To the extent that anything is clear about the fiscal cliff negotiations that begin this week, it's this: President Obama will push hard to increase taxes on the rich.

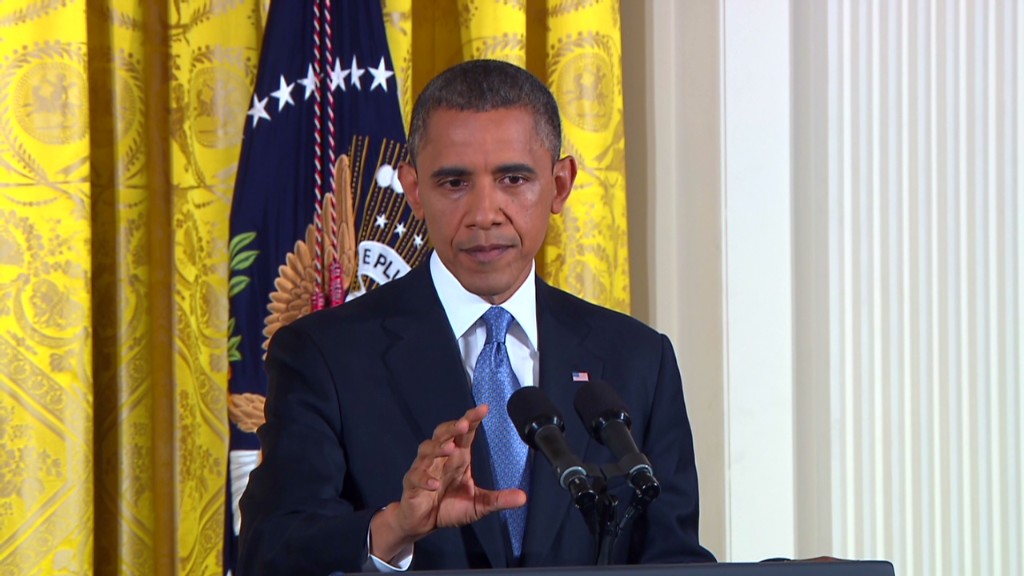

He made that point obvious at a press conference Wednesday, his first since being re-elected to a second term.

"When it comes to the top 2%, what I'm not going to do is to extend further a tax cut for folks who don't need it, which would cost close to $1 trillion," Obama said, referring to the Bush tax cuts that apply to income over $200,000.

"And it's very difficult to see how you make up that $1 trillion -- if we're serious about deficit reduction -- just by closing loopholes and deductions."

His starting position will be for a broad $4 trillion deficit-reduction plan that includes $1.6 trillion in new revenue, White House spokesman Jay Carney said Tuesday. The basis for it is Obama's 2013 budget proposal from last February.

That new revenue from his budget would come primarily -- although not exclusively -- from households making more than $200,000 ($250,000 if married).

Here are some of the tax measures Obama has put on the table:

Let some Bush tax cuts expire: As he often stresses, Obama wants to let the Bush tax cuts that apply to income over $200,000 expire. If that happened, the top two tax rates -- currently 33% and 35% -- would increase next year to 36% and 39.6%.

In addition, investment tax rates on the rich would increase to 20% for capital gains and to one's top income tax rate for dividends. Both are currently taxed at 15%.

All told, those changes would raise close to $1 trillion over a decade, assuming that the income exemption levels for the Alternative Minimum Tax are adjusted for inflation.

Limit tax breaks: Obama has proposed limiting the value of deductions and exclusions that high-income households enjoy -- a plan that would raise more than $500 billion.

Hike carried interest rates: The president has called for taxing carried interest as ordinary income, raising an additional $13.5 billion over a decade. Managers of private equity, venture capital and hedge funds are only taxed 15% on the portion of their compensation known as carried interest. If carried interest were taxed as ordinary income, those managers would pay more than double the rate they currently pay.

Impose millionaire minimum tax: Obama's 2013 budget proposal calls on Congress to use his proposed "Buffett Rule" as a guiding principle when it embarks on tax reform. The rule would ensure that those making more than $1 million pay at least 30% of their income in taxes.

The White House didn't estimate how much a millionaire tax could raise since everything would depend on the how the proposal is structured. But a bill from Senate Democrats modeled on the Buffett Rule was estimated to raise $47 billion over 10 years.

Enact business tax proposals: Obama proposed a host of smaller tax changes. Some of them, such as new manufacturing and "insourcing" incentives, would decrease revenue. Others, such as a financial transaction tax, would increase revenue. The tax increases would raise about $240 billion, according to the Committee for a Responsible Federal Budget.