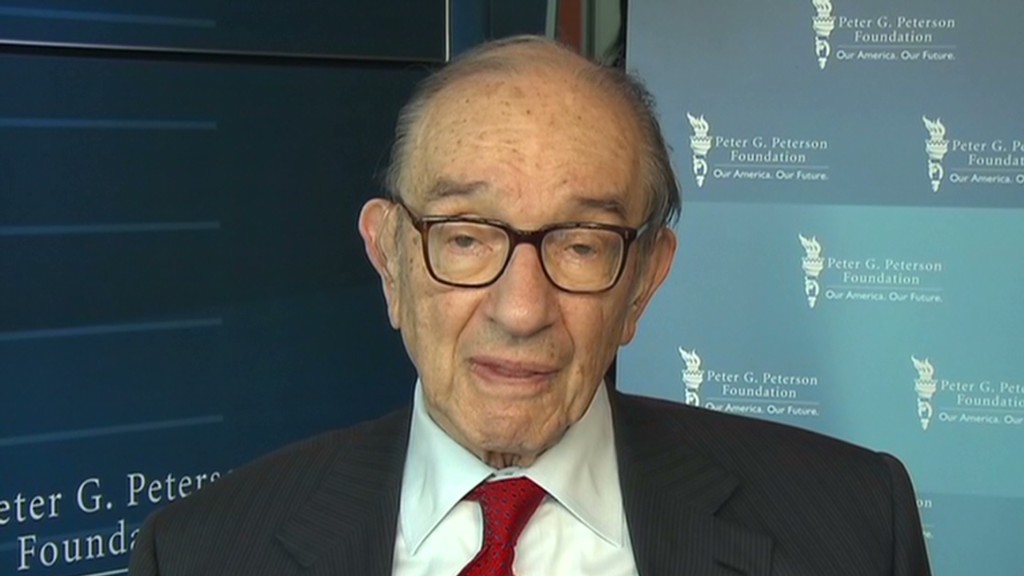

Former Federal Reserve Chairman Alan Greenspan said that even with record-high stock prices, investors don't need to worry about "irrational exuberance" this time.

In fact, his current view is that stocks are still "significantly undervalued."

The Dow Jones industrial average's 10-session winning streak heading into Friday is its longest since November 1996.

Less than a month after the 1996 streak, then Chairman Greenspan shook stock markets by warning that climbing share prices could be the result of irrational exuberance. That became one of the most famous phrases of his 18-year tenure as head of the central bank. But he has an opposite view today.

"Irrational exuberance is the last term I would use to characterize what is going on at the moment," Greenspan said on CNBC Friday morning. Asked about the recent bull market, he responded, "It's still got a ways to go as far as I can see."

Related: Dow - best streak since irrational exuberance

Greenspan said the current stock run is due to reduced fears that the European sovereign debt crisis would crash economies around the world. He also seemed to dismiss the idea that the Federal Reserve's asset purchase program is responsible for driving stocks higher.

Greenspan said that the recent rise in both stock and home prices has done a great deal to protect the economy from the damage many expected to see after payroll taxes rose at the start of the year.

"Both home prices and stock prices have been very powerful for us this year," he said.

While Greenspan gets a lot of credit for warning of the dangers of the stock market bubble that burst in March 2000, his track record of calling asset bubbles is not unblemished.

During the run up in housing prices that would eventually be blamed for the 2008 global financial meltdown, Greenspan denied there were any signs of a housing bubble, saying that home values were only "frothy." He later conceded that he was "shocked" when the financial system "broke down" that year.

Asked Friday if he thought Ben Bernanke, his successor, would return for another term as Fed chairman when his current term expires in January 2014, he responded, "I would hope so, but I can fully understand if he's had enough."