With so much talk about the need to revive U.S. manufacturing and create jobs, more companies are touting their American-made roots in order to lure customers.

The notion that buying something made domestically will boost the economy has become an article of faith during the economic crisis. And many businesses are trying to capitalize on that by attaching a "Made in USA" label to their products.

Buying American-made goods has become personal, according to Dave Schiff, chief creative officer at Made Movement, a website that markets and sells only American-made products. Shoppers believe that supporting businesses that manufacture domestically could help them in return.

People are looking for "Made in USA" labels because they know that's how jobs are created, he said. They think, "My son who is unemployed could benefit if I pay attention to a label. The economy at large gets a shot in the arm."

But before a company can use the iconic label, it must comply with a complex set of rules that dictates its use.

The Federal Trade Commission has a dizzying 44-page rulebook that lays out the guidelines -- and the specifics are enough to make your head spin.

For instance, domestically-made textiles, wool, fur or automobiles must, by law, have a "Made in USA" label. Companies aren't required to disclose country of origin for most other products, but many choose to tout their American-made status in order to appeal to customers.

Companies looking for that boost from the label have to be able to prove that their final products are assembled or processed in the United States, according to the FTC. The agency doesn't spot-check items that claim to be made in the United States, but it does investigate complaints.

Related: 7 hot Made-in-the-USA toys for the holidays

Of course, many manufacturers now rely on global supply chains, which makes it much harder to determine when a company can rightly make the claim. Regulators try to assess how much of a product's total manufacturing cost comes from the United States.

For goods that have parts made in many different countries, the FTC relies on what it calls a "one step removed" rule. For instance, if a shirt is made with fabric from overseas, but sewn together in the United States, it can't be labeled "Made in USA."

But if a manufacturer uses U.S.-made fabric that is sewn together domestically using thread made overseas, it would be permitted to use the "Made in the USA" label.

Companies that can't get all of their component parts domestically can use what the FTC calls qualified "Made in USA" claims, such as "Made in USA from imported parts" or "Assembled in the USA."

Related: The manufacturing jobs boom is for real

While the distinctions may be minor, a failure to follow the rules can cost businesses a ton of money.

If the FTC finds a label to be deceptive, it can file a lawsuit and ask for a court-ordered fine or consumer redress. According to Matt Wilshire, an FTC staff attorney, fines go as high as $16,000 per mislabeled item sold, or for every day that the item was advertised.

"This could become a very large figure very quickly," he said, citing one case that ended up costing a business nearly $400,000 in fines.

As costly as a labeling mistake could be, many feel like the regulations protect smaller businesses in the long run.

Brian Meck, who co-owns Fessler USA, a private-label manufacturer that makes clothing for retailers like Urban Outfitters (URBN), says that the regulations reward companies who pay higher costs to manufacture domestically by safeguarding the Made in USA claim. Without the rules, he said, big brands could benefit from the label while sourcing cheaper imported materials to cut costs, without anyone knowing the difference.

Meck also said that the regulations not only protect businesses, but also help consumers. "They give [consumers] the ability to know where their dollars are going and what they're really supporting."

Related: Best Places to Launch

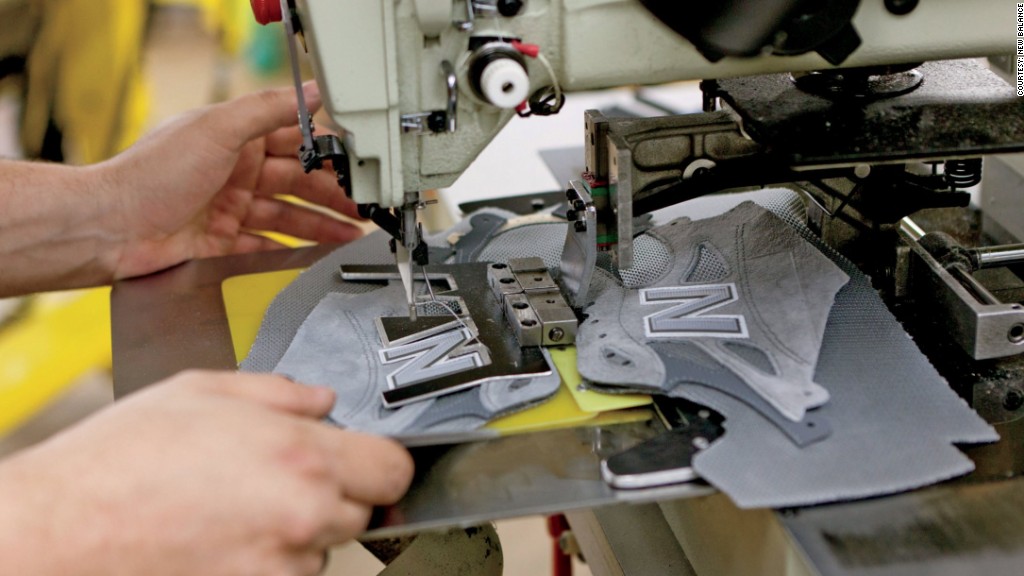

For New Balance Athletic Shoe, which is the last U.S.- made athletic footwear brand, the pros of manufacturing domestically outweigh the drawbacks.

"From a cost perspective, you add different burdens -- regulatory schemes, wage and benefits -- compared to competitors," said spokesman Matt LeBretton. "But the feedback that we get is pretty outstanding, so we do everything to make that continue to work."