|

Productivity gains slow

|

|

November 2, 2000: 12:17 p.m. ET

U.S. worker productivity advances 3.8% in 3Q; September leading indicators flat

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - The efficiency of U.S. workers, the hallmark of the record economic expansion, advanced at a faster-than-expected pace in the third quarter while labor costs jumped, the government said Thursday, an indication that workers are beginning to demand more for their contributions on the job.

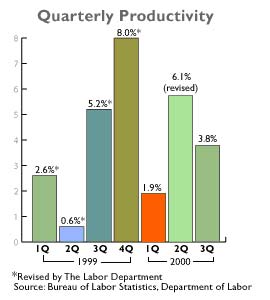

The Labor Department said that productivity -- an important gauge of worker output per hour -- grew at a 3.8 percent rate in the third quarter, above the 3.5 percent gain expected by analysts surveyed by Briefing.com, but well below the revised 6.1 percent rate posted in the second quarter. From the third quarter of last year, productivity rose at a 5 percent rate. The Labor Department said that productivity -- an important gauge of worker output per hour -- grew at a 3.8 percent rate in the third quarter, above the 3.5 percent gain expected by analysts surveyed by Briefing.com, but well below the revised 6.1 percent rate posted in the second quarter. From the third quarter of last year, productivity rose at a 5 percent rate.

The numbers further blurred the picture on whether the U.S. economy, now into its 10th and record year of uninterrupted expansion, is starting to slow, and whether productivity gains are rising at a quick enough pace to offset accelerating inflation. The economy advanced at a 2.7 percent pace in the third quarter, significantly slower than the 5.6 percent increase recorded in the second.

"Worker productivity generally creates a scenario where employees realize they can begin to demand more for what they do," Robert Brusca, chief economist with Ecobest Consulting, told CNNfn's Before Hours. "While the year-over-year productivity gains are still quite good, there is some evidence that wage inflation may be starting to creep in. The Fed won't like this."

Workers demanding more wages?

Productivity has been the key reason the U.S. economy has been able to grow at a faster-than-normal pace without sparking higher inflation. As companies invest in equipment to automate business processes, workers can boost output without working longer hours. That lets companies boost production, and sometimes pay workers more, without raising prices.

Fed officials have long been pointing to that phenomenon as the main reason the economy's strength hasn't triggered faster inflation. "The dramatic acceleration in productivity growth" is the single most important reason the U.S. economy is so strong, Fed Governor Laurence Meyer said in a speech last week. If productivity growth can continue at current rates that would be "profound" for the economy, he said. Fed officials have long been pointing to that phenomenon as the main reason the economy's strength hasn't triggered faster inflation. "The dramatic acceleration in productivity growth" is the single most important reason the U.S. economy is so strong, Fed Governor Laurence Meyer said in a speech last week. If productivity growth can continue at current rates that would be "profound" for the economy, he said.

That said, growth is expected to slow in the final months of 2000 and into next year as the Fed's six rate increases filter their way down into the economy. And as growth slows, demand for goods and services will decline, lowering the amount of output workers have to apply to get the job done. That's where companies may start feeling the pinch as they face workers who want more compensation, but aren't needed to produce as much, Brusca said. (311KB WAV) (311KB AIFF)

Higher rates boost the cost of borrowing for consumers and businesses, encouraging them to save rather than spend. Fed officials next meet November 15 to discuss interest rate strategy. Most economists expect they will hold rates steady, and some are predicting it will let down its guard a bit in its vigilance against inflation pressures.

A productive manufacturing sector

Labor also said that hourly compensation costs, which are part of overall labor costs, rose at a 6.4 percent rate in the quarter, the biggest gain since they rose 8.8 percent in the first quarter 1992. Compared with the same quarter a year ago, compensation costs rose 5.1 percent after a 4.9 percent second-quarter gain.

Financial markets registered little reaction to the report, but inflation-sensitive bond prices dipped slightly on the larger-than-expected rise in unit labor costs. At noon ET, stocks had posted mixed results while bonds were flat to slightly lower. Financial markets registered little reaction to the report, but inflation-sensitive bond prices dipped slightly on the larger-than-expected rise in unit labor costs. At noon ET, stocks had posted mixed results while bonds were flat to slightly lower.

"It's suggesting this structural change playing out in the U.S. economy seems to still be continuing," said Paul Ferley, assistant chief economist at Bank of Montreal/Harris Bank in Toronto.

Productivity growth was once again strongest in manufacturing, where it increased 6.4 percent from the previous quarter. Year-over-year, manufacturing productivity was up 7.5 percent, its biggest-ever increase.

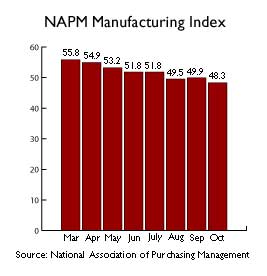

That's happening at the same time manufacturing output is slowing down, according to a report released Wednesday from the National Association of Purchasing Management. Activity at U.S. factories contracted for a third straight month in October while prices producers pay for their raw materials fell, the survey of purchasing managers showed.

Companies be nimble, companies be quick

Of particular note in the productivity report was the 0.8 percent drop in the average number of hours worked, "a very unusual result that shows how cost-conscious and nimble U.S. companies have become," noted Sherry Cooper, chief economist with brokerage BMO Nesbitt Burns. In the second quarter, hours worked rose 0.4 percent and advanced 3.2 percent in the first.

To be sure, not all companies are responding nimbly to a slowdown in demand -- and a slowdown in production. Consumer products maker Procter & Gamble (PG: Research, Estimates) earlier this week reported lackluster third-quarter profits and warned that its fourth quarter may not meet Wall Street's expectations. And Thursday, Internet carrier PSINet (PSIX: Research, Estimates) warned that it won't meet profit projections due to slower sales, and also warned of weaker fourth-quarter results. To be sure, not all companies are responding nimbly to a slowdown in demand -- and a slowdown in production. Consumer products maker Procter & Gamble (PG: Research, Estimates) earlier this week reported lackluster third-quarter profits and warned that its fourth quarter may not meet Wall Street's expectations. And Thursday, Internet carrier PSINet (PSIX: Research, Estimates) warned that it won't meet profit projections due to slower sales, and also warned of weaker fourth-quarter results.

Separately, the Labor Department reported that number of Americans filing new claims for unemployment benefits was unchanged at 308,000 for the week ended Oct. 28. The four-week moving average of claims, which generally provides a more accurate picture of jobless trends, was 309,750 for the period, up from a revised 308,000, Labor said. A weekly reading of above 300,000 trypically indicates a tight labor market.

And in another report, the Conference Board said its monthly index of leading U.S. economic indictors was unchanged in September, indicating slower growth heading into 2001. The index, considered a gauge of economic performance over the next three to six months, held steady following a 0.1 percent decline in August. It hasn't risen since March.

|

|

|

|

|

|

|