States would see massive cuts in federal spending should the nation fall over the fiscal cliff, according to a new report. But they could also see their tax revenue jump as federal tax rates rise.

The fiscal cliff is a combination of expiring tax policies and federal spending cuts that are set to take effect in January. President Obama and lawmakers are now scurrying to come up with a plan to avoid this scenario, which the Congressional Budget Office projects would push unemployment above 9% by the end of 2013 and shave 0.5% off the nation's economy.

"While states would be affected in different ways, the one clear thing is that almost all states will be affected in some way by the different elements of the fiscal cliff," said Anne Stauffer, project director at Pew Center on the States, which authored the report.

Roughly 18% of federal grant dollars flowing to states would be subject to across-the-board cuts, according to Pew, citing calculations from the Federal Funds Information for States. This includes funding for education, nutrition for low-income women and children, public housing and other programs. The cuts would total about $7.5 billion.

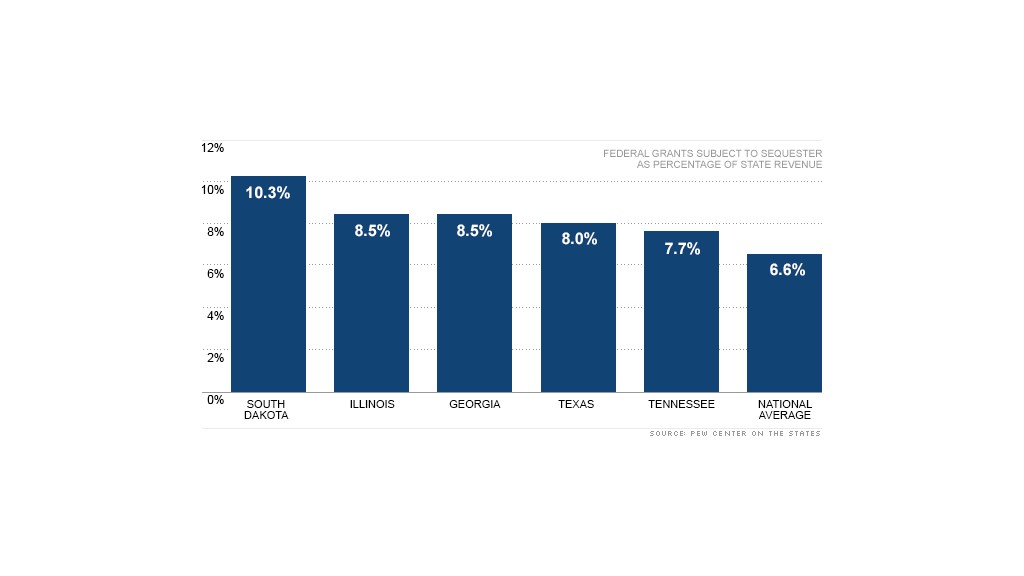

The reductions would affect states differently because each one varies in the type and amount of grants it receives. In South Dakota, for instance, federal grants subject to the cuts make up 10.3% of state revenue. But in Delaware, the grants only make up 4.8%. The national average is 6.6%.

Going over the fiscal cliff could also result in cuts to federal procurement, wages and salaries. In Maryland, Virginia and D.C., this makes up 19.7% of the combined region's economy. The national average is 5.3%, but in Delaware, it is only 1.3%.

On the flip side, states could bring in more revenue if $393 billion in federal tax increases, including the elimination of the Bush tax cuts, take effect. That's because state taxes are often linked to federal provisions so when more income is taxed at the federal level, the same goes for the state level.

At least 25 states and D.C. that link to various federal deductions would see increased revenues, as would the 30 states and D.C. that link to federal credits and 23 states that link to federal corporate income tax deductions. The 33 states that link to certain federal estate tax provisions would also see increased revenues.

However, the six states that allow a deduction for federal income taxes would see a drop in revenues.