|

Three-day win on Wall St.

|

|

March 7, 2001: 4:32 p.m. ET

Renewed confidence in select issues sparks broad rally on Dow, Nasdaq

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - U.S. stocks rallied for the third straight session Wednesday as investors displayed growing confidence in the major indexes, stepping off the sidelines to find select values while trying to determine whether or not the beaten-down technology sector is poised to turn around.

"I'm a little bit impressed because it seems like every time we start to drift buyers are being wooed out of the woodwork a bit," said Charles Payne, head analyst with Wall Street Strategies. "It shows that people are lining up and they want to jump in there but they need the right stimulus."

Analysts said the recent action was mostly driven by traders rather than long-term investors but they say it's just a matter of time before investors return to the buying fray. "I think the investors are a little bit gun-shy right now," said Barry Hyman, chief market strategist with Weatherly Securities. "I am impressed by today's behavior and I think investors should believe the economy will recover."

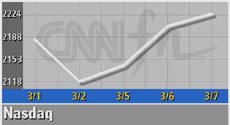

The Nasdaq rose 19.49 to 2,223.92, after rising nearly 40 points early in the session and then briefly dipping into negative territory. This is the first three-session winning streak for the tech-heavy index since late January. The index is now up 5 percent for the week. The Nasdaq rose 19.49 to 2,223.92, after rising nearly 40 points early in the session and then briefly dipping into negative territory. This is the first three-session winning streak for the tech-heavy index since late January. The index is now up 5 percent for the week.

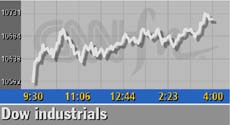

The Dow jumped 138.38 to 10,729.60. The blue chip index enjoyed a four-session winning streak, which last happened in late October, and is now up 1.58 percent this week. The Standard & Poor's 500 index advanced 8.09 to 1,261.89 -- up 2.1 percent for the week, thus far.

"This market, while not being the raging bull, certainly has some merits for investing," said Hyman. "If you (cross) out technology, you have a market with a great deal of underlying strength."

But investors weren't pouring money back into the markets, opting instead to cautiously find select bargains. This lack of conviction came as earnings warnings from JDS Uniphase and Broadcom attracted selling, and as analysts cautioned that this week's strength in the tech sector is not a sure sign that these stocks have resumed their leadership position. But investors weren't pouring money back into the markets, opting instead to cautiously find select bargains. This lack of conviction came as earnings warnings from JDS Uniphase and Broadcom attracted selling, and as analysts cautioned that this week's strength in the tech sector is not a sure sign that these stocks have resumed their leadership position.

"Sustainability and follow-through have been suspect all the way, but a lot of disappointment has been discounted in the market," said Bryan Piskorowski, market analyst with Prudential Securities.

Market breadth was positive. On the New York Stock Exchange advancers beat decliners 1,897 to 1,185 as more than 1.05 billion shares changed hands. Winners outpaced losers on the Nasdaq 1,951 to 1,682 as more than 1.67 billion shares were traded.

Meanwhile, the dollar rose against the yen and the euro while Treasury securities edged higher.

Broad advance on Wall Street

While technology stocks continued to attract buyers, some analysts say these stocks are still a bit expensive, given the current economic uncertainty.

Tech stocks vacillated, with some investors believing that sector stalwarts have been beaten down enough while other investors remained unsure that the worst is truly over.

"The tug-of-war continues between those who believe that the market may have bottomed out and those who believe this market rally may be short-lived," said Alan Ackerman, senior vice president with Fahnestock & Co.

Fahnestock's Ackerman said long-term investors were more likely to return to the market if the Federal Reserve cuts interest rates by a half percentage point when its monetary policy-making body meets in less than two weeks.

"I think there needs to be reassurance by the Fed that they'll continue to cut rates in order to get the economy going," he said. "Long-term investors have become fence-sitters -- people are really waiting for a catalyst."

The tug-of-war sentiment was seen clearly in the day's major tech stories.

JDS (JDSU: Research, Estimates) fell $1.06 to $26.94 after the fiber-optic products maker lowered guidance for its fiscal third and fourth quarters.

Broadcom (BRCM: Research, Estimates) tumbled $7.63 to $40.25 after the communications chipmaker late Tuesday cut its earnings and revenue outlook for the first quarter due to a slowdown in customer orders.

Internet provider Yahoo!'s (YHOO: Research, Estimates) stock was halted in early trading, pending a news announcement scheduled after the market close. Prior to halting trading, Yahoo! canceled its appearance at Merrill Lynch's Internet Conference. Yahoo! last traded down $1.44 at $20.94. Internet provider Yahoo!'s (YHOO: Research, Estimates) stock was halted in early trading, pending a news announcement scheduled after the market close. Prior to halting trading, Yahoo! canceled its appearance at Merrill Lynch's Internet Conference. Yahoo! last traded down $1.44 at $20.94.

But Intel (INTC: Research, Estimates) gained $1.44 to $32.94 even after its chairman, Andrew Grove, said he does not expect end demand for semiconductors to snap back rapidly -- noting it will take some time for the downturn in the chip industry to end.

WorldCom (WCOM: Research, Estimates), the nation's second-largest long-distance phone company, advanced 50 cents to $17.19 after it was revealed that it could be seeking a deal to sell itself, according to the Wall Street Journal.

Investors looking for a reason to buy could take some comfort from Goldman Sachs strategist Abby Joseph Cohen. She recommended that investors raise the portion of stocks in their portfolios to 70 percent of a model portfolio from 65 percent, and that cash should be reduced to zero from 5 percent. In March 2000, Cohen lowered the stocks portion of a model portfolio.

Cyclical issues on the Dow gave the blue chip index a steadier boost. Home Depot (HD: Research, Estimates) gained $2.34 to $43.70 and Caterpillar (CAT: Research, Estimates) rose $2.29 to $46.80.

Boom for Barrett

Aiming for more exposure to the booming U.S. natural gas market, Royal Dutch/Shell submitted a $2.2 billion bid Wednesday for Barrett Resources.

Shares of Royal Dutch Petroleum (RD: Research, Estimates), one of the parent companies of Royal Dutch/Shell, rose 51 cents to $60.46. On news of the bid, Barrett Resources (BRR: Research, Estimates) surged $15.49 to $61.11.

But not all the corporate news brought out the buyers.

Dow Jones (DJ: Research, Estimates), publisher of the Wall Street Journal, fell $4.38 to $56.97 after it warned Wednesday that first-quarter earnings will fall well below expectations due to softer advertising sales. The company also said it is exploring a number of cost-cutting measures that likely will include "some reductions in personnel."

Bear Stearns (BSC: Research, Estimates) fell $1.99 to $52.60 after the brokerage warned late Tuesday it would have a difficult time meeting first-quarter analysts' forecasts because of slumping stock markets. It also confirmed it has laid off 400 employees, or more than 3 percent of its work force, as part of a restructuring effort. Bear Stearns (BSC: Research, Estimates) fell $1.99 to $52.60 after the brokerage warned late Tuesday it would have a difficult time meeting first-quarter analysts' forecasts because of slumping stock markets. It also confirmed it has laid off 400 employees, or more than 3 percent of its work force, as part of a restructuring effort.

|

|

|

|

|

|

|