More than three in four Americans will pay higher taxes for 2013, thanks to the fiscal cliff deal passed in Congress on New Year's Day.

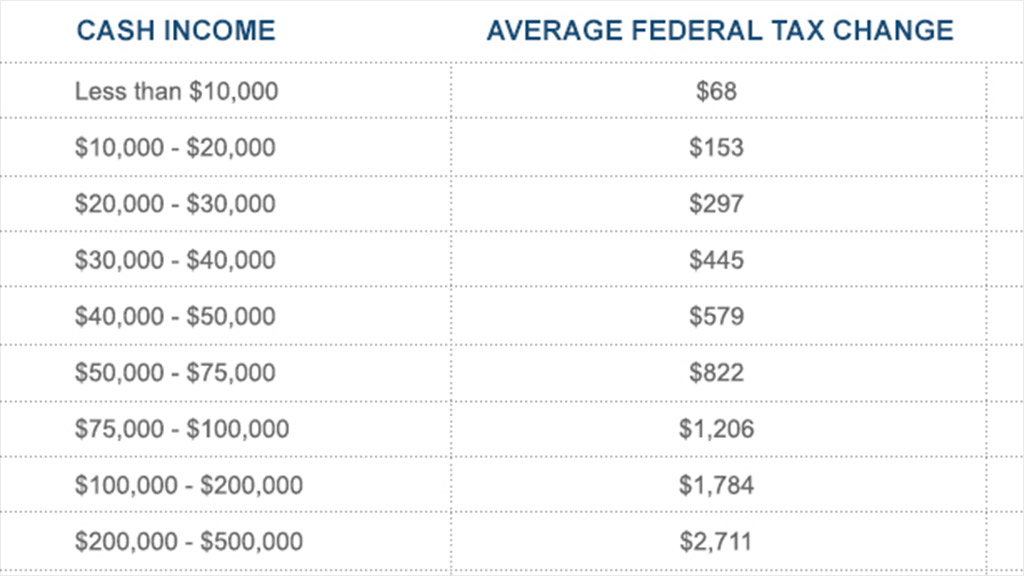

Over 77% of filers will pay more, according to the Tax Policy Center. The average increase is expected to be $1,257, but that figure belies the wide disparity in impact.

Those making less than $10,000 a year will pay $68 more in federal taxes, on average, while those making between $50,000 and $75,000 will see an $822 jump. Wealthy filers with incomes of $1 million or more will see a $170,341 spike, on average.

The ending of the payroll tax break will have the broadest reach, with most of the nation's 160 million workers seeing smaller paychecks. Wage earners will have to pay the full 6.2% in payroll taxes, up from the 4.2% they'd been paying for the past two years. This means those earning $30,000 annually will get $50 a month less in their paychecks, while those making $113,700 (the maximum amount subject to payroll tax) will see $189.50 less each month.

Related: No word on tax refunds

The rich will also get hit by the increase in the tax rate to 39.6% for couples with adjusted gross incomes above $450,000, or single filers above $400,000. Millionaires will pay $122,560 more a year just from this provision alone, according to the Tax Policy Center. And they'll have to pay a 20% levy on capital gains and dividends, up from 15%.

Americans, mainly wealthy ones, will also pay more in tax because of a variety of other measures both in the fiscal cliff deal and in President Obama's health care reform law. Joint filers making more than $300,000, or single taxpayers earning more than $250,000, will see their personal exemption and itemized deductions limited. And well-off taxpayers will pay 0.9% more on their family income above $250,000 for couples, or $200,000 for singles. And some will pay 3.8% on certain levels of investment income.

Who escapes the fiscal cliff tax hike? They are likely retirees, the unemployed, the disabled and the rich who don't work, said Roberton Williams, a senior fellow at the Tax Policy Center.

CNNMoney's Emily Jane Fox contributed to this story.