The United States economy grew slightly faster than initially reported in the second quarter, but was still too weak to signal any major improvement in the job market ahead.

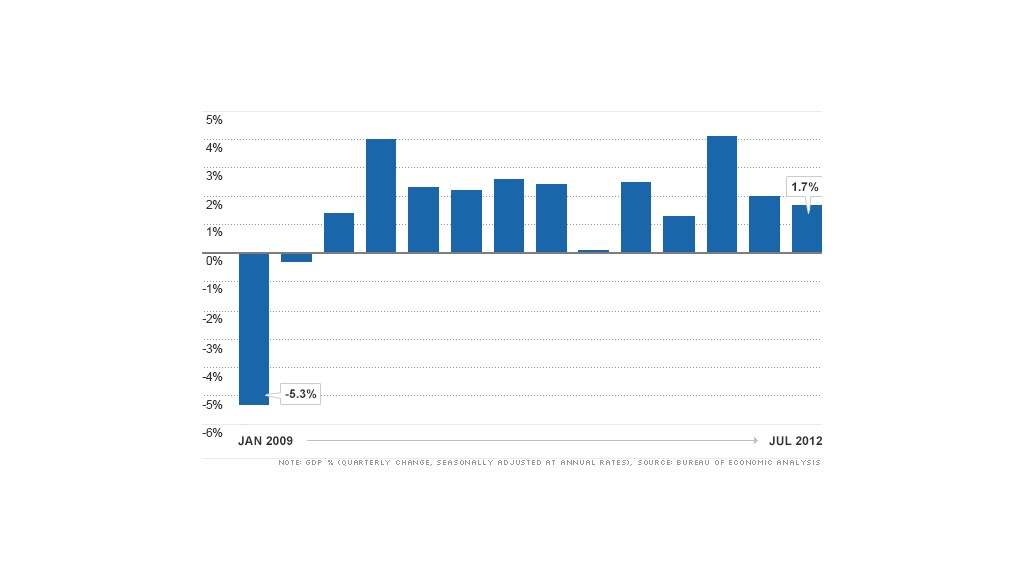

Gross domestic product, the broadest measure of the nation's economic health, grew at an annual rate of 1.7% from April to June, the Commerce Department said Wednesday, slightly higher than the 1.5% rate originally reported, and in line with economists' expectations.

Exports were stronger than initially reported during those months, boosting the overall number slightly. Meanwhile, consumer spending -- which accounts for roughly two-thirds of the U.S. economy -- grew slightly faster, but still at a very weak pace.

While the upward revisions were slightly encouraging, the economy was still slower in the second quarter than the first three months of the year, when the growth rate was 2%.

And at those levels, the recovery is still far too weak to signal a robust pickup in hiring any time soon.

"The U.S. recovery continues, but remains disappointing," said Stuart Hoffman, chief economist for PNC Financial Services Group, in a note to clients. "The economy is expanding, but not quickly enough to bring down the unemployment rate."

Economists often say U.S. GDP needs to grow around 3% a year to bring unemployment down significantly. The unemployment rate currently stands at 8.3%.

Check the unemployment rate in your state

Looking ahead, the public sector remains a big concern. Government cuts have been dragging on economic growth for two years, and as fiscal cliff looms in 2013, the Congressional Budget Office predicts the major round of tax hikes and spending cuts could push the U.S. economy back into a recession.

"Economic growth is unlikely to accelerate until consumers and businesses are more confident that the economy will be better tomorrow than it is today," James Marple, senior economist with TD Bank, said in a note to clients. "This is the real tragedy of the fiscal cliff. Not only does it threaten to pull the economy into recession next year, it is weakening the recovery right now by pulling down business and consumer confidence."

Some economists are still hopeful the recovery will accelerate in the second half of the year, as it has in four of the last five years.

Retail sales already started to improve in July and the housing market has shown signs of recovering slowly.

Meanwhile, Wednesday's GDP report shows businesses accumulated smaller inventories than originally reported in the second quarter -- implying that to meet future demand, they may have to ramp up production slightly, said Brett Ryan, a U.S. economist with Deutsche Bank.

Corporate profits were also up 6.1% over the same quarter last year, a sign that despite looming uncertainty, companies are holding up.

"The fact that they still remain profitable means that companies are less likely to feel the need to fire workers," Ryan said.

As for whether they'll hire, "that's a good question," he added.