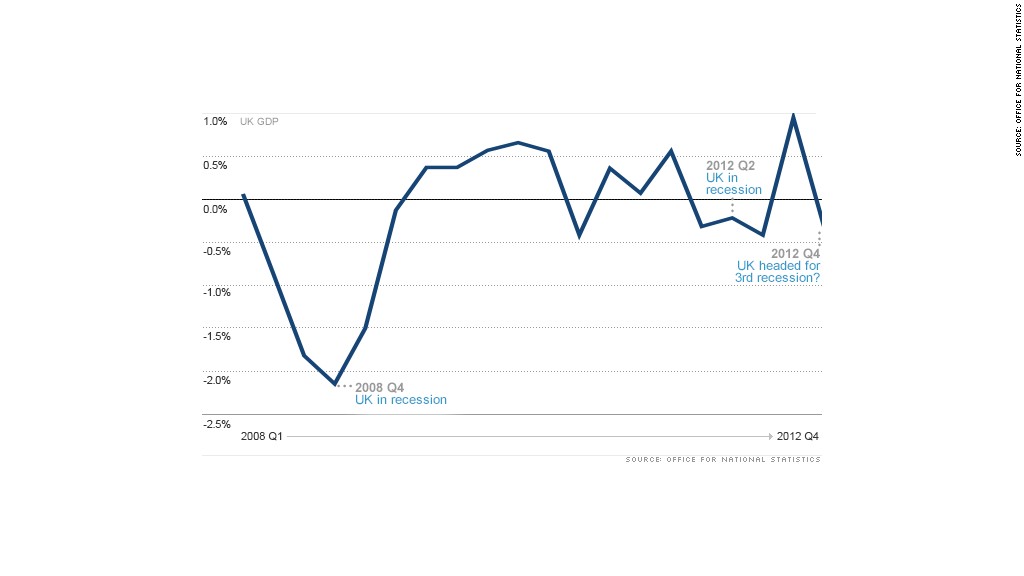

The British economy slipped back into reverse in the final quarter of 2012, raising the prospect of a third recession since the financial crisis and increasing pressure on the government to ease up on its austerity drive.

Gross domestic product for the U.K. fell by 0.3% in the fourth quarter, a weaker performance than many economists were expecting. The economy emerged from recession in the third quarter with growth of 0.9%, but one-off factors such as the London Olympics were largely responsible for the economic boost.

Output in the dominant services sector was flat, but industrial production fell by 1.8% in the last three months of 2012. Meanwhile, the construction sector saw growth of 0.3%.

The International Monetary Fund this week shaved its 2013 growth forecast for the U.K. economy to 1%. Its chief economist Olivier Blanchard said Thursday that the time was right for Britain to consider adjusting its program of fiscal consolidation -- a call rejected immediately by U.K. finance minister George Osborne.

Speaking at the World Economic Forum in Davos, Osborne said his plan to reduce the U.K. budget deficit had created credibility with investors allowing the country to borrow at very low rates.

"Credibility is very hard won and easily lost," he said. "And I think it would be a huge mistake to put that at risk."

Related: Eurozone forecast cut, but Lagarde is optimistic

But a fall back into recession could put the country's AAA credit rating in doubt, risking an increase in borrowing costs.

"Another contraction in Q1 -- and thus a 'triple-dip' recession -- seems worryingly easy to deliver," stated economists at Nomura in a research note.

Government cuts, falling real disposable incomes and recession in the eurozone are depressing activity in the U.K. Three big retailers have already collapsed this year, putting thousands of jobs at risk.

The government said last month that the belt tightening would have to continue into 2018, a year longer than expected, due to low revenues. National output remains about 3% below pre-recession levels.

Evidence that the world's sixth largest economy is still going nowhere comes as a debate rages around its membership of the European Union.

Prime Minister David Cameron this week said he would offer the British people the chance to vote on whether the country should remain within the EU if his party wins the next election in 2015.

Some business leaders have given him their support, arguing that Britain should take the opportunity presented by the eurozone crisis to push for a less bureaucratic and more competitive and flexible single market in the EU.

Others, however, have warned that the risk of the U.K. voting to leave the EU could have a chilling effect on investment.

"It's at best neutral, at worst negative," Martin Sorrell, CEO of advertising group WPP, told CNN. "You just added another reason why people are going to postpone investment decisions. And the last thing we need is people postponing more."