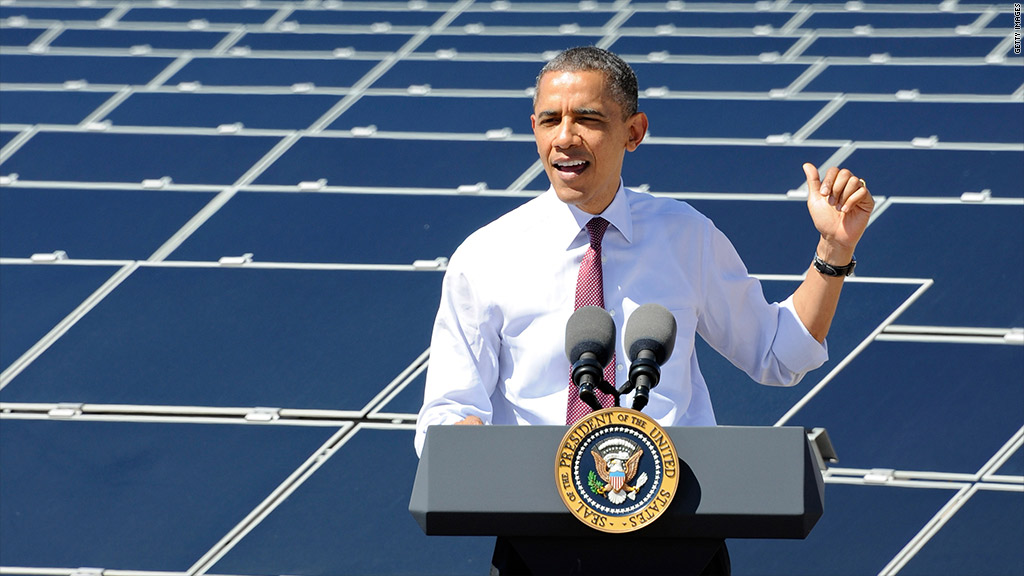

President Obama is getting hammered for funding renewable energy companies that have since gone belly up.

During the first presidential debate, Mitt Romney said "about half" of the companies funded by Obama's administration went bankrupt. That is true -- for just the first two years of the program that supported Solyndra, which the campaign later clarified. (See correction below).

But a spokesman for the Energy Department said that agency has dozens of programs that funded over 1,300 companies in the renewable energy space, and that less than 1% have gone bankrupt -- also true.

So just how many federally-funded energy companies have failed?

A total of five have gone bankrupt, according to the House Committee on Energy and Commerce. All of the failed companies that the Committee identified came from just two programs that received significant dollar amounts from the Department of Energy. Those two programs funded 63 firms. The other 58 are still in business. That's a failure rate of about 8%.

While other departments within the government have given money to renewable energy firms, some of which may have also gone bankrupt, the bulk of the funds were administered by the Energy Department.

The companies -- and what became of taxpayer money -- are as follows:

A123: The battery maker received a $249 million Department of Energy stimulus grant to build two factories in Michigan to manufacture batteries for electric cars.

The company drew down $132 million of that grant, and the factories are up and running, according to the DOE.

As part of A123's bankruptcy announced earlier this week, the factories were sold to Johnson Controls (JCI), which is expected to keep them open. Since the investment was a grant, the government got no money back. It's unclear whether Johnson will be eligible to draw down the remaining grant funds.

Abound Solar: The manufacturer of thin-film solar panels received a $400 million DOE stimulus loan guarantee to build two factories -- one outside Kokomo, Indiana and another outside of Denver.

Abound drew down $70 million of the grant to build the Denver factory. Abound declared bankruptcy in June amid strong competition and the collapsing price of solar panels.

Its assets are being auctioned off, and DOE is expected to lose to $40 to $60 million on the deal.

Beacon Power: The company received a $43 million DOE stimulus loan guarantee to build a facility in upstate New York that uses flywheels to store extra energy from the power grid, and then release it when needed. Such technology is seen as essential to integrate wind and solar into the grid, as those sources don't produce energy 24/7.

The company spent $39 million to build the project, which consists of wheels inside vacuum tubes that can spin at near perpetual motion. Beacon went bankrupt amid low prices for natural gas, which can be burned to produce electricity.

The flywheel plant was sold to a competitor, and DOE is slated to receive at least $27 million in the deal.

Ener1: A subsidiary of the company, EnerDel, received an $118.5 million grant to build two plants outside Indianapolis to manufacture batteries for electric cars and other uses.

Ener1 declared bankruptcy in January, and the company was bought by a Russian investor. The plants in Indianapolis continue to make batteries.

Solyndra: The manufacturer of advanced solar panels received a $535 million loan guarantee to build a factory outside of San Francisco.

Solyndra went bankrupt in 2011 amid falling prices for solar panels, and has since served as the poster child for well-meaning government policy gone bad.

Its assets are being auctioned off, and DOE is not expected to recover any meaningful amount of money.

Related: Obama vs. Romney: 9 energy flashpoints

The House Committee also pointed to two other DOE-funded companies that have made negative headlines as of late, but are still in businesses.

Fisker Automotive: The electric car maker received a $529 million DOE-backed stimulus loan to design a mid-priced model and build a factory to manufacture the vehicle in Delaware.

In February, Fisker put the manufacture of the sedan on hold amid lower than expected demand for electric cars and announced layoffs, though still says it plans on building the car in 2014. The company has drawn down about $200 million of the loan.

Nevada Geothermal Power: The firm received a $98 million DOE-backed loan to build a geothermal power plant north of Reno.

According to the House Committee on Energy and Commerce, an internal audit of the firm revealed $98 million in net losses and significant debt.

DOE says the power plant the loan built has a long-term agreement to sell electricity, and its investment will be protected no matter what happens to the parent company.

Correction: An earlier version of this story incorrectly stated how Romney described the bankrupt companies during the debate. The campaign later clarified that Romney was referring to the first two years of the 1705 loan program when he said "about half" went bankrupt. Romney did not qualify the statement during the debate.