There were nearly 50 million Americans living in poverty in 2011, under an alternative measure released by the Census Bureau Wednesday.

That's 16.1% of the nation, higher than the official poverty rate of 15%. The official rate, released in September, showed 46.6 million people living in poverty.

Neither the supplemental nor the official poverty rates last year were significantly different than in 2010.

The Census Bureau's second annual supplemental poverty measure includes various government benefits and expenses not captured by the official poverty rate, which will continue to be used to determine eligibility for public assistance and federal funding distribution. The alternative calculation also takes into account geographic differences in prices.

Work, medical and federal tax expenses drove more people into poverty, the report showed. These costs outweighed the benefit of non-cash public assistance, such as food stamps, housing assistance and refundable tax credits, which lifted many Americans out of poverty.

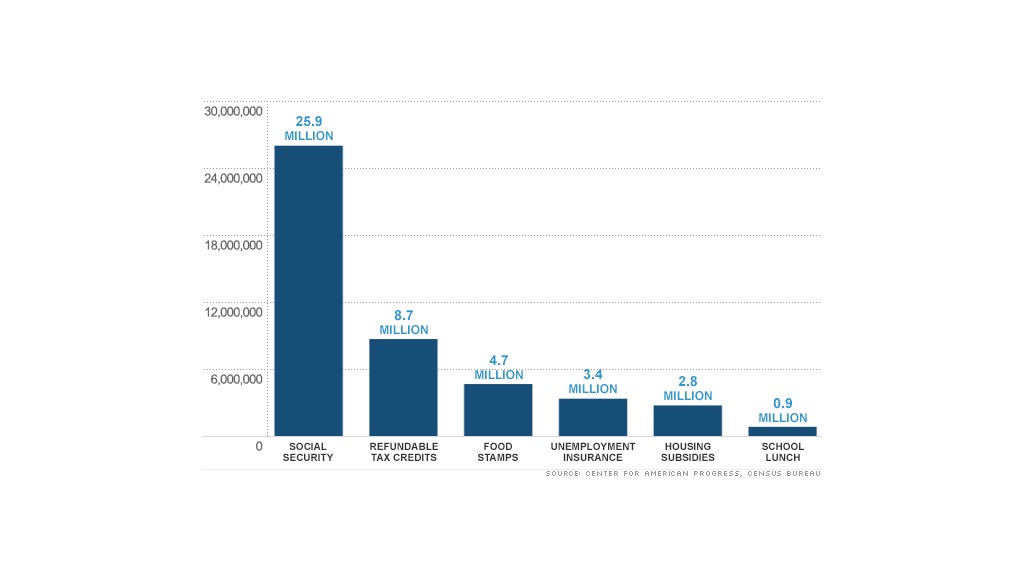

Keeping people out of poverty

The alternative measure showed the importance of Social Security and the weight of medical care on the elderly. Without Social Security, some 54.1% of Americans age 65-plus would be in poverty, as opposed to 15.1%. But if they didn't have to pay out-of-pocket health care costs, their poverty rate would have fallen nearly in half to 8%.

Refundable tax credits -- the earned income tax credit and the child tax credit -- proved the next most effective government initiative keeping Americans out of poverty. It lowered the supplemental rate by 2.8 percentage points. That kept 8.7 million Americans above the poverty line, according to Melissa Boteach, director of the Poverty to Prosperity program at the Center for American Progress.

Food stamps, meanwhile, kept 4.7 million people out of poverty, and unemployment insurance 3.4 million. Programs such as school lunch, heating assistance and Temporary Aid to Needy Families, had a much smaller impact, each affecting fewer than 1 million people.

On the other hand, work expenses, federal taxes and medical costs pushed more people below the poverty line than officially reported. Medical outlays pushed 10.6 million people into poverty, while work expenses added another 5.3 million Americans to the poverty rolls

The supplemental report shows why lawmakers should not cut these anti-poverty programs in Congress' deficit discussions, Boteach said. For instance, work costs already push 5 million people below the poverty line. But federal spending cuts could eliminate 25,000 child care seats and 75,000 Head Start openings.

"This report should be a wake-up call that the pathways to the middle class should be protected," she said.