Some call it QE Infinity.

The Federal Reserve announced plans Wednesday to expand its controversial and open-ended stimulus program known as quantitative easing, and keep short-term interest rates near zero. And the central bank dropped more hints as to when those easing programs might end, linking both to the strength of the job market.

One economist called it an "historic move," signaling the Fed is putting more weight on the unemployment rate than ever before.

"This is as aggressive as Fed easing has ever been," said Sherry Cooper, chief economist for BMO Financial Group.

The Fed will buy $45 billion in Treasuries, in addition to its existing policy of buying $40 billion in mortgage-backed securities each month. Those new Treasury purchases go above and beyond Operation Twist, a policy set to end this month that swapped short-term Treasuries the Fed already owned for longer term bonds.

The hope is the additional purchases will continue to push long-term interest rates even lower. Mortgage rates have already fallen to record lows, in step with the Fed's stimulus program, and a housing recovery seems to be building steam.

The end date for all this easing? Bond buying will continue until the job market improves "substantially," and rates will remain at historic lows until the unemployment rate falls to 6.5%, or inflation exceeds 2.5% a year.

Wednesday was the first time the Fed has issued an exact target for the unemployment rate, and it marked the end of the Fed's calendar guidance, which previously stated it planned to keep interest rates low until at least 2015.

The unemployment rate recently fell to 7.7% in November, but the decline was largely because 350,000 people stopped looking for work that month.

"Although the unemployment rate has declined somewhat since the summer, it remains elevated," the Federal Reserve said in a statement Wednesday.

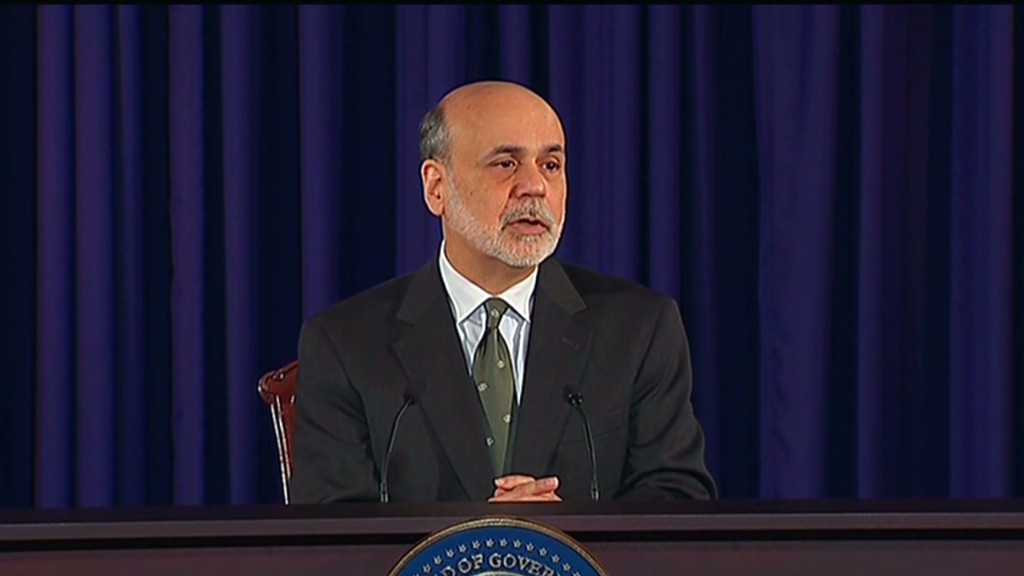

Fed Chairman Ben Bernanke has also repeatedly expressed concerns about what might happen to the economy if Congress and the White House are unable to agree on a deal to avert the so-called fiscal cliff of tax hikes and automatic spending cuts by the end of the year.

For these reasons, the Fed reiterated Wednesday that it expects to keep its key interest rate, the federal funds rate, near zero until there is more significant improvement in the job market. The federal funds rate is the rate banks pay to lend money to each other overnight, and it influences other key interest rates on mortgages, credit cards and business loans.

Related: Federal Reserve official aims for 6.5% unemployment

The Fed has kept this rate near zero for four years, but that alone has not stimulated the economy enough to lead to a full jobs recovery. To add additional stimulus, the Fed has also been purchasing various types of bonds.

The Fed's policy is not without risks though. Some economists fear the Fed will find it difficult to shed these assets should the economy eventually heat up.

Because these purchases also add to the money supply, critics (including some Fed officials) also worry this policy could eventually fuel inflation and weaken the value of the U.S. dollar.

Richmond Fed President Jeffrey Lacker, one of the Fed's voting members, opposed buying more bonds Wednesday, as he has all year. He has said in the past that he fears the purchases will have little impact on the economy, other than to fuel inflation.

For now, rapid inflation seems a long way off though. The Fed's preferred measure of inflation, calculated by the Commerce Department, has not exceeded 2% a year (the Fed's long-run target) for four consecutive years. And with wages barely rising, inflation is unlikely to accelerate any time soon.

The Fed also issued new economic forecasts Wednesday. The central bank lowered its growth projections for 2013 slightly but also indicated that the unemployment rate may fall further than it had thought just a few months ago.