|

Stock picks by the pros

|

|

September 26, 2000: 3:29 p.m. ET

Analysts pick Nortel Networks, Ciena, Banc of America, 3Com, Tyco

|

NEW YORK (CNNfn) - Market strategists and sector analysts reviewed stocks in telecom equipment, banking, energy and imaging sectors this week, recommending companies such as Sycamore Networks, Manpower, UPS and Pitney Bowes.

While the markets remained lower throughout the trading day, recent guests on CNNfn commented on the stocks they are buying and why.

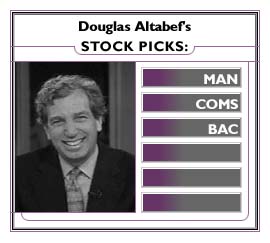

"We are shifting from a momentum (-driven) to a fundamentally driven market. So there's a great deal more focus on fundamentals, earnings. Also we're part, you know, this is part of the transition to a slowing economy. Everyone wants the economy to slow, they just don't want you to slow. So when you announce that you are slowing, it's disruptive. And when you're a big boy like an Intel, that's going to have a great impact in the market. But I think that this is - it's an inevitable part of slowing of the economy, is ratcheting, you know, is realigning expectations for performance. But just as momentum led us to follow bellwether stocks up, fundamentals are leading us to follow bellwether stocks down," Douglas Altabef, managing director of Matrix Asset Advisors. "We are shifting from a momentum (-driven) to a fundamentally driven market. So there's a great deal more focus on fundamentals, earnings. Also we're part, you know, this is part of the transition to a slowing economy. Everyone wants the economy to slow, they just don't want you to slow. So when you announce that you are slowing, it's disruptive. And when you're a big boy like an Intel, that's going to have a great impact in the market. But I think that this is - it's an inevitable part of slowing of the economy, is ratcheting, you know, is realigning expectations for performance. But just as momentum led us to follow bellwether stocks up, fundamentals are leading us to follow bellwether stocks down," Douglas Altabef, managing director of Matrix Asset Advisors.

"Manpower (MAN: Research, Estimates) is a play on the recovery, eventually, of the euro. Because they're the world's largest temp services company. They do a tremendous amount of their business in Europe. Business is going well. But they're being very adversely impacted by the euro. In Europe, you know, it's lifetime employment, you can't fire someone. So temp services are very, very popular," Altabef said.

"Another interesting company, if you put -- if you were a 3Com (COMS: Research, Estimates) investor a year ago, and you put the value of your Palm shares together with 3Com, you've made a fortune. 3Com can still do well," he said.

"Banc of America (BAC: Research, Estimates) is one of the better-priced money center, large banks. They've had acquisition, they've had acquisition digestion problems. But they've got a terrific market. They've got a good business plan and good management," Altabef observed.

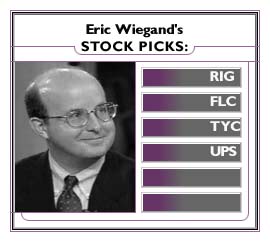

"You look at the disappointing announcements from DuPont and Dow and the other basic materials' companies is the raw material costs have increased; and then, certainly through the consumer staples, or multinationals as they pointed to -- repatriation issues as they were bringing in earnings that were derived in Europe because of the weakness in the euro. I think the unilateral intervention on behalf of the euro, was, I don't believe, meant to reinvigorate the currency, as it was really to stop the downfall, and I think the response that we saw Friday really points to that. For a brief moment, you saw the euro go back to 90 cents on the dollar, before starting to recede once again. The confidence in the currency is not very great. So, obviously, the confidence in companies that derive a significant portion of their earnings from Europe is comparable, and not very safe. As far as the energy side of the equation is concerned, the big issue there is -- I do think it was somewhat rhetorical, the releasing of the strategic petroleum reserves, because as has been mentioned earlier, refining capacity domestically is running between 90 and 95 percent. So we're changing the source of the oil, we're not changing the level of the output," said Eric Wiegand, equity strategist at Warburg Pincus private equity group. "You look at the disappointing announcements from DuPont and Dow and the other basic materials' companies is the raw material costs have increased; and then, certainly through the consumer staples, or multinationals as they pointed to -- repatriation issues as they were bringing in earnings that were derived in Europe because of the weakness in the euro. I think the unilateral intervention on behalf of the euro, was, I don't believe, meant to reinvigorate the currency, as it was really to stop the downfall, and I think the response that we saw Friday really points to that. For a brief moment, you saw the euro go back to 90 cents on the dollar, before starting to recede once again. The confidence in the currency is not very great. So, obviously, the confidence in companies that derive a significant portion of their earnings from Europe is comparable, and not very safe. As far as the energy side of the equation is concerned, the big issue there is -- I do think it was somewhat rhetorical, the releasing of the strategic petroleum reserves, because as has been mentioned earlier, refining capacity domestically is running between 90 and 95 percent. So we're changing the source of the oil, we're not changing the level of the output," said Eric Wiegand, equity strategist at Warburg Pincus private equity group.

"Sectors that we continue to like would be financials," Wiegand asserted. "We still like energy and I do think the underlying weakness in the commodity is creating some opportunity, and I do think it's perhaps a little bit early on the technology side. As far as company-specific, in the energy area, I think Transocean Sedco Forex (RIG: Research, Estimates) -- I know it's a mouthful -- it's a great place to be. It has a transaction that's pending, whereby they're acquiring Falcon Drilling (FLC: Research, Estimates). It will make them the third largest oil service company out there. The big issue there is if you believe that we are constrained in our ability to refine and develop oil and gas, they stand in a great position as we have all this under-investment and energy infrastructure. Tyco (TYC: Research, Estimates) would be another name and certainly for longer-term investors, benefiting from lower fuel costs, I would also look at UPS (UPS: Research, Estimates)."

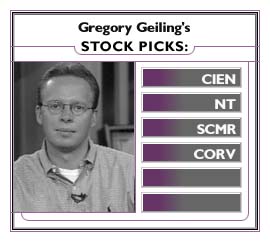

"The deal with Korea Telecom is number one for Ciena (CIEN: Research, Estimates). It's a great new customer. It expands the region and it gives us better visibility for the next couple of quarters. No. 1, it's great from that perspective. No. 2, it's an accessory contract. If you look at Ciena, the vast majority of revenue have been coming from backbone deployments it's a new area for Ciena. It's their fourth customer in the IP area. And that gives us more visibility in the product. It's a great region to go into the markets. And for Ciena, this is once again, another strong foothold in the region," said Gregory Geiling, telecom equipment analyst at J.P. Morgan. "The deal with Korea Telecom is number one for Ciena (CIEN: Research, Estimates). It's a great new customer. It expands the region and it gives us better visibility for the next couple of quarters. No. 1, it's great from that perspective. No. 2, it's an accessory contract. If you look at Ciena, the vast majority of revenue have been coming from backbone deployments it's a new area for Ciena. It's their fourth customer in the IP area. And that gives us more visibility in the product. It's a great region to go into the markets. And for Ciena, this is once again, another strong foothold in the region," said Gregory Geiling, telecom equipment analyst at J.P. Morgan.

"Ciena has been very successful in the international markets for the past several years. They've gotten really good traction in the European markets and now they're getting a lot more focus on Asia. It's still early. A lot of the big telecom equipment companies are aggressively going after the Asian market and a lot will be successful but for Ciena it's a great hold," Geiling said.

"The Asian opportunity or the Korean opportunity is several billions of dollars in business because a lot of these markets are now upgrading to these new optical products that Ciena as well as Sycamore and NorTel. I think what distinguished Ciena is probably two very important factors. Number one, the product is ready today. A lot of Ciena's competitors have a product that's close to being ready, but isn't yet shippable. And Ciena's ready to go today. And number two, a lot of these customers know Ciena pretty well. Ciena's been around for a long time. They've dealt with a lot of these companies in different parts of their networks in the past. So I think the technology being ready and Ciena having a history with a lot of these companies was probably two of the most important factors," he said.

"This whole group has been beat up over the past couple of weeks as you know because of all these capital spending concerns. And I think for Ciena this is great because it gives a little bit more visibility into the customers. And I think at this valuation, everybody's realizing that the optical stocks are still very attractive from a growth perspective. And even though their valuations are still pretty lofty relative to other industries, Ciena is one of the more attractive names from a valuation perspective. This is a catalyst for a lot of pent up buying that was out there. We're still very positive on the stock," Geiling said.

"Other than Ciena, we're fans of Nortel Networks (NT: Research, Estimates). Nortel's the largest most established optical company out there. They're continuing to grow their top line over 40 percent, which is off a $20-plus billion revenue base. So a very strong performer," he observed. "The other two names are new up and coming names in this space, Sycamore Networks (SCMR: Research, Estimates) and Corvis Corporation (CORV: Research, Estimates). Both of these guys are coming to market with best of technology, next generation technology. They've only been around for a short period of time, but their revenue ramps will be astronomical. And both of these stocks are in a very good position over the next couple of years."

"I think Electronics for Imaging (EFII: Research, Estimates) will have a super 2001," Jonathan Rosenzweig, imaging technology analyst at Salomon Smith Barney, said.

"They (have) a tremendous flow of new products. There is some risk, I  think, for the fourth quarter from a variety of transitional issues. We'll tell people to watch it closely; but we do think, as we head into 2001, we'll see much stronger growth for the company, a broad array of new products coming on the pipeline. We... think it will be a great growth stock for 2001. (It's) a stock that we'd be looking hard at as we move forward," Rosenzweig said. think, for the fourth quarter from a variety of transitional issues. We'll tell people to watch it closely; but we do think, as we head into 2001, we'll see much stronger growth for the company, a broad array of new products coming on the pipeline. We... think it will be a great growth stock for 2001. (It's) a stock that we'd be looking hard at as we move forward," Rosenzweig said.

"Pitney Bowes (PBI: Research, Estimates) (is) similar to Electronics For Imaging. (There are) some issues to be a little bit cautious of in the third and fourth quarter as we head into 2001. We have a lot of things that will help benefit the company, including what we call digital meter migration, which has been talked about for a long time, but is finally starting to materialize," he said.

"We'll see a resurgence in growth in (Pitney Bowes') outsourcing business. The company is somewhat of a defensive play on all the concerns over foreign exchange because such a small portion of the business does come from abroad. So I think, in a lot of ways, Pitney Bowes is an attractive risk reward," Rosenzweig said.

-- compiled by Staff Writers Lucy Banduci and Mark Gongloff

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|