|

American Air tops target

|

|

October 18, 2000: 3:34 p.m. ET

Carrier posts 3Q gains despite fuel hike; US Airways loss larger than expected

|

NEW YORK (CNNfn) - American Airlines' corporate parent flew well above Wall Street forecasts Wednesday as it posted its best third quarter in its history.

But troubled US Airways Group Inc. posted a much larger-than-expected third-quarter loss as officials there blamed high fuel prices and increased competition for their woes. And its chief executive warned analysts that it will report a loss in the fourth quarter.

American's owner, AMR Corp., earned $322 million or $1.96 a diluted share, excluding a charge for the repurchase of debt. Analysts surveyed by earnings tracker First Call forecast that profit would rise to $1.78 a share from the $213 million, or $1.38 a share, it earned from continuing operations a year earlier.

Including the charge, the company's net income came to $313 million, or $1.91 a diluted share, compared with $279 million, or $1.76 a diluted share, including the $66 million, or 38 cents a diluted share, earned by its former interest in computerized reservation service Sabre (TSG: Research, Estimates), which has since been spun off. Including the charge, the company's net income came to $313 million, or $1.91 a diluted share, compared with $279 million, or $1.76 a diluted share, including the $66 million, or 38 cents a diluted share, earned by its former interest in computerized reservation service Sabre (TSG: Research, Estimates), which has since been spun off.

Revenue rose 12 percent to $5.3 billion from $4.7 billion.

The airline had the 10 busiest days in its history during the quarter. CEO Donald Carty said No. 2 American gained business, perhaps disproportionately, from the difficulties of "a major competitor" this summer.

While he did not identify the carrier, it is obvious that he referred to UAL Corp.'s United Airlines, the world's largest carrier, which suffered from cancelled and delayed flights due to labor negotiation problems with its pilots and mechanics. UAL (UAL: Research, Estimates), which is due to report results Thursday, already has warned it will post a loss in the quarter.

For the first nine months, AMR posted net income of $766 million, or $4.77 a diluted share, up from $705 million, or $4.44 a share, a year earlier. Revenue increased to $14.8 billion from $13.2 billion a year earlier, when results were hit by the airline's own work action by pilots.

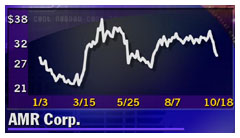

Despite the strong numbers, shares of AMR (AMR: Research, Estimates) fell $1.19 to $27.81 in trading Wednesday.

US Airways hit by fuel, increased competition

US Airways, the nation's No. 6 airline which has agreed to be purchased by UAL, lost $30 million, or 45 cents a share, in the quarter.

While that's an improvement from the $85 million loss, or $1.19 a share, it posted a year earlier, it is far below the expectations of analysts surveyed by earnings tracker First Call, who forecast only a 19 cent a share loss in the latest period.

CEO Rakesh Gangwal told analysts Wednesday the airline will again lose money in the fourth quarter. First Call had forecast US Airways would earn 3 cents a share in the fourth quarter after a loss of 68 cents a share a year ago.

Gangwal did not give details or a range for the size of the loss but he cited the same problems that hit results in the third quarter: higher fuel costs and increased competition.

"Competition in core markets remains intense," he said, adding he expects fares will be lower on a year-to-year basis. He also said he expects jet fuel will cost about $1.06 a gallon, 16 percent more than in the third quarter and more than 50 percent higher than a year ago.

US Airways also missed earnings estimates in the second quarter. The company's results in the third quarter of 1999 were hit by flight cancellations due to Hurricane Floyd and by labor relation problems that it was able to avoid this year.

Overall revenue climbed 13 percent to $2.4 billion from $2.1 billion a year earlier. Overall revenue climbed 13 percent to $2.4 billion from $2.1 billion a year earlier.

Fuel was part of the problem, as the average price excluding taxes rose nearly 60 percent to 91.33 cents a gallon, and the amount used rose another 17 percent due partly to the fewer flight cancellations. But the inability to raise fares as competitors did was a big part of the problem as well.

Other airlines have been able to deal with rising fuel costs by increasing fares and passenger volume. While US Airways' passenger traffic increased nearly 20 percent to 12.9 billion passenger-miles, its yield, a measure of fares, fell 5.6 percent to 15.27 cents per paid mile flown by passengers.

The airline said it is working with regulators and is confident that its $4.3 billion purchase by UAL will be approved. But the deal has generated opposition from consumer groups and some of the unions at employee-owned UAL.

For the first nine months, the company lost $65 million, or 97 cents a share, excluding a change of accounting practices. That compares with earnings of $278 million, or $3.72, a year earlier. Year-to-date revenue rose 7 percent to $6.9 billion from $6.5 billion a year earlier.

Shares of US Airways (U: Research, Estimates) lost $1.38 to $30.88 in trading Wednesday.

In other airline earnings news, Amtram Inc. (AMTR: Research, Estimates), the operator of American Trans Air, or ATA, reported net income of $3.0 million, or 23 cents a diluted share, more than double the First Call forecast of 11 cents a share. But profits at the nation's 11th-largest airline were well below the $13.7 million, or $1.01 a share, it earned a year earlier.

Revenue rose 14.7% to $347.3 million, with about a third of that coming from charter service. The airline said new planes it is bringing into its fleet should help it handle the increased cost of fuel, but that charges for disposition of the older aircraft may occur later this year.

Shares of Amtram fell 31 cents to $10.13 in trading Wednesday.

|

|

|

|

|

|

AMR Corp.

US Airways

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|