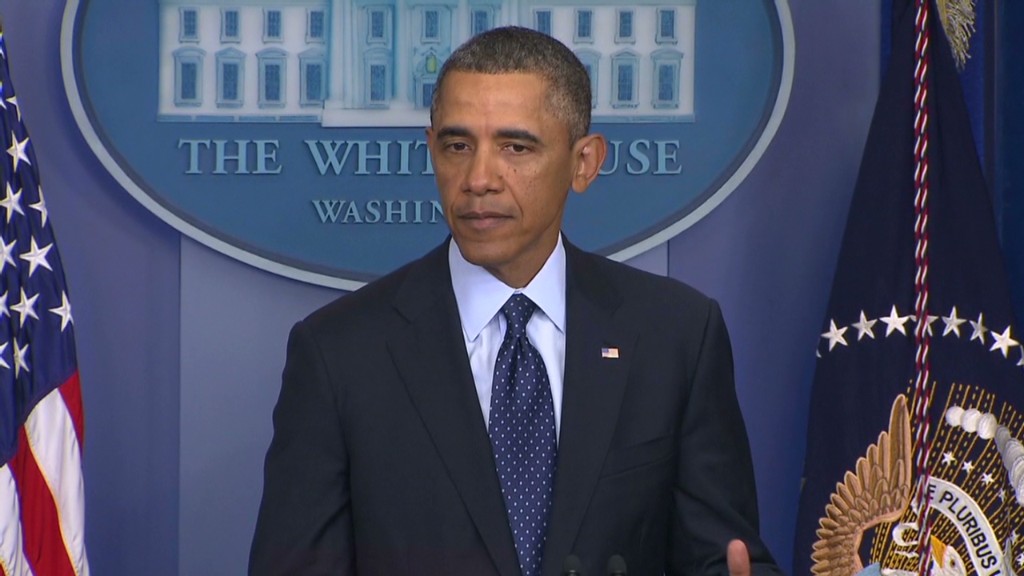

President Obama on Wednesday is expected to make the case for cutting deficits by $1.8 trillion -- a number that would bring total proposed debt reduction under Obama to unprecedented levels.

The president's budget, which is not expected to fly on Capitol Hill, nonetheless sets an important marker for continuing debt talks with lawmakers.

His tax and spending framework would bring total deficit reduction to about $4.3 trillion relative to where things stood in August 2010, which was the launching point used by the president's fiscal commission chaired by Erskine Bowles and Alan Simpson.

More than half that amount -- $2.5 trillion -- would come from several measures that came about from negotiations with Republicans:

- initial savings from the 2011 Budget Control Act, not including the automatic budget cuts that went into effect in March;

- lower spending levels set by temporary government funding resolutions enacted since 2010;

- revenue raised by the fiscal cliff deal passed at the start of this year.

The remaining $1.8 trillion would come from Obama's 2014 budget proposal.

The president will seek to replace the $1.2 trillion in deficit reduction that would result from the automatic budget cuts, also known as the sequester. And then he will propose another $600 billion in deficit reduction on top of that, much of which may come from his tax proposals.

In terms of sheer dollars, the country has never cut deficits by $4.3 trillion over a decade.

But when measured in terms of how much it would reduce the country's accumulated debt load as a percent of the economy, it really doesn't rank.

Reducing projected deficits by $4.3 trillion would still leave the country with a public debt level equal to about 73% of the economy, or about 4 percentage points less than today.

Related: The geeky debt fix that might work

That pales in comparison to how much deficits fell in the decade following World War II -- a whopping 57 percentage points.

Some key differences between then and now may partly account for that huge disparity. And a drop to 73% of GDP would certainly be an improvement. But a 73% debt level is still high by historical standards.

One more recession or war could put a strain on federal coffers and push the debt past 73% very quickly.

Of course, debt to GDP is not the only metric to assess the merits of $4.3 trillion in deficit reduction. The content of the plan matters a lot.

Independent deficit hawks, who are most interested in long-term debt reduction and not a slash-and-burn approach that threatens the economy today, urge passage of a comprehensive plan that keeps the debt moving downward past the next decade.

Right now, the $2.5 trillion already enacted plus the automatic budget cuts wouldn't do that. Without more substantial policy changes, the debt is expected to rise again as a percentage of the economy soon after 2023.

That's because the deficit reduction enacted so far has been near-sighted.

Many of the spending reductions have cut into the country's "seed corn," such as education, research, science and technology, said G. William Hoagland, senior vice president of the Bipartisan Policy Center. "That's where we should be investing, not cutting."

Budget experts argue Congress must enact a long-term plan that controls health spending growth, adjusts Medicare and Social Security for the swell of new retirees over the next two decades, boosts economic growth and raises more revenue through serious tax reform.