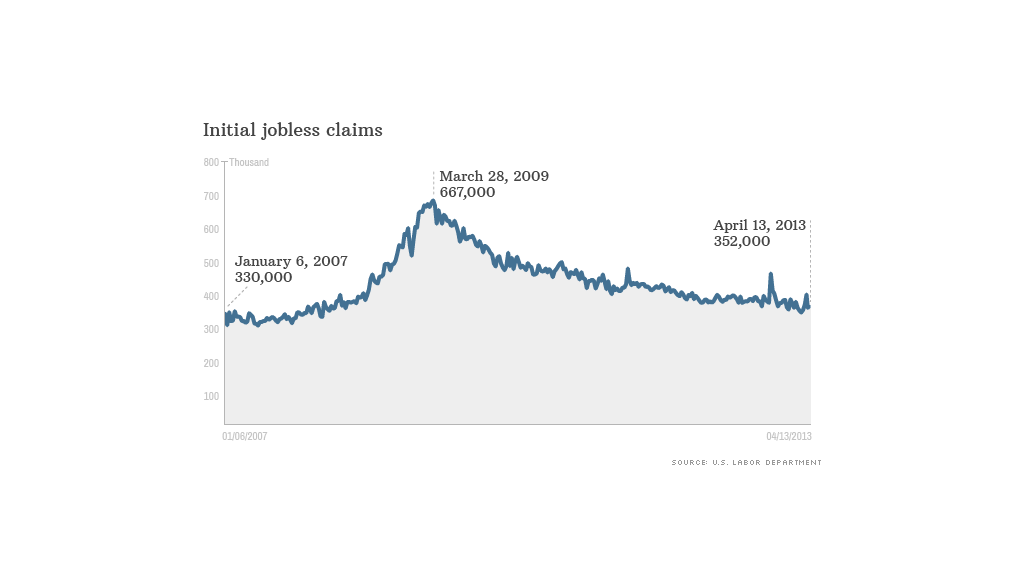

The number of Americans filing for their first week of unemployment benefits rose slightly last week.

About 352,000 people filed claims for their first week of jobless benefits, up from a revised 348,000 the week before, the Labor Department said Thursday.

The figure is slightly lower than expected. Economists had forecast the number to come in at 355,000, according to Briefing.com.

While the number is little changed from last week, it is usually a choppy statistic in March and April, when the Easter holiday and school spring breaks tend to distort the figures. The seasonal adjustment process gets trickier to account for, since the holiday and break fall on different weeks every year.

That's why before this week, claims had been on a roller-coaster ride. They fell dramatically last week after rising sharply a week earlier.

The four-week moving average -- which smooths out the volatility -- showed a smaller increase to 361,250 new claims.

In total, there were nearly 3.1 million filing for their second week or more of unemployment benefits two weeks ago, the most recent data available.