flow."

Tyco opted for an IPO of CIT, which it acquired last year for $9.2 billion, instead of selling the unit outright, even as it negotiated with potential buyers of the division. Lehman Brothers pulled its $5 billion bid for CIT on May 24 after news of the offer became public. Two private equity firms, Blackstone Group and Bain Capital, were planning to make a joint offer for CIT until Lehman swooped in with its own bid.

In April, the CIT Group filed with the SEC for an IPO that could raise as much as $7.15 billion. The offering would trade as "CIT" on the New York Stock Exchange.

But even as Kozlowski tried to reverse the situation at Tyco, he faced questions about his personal dealings.

The investigation began several months ago. Prosecutors believe Kozlowski, who has moved hundreds of millions of dollars into family trusts, may have used those trusts to buy goods and services without paying state sales taxes, according to a report in the New York Times, citing lawyers involved in the probe.

Kozlowski is being represented by Stephen E. Kaufman, an experienced criminal lawyer, according to the report. Kaufman was not immediately available for comment Monday.

Officials at the district attorney's office also were unavailable for comment on the Times story.

|