President Obama's proposal to let the Bush tax cuts expire for top earners would hit only a tiny fraction of all small businesses, but it includes nearly 1 million companies that employ people.

That's according to an IRS study, which counted more than 20 million enterprises as small businesses.

Most of them are solo entrepreneurs with no employees. Only a tiny portion of them earn more than the $200,000 threshold ($250,000 if married) that would face an increase if the top two rates go up.

But high-income earners also make up 24% of small businesses with employees, or 923,000 of them, according to a report by Treasury Department economists.

Related: Obama's 18 small business tax cuts - explained

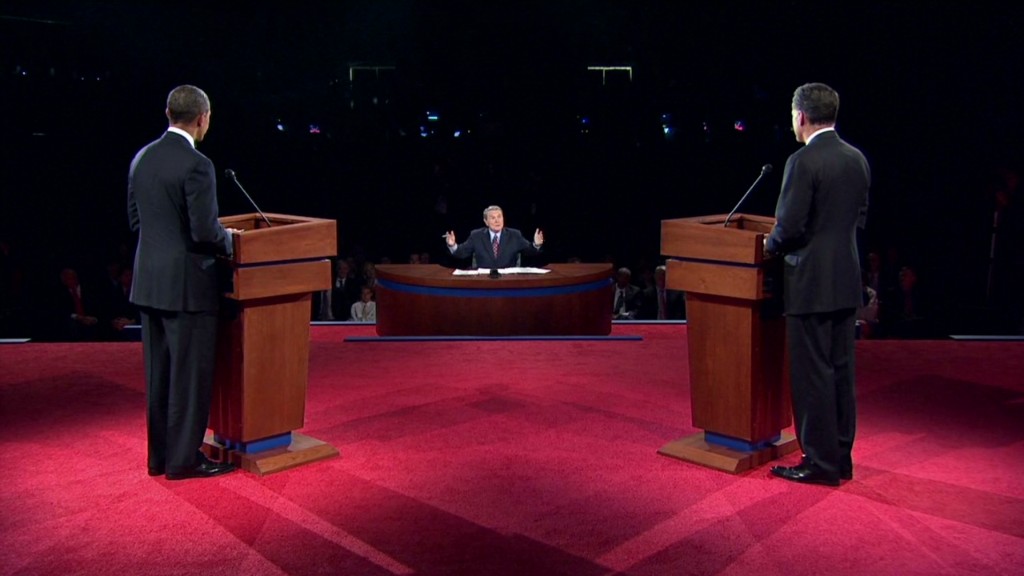

That's why Obama can say his proposal wouldn't affect many small businesses -- between 3% and 10%, depending on how you define a small business. It's also why Romney can say that it is aimed at "job creators," as he did at Wednesday night's debate.

Those small businesses also employ an estimated 60 million Americans -- about half of all private sector employees.

"No matter how you slice it and dice it, it's hard to avoid that this is a tax increase on a significant share of small business owners," said Raymond Keating, chief economist of the Small Business & Entrepreneurship Council.

The Obama plan would raise the top two tax brackets from 33% to 36% and from 35% to 39.6%.

To business owners, higher tax bills would restrict their ability to grow and hire workers.

Brandon Shamim expects to be in the high-income group next year. The consulting firm he co-owns, Beacon Management Group, has been gaining strength since the recession by staying small, keeping only three employees and a few part-timers.

If next year proves profitable enough, he plans to finally get around to hiring a project manager and a marketer. Shamim would also buy an office instead lease one at his current Pasadena, Calif., office building.

However, higher taxes would make him rethink those plans.

"The bold moves we want to make would no longer be afforded to us," he said.

At the New York-based consulting firm Sales Huddle Group, higher taxes wouldn't affect hiring but it would create some extra strain. Its owner, Sam Caucci, said cutting anyone from his 10-person team isn't an option.

"[Higher taxes] are going to make me work harder," Caucci said. "That means I'll need to cut costs and overhead expenses. I can't let the things happening in Washington affect my company's mission and vision."

Related: Big firms that avoid taxes are moochers, small companies say

Startups -- the nation's true source of net job creation -- are also at risk.

The tax increases would affect David Moritz, owner of Society Awards, which makes trophies for prestigious ceremonies like the Golden Globe and the Emmys. That's a problem for the New York City entrepreneur, who uses the financial success of Society Awards to fund the creation of other companies. Since 2008, Moritz has opened a branding firm and a beverage company, and he now has over a dozen employees in all three.

Moritz is hostile to any talk of raising taxes, insisting he's more efficient at creating jobs with his money than whatever the federal government plans to do with it. If his tax rates increase, Moritz expects his tax bill to increase by $20,000 or more. That's money he planned to use to launch a furniture company and hire two employees to run it.

"Every dollar I spend on my business I pay to another business," Moritz said. "The government would collect more revenue if they would just let me spend it."