The sharp drop in gas prices over the last month or so could provide America's economy with a much-needed jolt, putting money into consumers' pockets just as the impact of federal spending cuts reverberates through the economy.

In fact, some economists believe they could balance each other out nearly dollar for dollar.

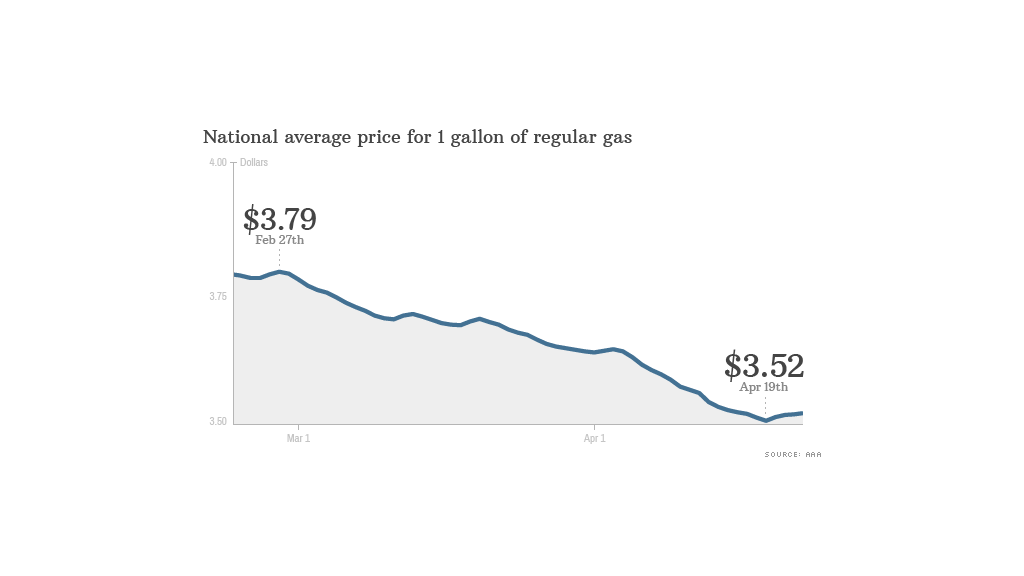

Gasoline prices have fallen some 30 cents a gallon since hitting a high of nearly $3.80 a gallon earlier this year. The drop is mostly due to declining oil prices.

If the gas price drop continues -- and many expect it will -- prices could slip below $3.40 a gallon by summer, according to the research firm Capital Economics.

If prices stay that low, the savings for drivers over the course of a year could top $80 billion. That's $80 billion to spend on other things like clothes, electronics or entertainment.

Related: Check gas prices in your state

"To put that into context, it is roughly the same size as the sequestration spending cuts that took effect at the start of last month," researchers at Capital Economics wrote in a recent note. As a result, economic growth "might not be as bad as we had initially feared."

Not that the economy's on fire. Most economists are expecting first-quarter growth to come in at a relatively strong 3% or so when the numbers are released later this week.

But it's the second quarter that's got people concerned, partly because of the federal spending cuts and related tax hikes that are sapping consumer spending. Any additional money being pumped into the economy -- from, say, falling gas prices -- could help growth in the second quarter.

"Gasoline prices have been declining this spring, and the national average price is lower today than it was at the same time last year," Gary Thayer, an economist at Wells Fargo, wrote in a note last week. "Consequently, consumer sentiment and consumer spending are likely to improve in the months ahead."