|

Stock picks by the pros

|

|

June 14, 2000: 4:25 p.m. ET

Analog Devices, Conoco, Glaxo Wellcome, Royal Dutch mentioned

|

NEW YORK (CNNfn) - Market analysts and portfolio managers Wednesday favored the pharmaceutical, financial, and energy sectors as good places to park money in a meandering market.

While the markets ended mixed ahead of a key economic report due this week, recent guests on CNNfn commented on the stocks they are buying, and why.

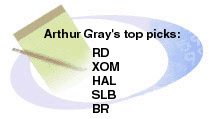

Arthur Gray, senior managing director of Carret & Co., is not interested in today's "benign Consumer Price Index numbers. That's ancient history. That was last month. Let's look ahead. The stock market's supposed to be a leading indicator as to what's happening next month and the month after that," he said. Arthur Gray, senior managing director of Carret & Co., is not interested in today's "benign Consumer Price Index numbers. That's ancient history. That was last month. Let's look ahead. The stock market's supposed to be a leading indicator as to what's happening next month and the month after that," he said.

He has a number of picks in the oil and gas sector. "We stick to the big ones. We have Royal Dutch (RD: Research, Estimates), Exxon (XOM: Research, Estimates), Halliburton (HAL: Research, Estimates), Schlumberger (SLB: Research, Estimates) and Burlington Resources (BR: Research, Estimates), a gas play, " said Gray.

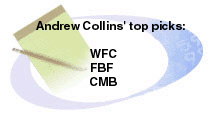

"I think that investors, particularly in the financial sector, will cease focusing on interest rates, if they haven't already, and will increasingly focus on credit quality," said Andrew Collins, bank and brokerage analyst, ING Barings. "But I think that if the economy continues to chug along, say at a 2-to-3 percent growth level, we won't see that impact credit quality in any meaningful way." "I think that investors, particularly in the financial sector, will cease focusing on interest rates, if they haven't already, and will increasingly focus on credit quality," said Andrew Collins, bank and brokerage analyst, ING Barings. "But I think that if the economy continues to chug along, say at a 2-to-3 percent growth level, we won't see that impact credit quality in any meaningful way."

"We look to some of the banks, in particular. Wells Fargo (WFC: Research, Estimates), very rapid online retail growth there," Collins said. "They have almost 1.7 million customers, 25 percent of their total households online right now. And I think that they're going to probably take advantage of that opportunity as banks are a very trusted adviser," he said. "So I'm pretty comfortable right now with the outlook over the next 12 months in terms of the banks. Not only at Wells, but also at Fleet (FBF: Research, Estimates) and at Chase Manhattan (CMB: Research, Estimates)."

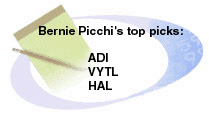

"They say that the market rises on a wall of worry. And I think that you are going to hear more and more concern about exactly that issue," said Bernie Picchi, portfolio manager, Federated Investors. "[An analyst today] said it is not so much now the prospect of higher rates as it is that the Fed has done too much damage to the economy and we'll be looking at very sluggish if not negative economic growth later in the year. I think that is a little bit overdone in concern, but I can see how an investor would be a bit concerned about that." "They say that the market rises on a wall of worry. And I think that you are going to hear more and more concern about exactly that issue," said Bernie Picchi, portfolio manager, Federated Investors. "[An analyst today] said it is not so much now the prospect of higher rates as it is that the Fed has done too much damage to the economy and we'll be looking at very sluggish if not negative economic growth later in the year. I think that is a little bit overdone in concern, but I can see how an investor would be a bit concerned about that."

Picchi's picks include a chipmaker, a fiber optic and an oil driller.

"Analog Devices (ADI: Research, Estimates) is a company that makes processing chips, the devices that convert all of analog signals - which is basically vision and hearing all of those sort of things - into digital signals," he said. "And with the explosion of all sorts of digital devices, digital telephones, digital televisions and so forth, there's just going to be more and more demand for ADI's products."

"Viatel (VYTL: Research, Estimates) are currently in the process of constructing one of the largest fiber optic communications rings around northern Europe," Picchi said. "They're offering communication capacity to their customers businesses, small business and large business and government, significantly less expensively then the incumbent carriers like Deutsche Telecom or France Telecom are doing. And I think the company will be acquired."

"Halliburton (HAL: Research, Estimates) are a very strong company particularly in the overseas oil and gas development business. And I think it's going to have a nice long run for a long period of time," said Picchi.

"The slowing economy doesn't bother the pharmaceuticals industry, but all the political rhetoric does. I actually don't think anything really negative will actually get past, certainly not this year. But we're in a little bit of a low on the primary to convention season, so I think that makes it a safe haven in the short term. But as the election picks up again, I think people will get a little bit spooked by all the headlines they see. If you're a long-term investor, it doesn't matter. You can ride through it. The valuations are fine. If you're a really short-term investor, maybe you can wait and see a little bit more," said Alex Zisson, pharmaceuticals analyst, Chase H&Q. "The slowing economy doesn't bother the pharmaceuticals industry, but all the political rhetoric does. I actually don't think anything really negative will actually get past, certainly not this year. But we're in a little bit of a low on the primary to convention season, so I think that makes it a safe haven in the short term. But as the election picks up again, I think people will get a little bit spooked by all the headlines they see. If you're a long-term investor, it doesn't matter. You can ride through it. The valuations are fine. If you're a really short-term investor, maybe you can wait and see a little bit more," said Alex Zisson, pharmaceuticals analyst, Chase H&Q.

"We're just at the start of cracking the human genetic code. So, especially if you're a long-term investor, you could argue we're really just at the start of the whole drug discovery process," Zisson observed. "But specifically, Schering-Plough (SGP: Research, Estimates) we really like, they have two or three drugs in the pipeline. Glaxo Wellcome (GLX: Research, Estimates) just launched a couple of drugs. American Home (AHP: Research, Estimates) has a bunch of new drugs rolling out. So there are plenty of good companies with good new product cycles for people to invest in. Alza (ALZA: Research, Estimates), they have two or three new drugs coming out which we really like."

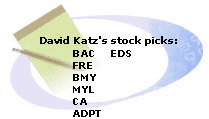

"We expect the whole year to be very volatile. When the market's excited and upbeat, it goes up a few percents, and when they get concerned about things like earnings, they'll go down. At this point, we'd probably think we're in the middle of a trading range. We think at the end of the day the market is going to be up maybe 10 or 15 percent for the year. Expect wild volatility along the way," said David Katz, stock analyst, Matrix Asset Advisors. "We expect the whole year to be very volatile. When the market's excited and upbeat, it goes up a few percents, and when they get concerned about things like earnings, they'll go down. At this point, we'd probably think we're in the middle of a trading range. We think at the end of the day the market is going to be up maybe 10 or 15 percent for the year. Expect wild volatility along the way," said David Katz, stock analyst, Matrix Asset Advisors.

"We like companies like Bank of America (BAC: Research, Estimates), or Freddie Mac (FRE: Research, Estimates) on the financial side. On the drug side, Bristol-Myers Squibb (BMY: Research, Estimates), Mylan Labs (MYL: Research, Estimates), which is a very volatile stock, just sold off about 30 percent. We think it's a great buying opportunity here. On the technology side, companies like Computer Associates (CA: Research, Estimates), Adaptec (ADPT: Research, Estimates), or EDS (EDS: Research, Estimates)," Katz said.

"If you look at 1999, financial stocks had good earnings fundamentals, but the stocks were horrible. It was their worst relative performance in the last 10 or 20 years," said Katz. "Typically, the financial stocks start to move on the upside when the Fed is about to down raising rates. We think that's the case. Now's the time to buy them."

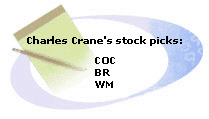

"I think they are. I think that the Fed either finished its tightening for this cycle, or it has 25 basis points to go in a couple of weeks. I do not see the Fed tightening further in August," said Charles Crane, market strategist, Spears Benzak Salomon & Farrell. "I think they are. I think that the Fed either finished its tightening for this cycle, or it has 25 basis points to go in a couple of weeks. I do not see the Fed tightening further in August," said Charles Crane, market strategist, Spears Benzak Salomon & Farrell.

"I think that stocks still have a positive bias," Crane continued. "I don't think that the pace of appreciation will be anywhere near as handsome as it has been. I do think that the wrestling match in the second half of this year will be between earnings and valuation; whereas for the last six months, it's been between interest rates and valuation."

"In the energy sector, you are facing the first factor: energy company earnings will be exploding over the next several quarters as a result of the higher energy prices," said Crane. "Two stocks that come to the head of the list in terms of being cheap at this point in time are Conoco (COC: Research, Estimates), and I would favor the Class B shares here over the Class A, and Burlington Resources (BR: Research, Estimates), a natural gas play. Washington Mutual (WM: Research, Estimates) is a Seattle-based financial services company, across a number of different markets. It caters primarily to individuals and small businesses. Stock is trading at 8-1/2 times earnings. I don't think earnings will explode after the Fed is done tightening. However, I do think that you could see that multiple expand to the low double-digits. There's your appreciation."

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|