Millionaires would get a sizable tax cut if Rep. Paul Ryan's budget proposal were to become law.

Those with incomes exceeding $1 million would enjoy an average tax cut of more than $200,000, according to Citizens for Tax Justice, a left-leaning group. And it could be even bigger if Congress doesn't try to limit tax deductions, credits and preferences to offset the costs of the proposed tax cuts.

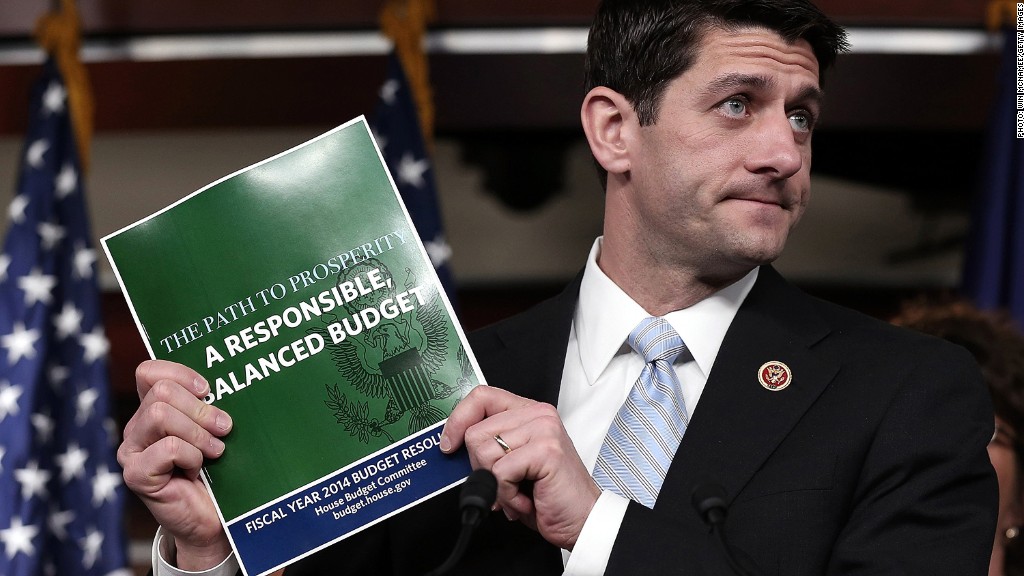

Under the Ryan budget, released Tuesday, income would be taxed at only two rates, 10% and 25%. Currently, there are seven brackets ranging from 10% to 39.6%. The House Budget Committee chair doesn't provide a lot of other details about his tax reform plan, which also calls for eliminating the alternative minimum tax and the Obamacare tax hikes on the wealthy.

Ryan, who was the Republican vice presidential candidate last year, also didn't explain how he would recoup the income lost from eliminating higher tax rates. He is leaving it for the House Ways and Means committee to work out the details, including the income thresholds at which the rates would kick in.

In last year's budget, Ryan proposed getting rid of tax loopholes and preferences, while maintaining tax breaks for savings and investments, such as the lower rate on capital gains. The rich benefit the most from the preferential rate on capital gains. But Ryan doesn't go into that much detail in this year's plan.

Related: The rich pay majority of U.S. income taxes

Citizens for Tax Justice looked at how millionaires -- whose average income is $3.15 million -- would fare if the highest tax rate was lowered from 39.6% to 25%. Even if the wealthy gave up all their tax breaks, they'd still wind up paying $203,670 less in taxes. And if the tax preferences were maintained, their tax burden could be up to $345,640 lighter.

Other taxpayers would save much less, according to Roberton Williams, a senior fellow at the centrist Tax Policy Center, which crunched the numbers without taking into account measures the Republicans may add to raise revenues.

Those in the middle of the income spectrum -- earning between $43,000 and $68,000 -- would wind up with a tax cut of about $900 on average, while those earning below $22,000 would have savings of only $40.

"The higher you go, the bigger the savings will be," Williams said.

But since Ryan said his budget would not cost the government any revenue, the tax cut would have to be made up somewhere. Steve Wamhoff, Citizens for Tax Justice's legislative director, fears it would hit the middle class and others in some other way.

"If the rich pay less, then someone has to pay more for this whole thing to balance out," he said.

One of the wild cards is how Congress will handle tax deductions, credits and other preferences. Ryan said the goal is to help everyone.

"House Republicans want to clear out special-interest loopholes and lower everybody's rates," said a Ryan spokesman. "We want to reform the tax code to help the economy. We don't want to raise taxes to pay for more spending."