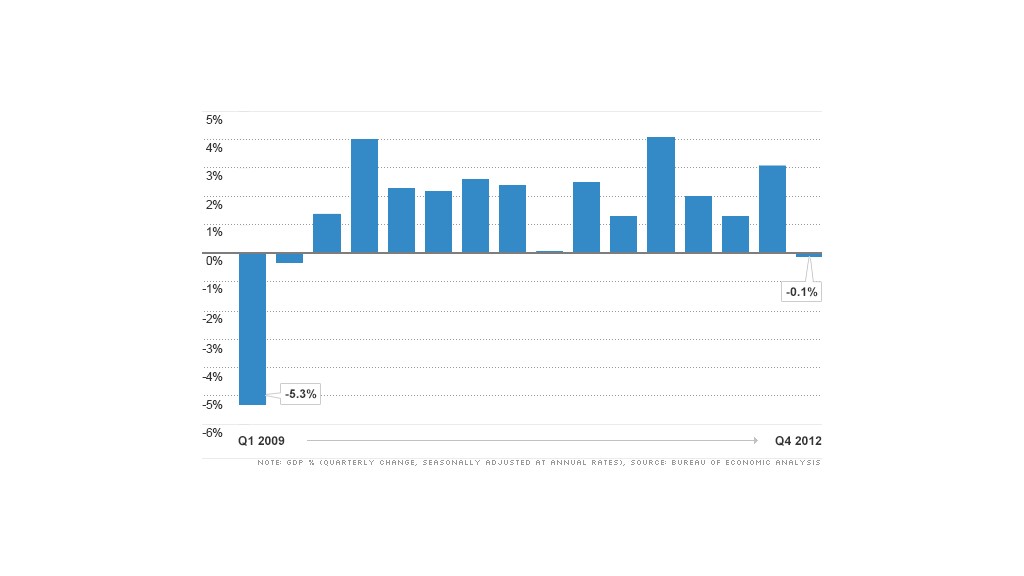

Uncle Sam cut spending and businesses drew down inventories in the fourth quarter of 2012, causing the U.S. economy to contract for the first time in more than three years.

But don't start throwing around the R-word just yet.

"No one I know would seriously call this an indicator of recession," said Bill Hampel, chief economist with the Credit Union National Association.

Gross domestic product, the broadest measure of the nation's economic growth, contracted at an annual rate of 0.1% from October to December, the Commerce Department said Wednesday. It was the first quarterly contraction since the second quarter of 2009, amid the Great Recession.

Related: Automatic spending cuts more likely now

While a contraction is never encouraging, economists pointed to temporary effects that may have caused a one-time dip, and they see better growth ahead.

It's "the best-looking contraction in U.S. GDP you'll ever see," Paul Ashworth, chief U.S. economist for Capital Economics said in a research note. "The drag from defense spending and inventories is a one-off. The rest of the report is all encouraging."

A large cut in federal spending, primarily on defense, was one of the biggest drags on growth. Defense spending contracted at a 22% annual rate.

Alan Kreuger, head of President Obama's Council of Economic Advisers, attributed the deep decline to the looming sequestration deadline.

"A likely explanation for the sharp decline in Federal defense spending is uncertainty concerning the automatic spending cuts that were scheduled to take effect in January, and are currently scheduled to take effect on March 1st," he said in a blog post.

Defense spending tends to be a volatile number in the GDP report, and is unlikely to decline so dramatically next quarter, Hampel said.

The other major drag came from business inventories declining in the fourth quarter. When that happens, it often signals businesses will have to buy more goods in the upcoming quarter to restock their shelves, which could lead to stronger growth in the first quarter of 2013.

"Businesses were selling in the fourth quarter, but not replacing the stuff on the shelves," Hampel said. "When inventories fall in one quarter, they're really likely to rise the next quarter."

Related: Housing to drive economic growth (finally!)

Some of that could be due to Hurricane Sandy. The Commerce Department estimates the storm led to a $35.8 billion loss in private fixed assets and an $8.6 billion loss in government fixed assets in the fourth quarter.

Aside from those factors, there were positive signs in the report. Consumer spending makes up the largest part of the U.S. economy and accelerated at a 2.2% annual rate in the fourth quarter.

"The basic engine of the economy looks to be in good shape," Hampel said.

Economists are predicting the U.S. economy will bounce back in the first quarter of 2013, and stay on trend with a 2% to 2.5% growth rate seen during the recovery.

A gradual housing recovery is likely to be a big contributor to that growth.

Meanwhile, sequestration remains a threat to the economy over the short term, as chances are growing that automatic, across-the-board government spending cuts may soon take effect. The cuts could slash the amount federal agencies are allowed to spend by $85 billion over seven months.

"Today's report is a reminder of the importance of the need for Congress to act to avoid self-inflicted wounds to the economy," Krueger said.

Weak global demand for American-made goods and services, particularly from Europe and China, also remains a concern.

"The momentum in the economy is positive, but not booming," Hampel said.

Wednesday's GDP report is the Commerce Department's first estimate for the fourth quarter figures. The government plans to revise the numbers twice over the next two months.