NEW YORK (CNNfn) - Michael and Deborah M., both lawyers in their 30s, are living and investing within their means. Diligent about saving regularly and hoping to retire by 60, they have a fairly high tolerance for risk and subscribe to a buy-and-hold investing philosophy. "We don't churn our funds," Michael said.

But the Detroit-based couple should check under the hood of their mutual funds if they want to make sure they're not taking too much risk by betting the farm on one part of the market, financial experts said.

The lesson is simple, they noted: when investing long-term, the goal is to diversify, not simply multiply holdings.

Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a regular CNNfn.com feature that looks at issues of portfolio diversification and asset allocation. In each article, we review an investor's investments and ask financial experts for advice. If you want help with your nest egg, see below for more information.

Michael, 37, and Deborah, 33, earn a combined income of $140,000 and have amassed a $190,000 portfolio, primarily in employer-sponsored retirement plans and IRAs.

All told, they are investing in 11 funds, which is not excessive given the his-and-her nature of their savings. But the funds in their accounts can have a high degree of overlap in terms of holdings, and they give the couple too heavy a weighting in large-cap growth stocks, said certified financial planners James W. Whaley of Greenbrier Capital Management in Knoxville, Tenn. and Robert Veasey, Jr. of Sowa Financial Group in East Providence, R.I.

Lighten up on large caps

The biggest account, and the one of greatest concern to the planners, is Michael's $100,000 rollover IRA at Fidelity, where he has access to all funds at Fidelity's supermarket. Currently he has the money divided equally between two large-cap growth funds: Fidelity Growth Company and White Oak Growth.

"It's not what I'd consider a good portfolio," Whaley said. "He's getting very little diversity." "It's not what I'd consider a good portfolio," Whaley said. "He's getting very little diversity."

Instead, Whaley would prefer Michael reallocate his money as follows: 50 percent in large-cap funds – with half in growth, half in value; 25 percent in small-cap stocks and another 25 percent in an international fund that primarily invests in non-U.S. stocks. If he wanted to be somewhat more conservative, Whaley said, he could shave 5 percent off both his small-cap and international allocations and put the 10 percent remaining into a bond fund.

Michael could keep 25 percent of his money in either the Fidelity Growth Company Fund or the White Oak offering, but not both, he added. Whaley recommended keeping the Fidelity fund since it spreads its risk over more holdings.

He suggested Michael put another 25 percent in the Accessor Value Fund, at least 20 percent in Putnam International Growth and another 20 percent in the UAM Sirach Special Equities.

Make friends with mid caps

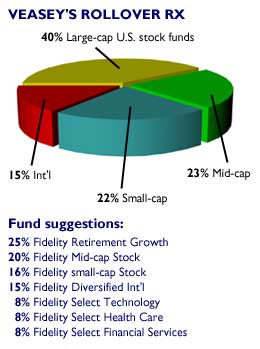

In addition to small-cap and international stocks, Veasey recommended Michael broaden his exposure to the mid-cap arena and invest about 24 percent of his money in three sector funds that track what Veasey believes will be the growth engines of the economy in the next 10 years: health, technology and financials.

| |

CURRENT PORTFOLIO CURRENT PORTFOLIO

|

|

| |

|

$100,000 Rollover IRA

$33,000 401(k)s

$25,000 Investment Club Account

$24,000 Profit-Sharing Plan

$6,600 Roth IRAs

$1,200 Education Savings Plan

|

|

|

Accordingly, he suggested a 40 percent allocation in large-caps, 23 percent in mid-caps, 22 percent in small caps and 15 percent in international holdings.

His fund recommendations, all Fidelity although he noted there are plenty of other good funds out there, include Fidelity Retirement Growth, which he said has a better track record than Fidelity Growth Company; the Boston-based firm's Mid-cap Stock and Small-cap Stock funds; its Diversified International fund; and its Select Technology, Health Care and Financial Services funds.

Consolidate Deborah's 401(k)

For Deborah, the planners focused on her $27,000 401(k) account. She contributes to five funds: 25 percent of her money goes to the large-cap growth Janus Fund; 15 percent to the large-cap value Neuberger Berman Partners Trust; then 20 percent each to Dreyfus S&P 500 Index Fund; the large-cap blend Fidelity Asset Manager and the mid-cap Warburg Pincus Emerging Growth.

With too high a correlation in style and holdings between the Janus, Dreyfus and Fidelity funds, "the stocks (in the funds) would respond in the same way in a down market," Veasey cautioned. With too high a correlation in style and holdings between the Janus, Dreyfus and Fidelity funds, "the stocks (in the funds) would respond in the same way in a down market," Veasey cautioned.

Indeed, she could eliminate two of the three and still get the same mileage out of her investment, Whaley said.

If her plan provides few choices besides the ones she is already investing in, Veasey said, then she might consider putting 40 percent of her money in the Warburg Pincus fund; and 30 percent in both the Neuberger Berman and Janus funds.

Or, if she wanted to be more conservative, she might consider putting all her money in the Fidelity Asset Manager fund, he said, since it holds a combination of stocks, bonds and cash. In that way, she would get about 80 percent to 85 percent of the upside while getting more protection on the downside, although she would be limiting her allocation primarily to large caps.

Ideally, Veasey said, if her plan offers a broader array of funds, she might consider 30 percent in a large-cap offering; 25 percent in an actively managed small-cap fund; another 25 percent in an actively managed mid-cap fund; and 20 percent in an international fund.

Churning taxable money

The couple also puts $1,200 per year in an investment club. Their $25,000 account is invested in two funds: the large-cap growth Janus Twenty and the large-cap blend Fidelity Dividend Growth.

Click here to read last week's Portfolio Rx. And be sure to read this week's Checks and Balances column.

Janus Enterprise, a mid-cap growth fund, and Fidelity Small-Cap Stock Fund might be better choices, again to tame the large-cap overload in the rest of their portfolio, Veasey said.

Or, if they don't mind paying a load, they might consider the Phoenix-Engemann Small & MidCap Growth Fund. "We really like the management and we like the combination of small-cap and mid-cap under one roof," Veasey said.

Since their club holdings are taxable, Whaley suggested they might consider investing in a tax-efficient mutual fund or simply stocks, since they can better control their capital gains tax hit.

No change is forever

Given the couple's time horizon and the fact that large-cap growth stocks' have had a winning run over the past five years, it is understandable why the funds they own held appeal.

But going forward, the two planners advised, they should boost their exposure to other parts of the market to protect against the inevitable downturns in any one segment of the market. In Michael's IRA alone, "it's like he's driving in the rearview mirror," Whaley said.

That's why the couple – and indeed all investors – should review their asset allocation at least every two years, Whaley and Veasey said, making adjustments to keep pace with the changing situation in their lives and in the market.

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. Please include a daytime phone number so that we may reach you. If we choose your portfolio, we will use your information, including your name in an upcoming story.

* Disclaimer

|