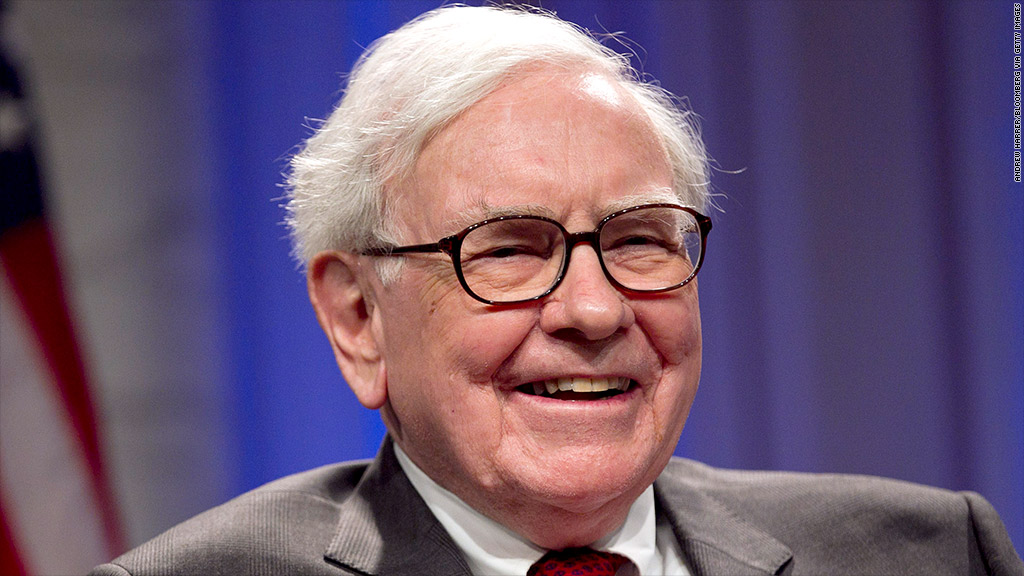

Warren Buffett is on his way to becoming one of Goldman Sachs' 10 largest shareholders.

Goldman (GS) said Tuesday that Buffett's firm Berkshire Hathaway (BRKA) would receive a large block of the investment bank's stock in October.

It's the outcome of Buffett's $5 billion emergency cash infusion into Goldman at the height of the financial crisis in 2008, when Wall Street firms were frozen in panic after the bankruptcy of investment bank Lehman Brothers.

At the time, Buffett received preferred shares worth $5 billion that paid a dividend of $500 million annually. He also got warrants to buy 43 million shares of Goldman stock for $115 apiece by October of this year. If Buffett were to cash in at Goldman's current stock price of around $145, his stake would be worth $6.3 billion, a profit of $1.3 billion.

But Goldman and Buffett said Tuesday they had revise the options so that Berkshire will receive shares equal in value to that profit. At current stock prices, that would mean an additional 9 million shares. It would be enough to rank Buffett as Goldman's ninth largest shareholder, according to LionShares, a stock tracking service.

Related: Buffett worried about Fed policy

"We intend to hold a significant investment in Goldman Sachs, a firm that I did my first transaction with more than 50 years ago," said Buffett in a statement.

Goldman repurchased its preferred shares from Buffett in 2011. But Berkshire continued to hold the warrants from that original investment.

Shares of Goldman were 0.6% lower, while Berkshire was up about 1%.