The pace of home price increases continued to accelerate in February, according to a reading Tuesday that showed the biggest gain since near the height of the housing bubble.

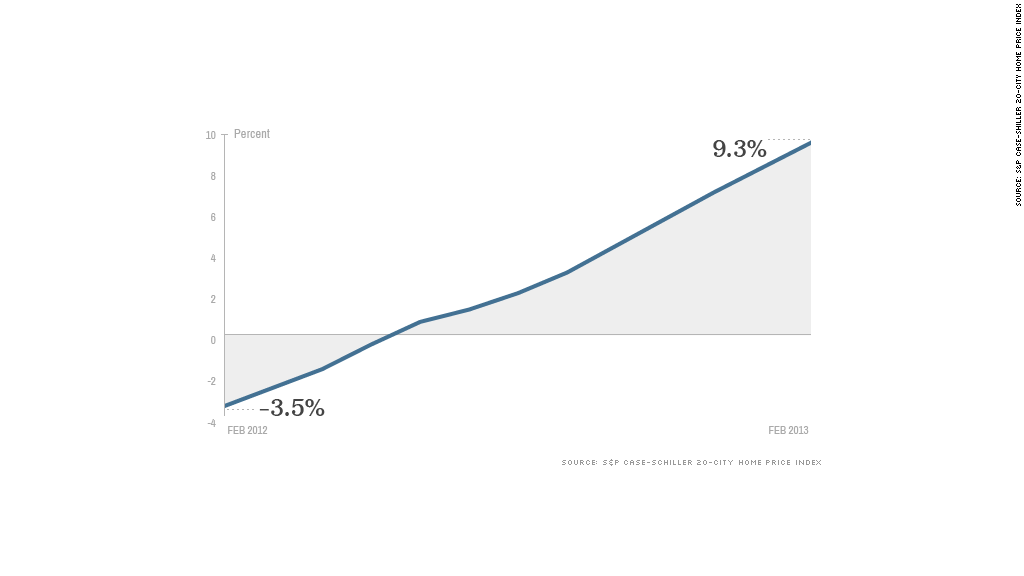

The S&P Case-Shiller index of home prices in 20 major markets posted a 9.3% rise over the last 12 months. That's up from the 8.1% rise in January. It was the biggest 12-month gain in the index since May 2006, which was just one month after the index showed record-high home prices.

The index showed a 12-month decline in prices almost every month over a five-year period through May 2012. But every month since then has shown a gain in home prices, and each month's gain has been stronger than the one that came before.

"Despite some recent mixed economic reports for March, housing continues to be one of the brighter spots in the economy," said David Blitzer, chairman of the index committee at S&P Dow Jones Indices.

Stan Humphries, chief economist for home price tracker Zillow, said there are signs in the market that the pace of increase started to slow in March.

"Regardless what data you look at, home values are clearly rising at an unsustainable pace," he said. He said the increases in the index need to be taken with a grain of salt, being distorted by the shift in transactions to private home sales rather than the foreclosure sales that had been dominating the market.

The housing recovery has been driven by a number of factors, including near record-low mortgage rates, a drop in foreclosures and reduced unemployment, all of which have helped lift both new-home sales as well as sales of previously owned homes. The rising home prices has helped bring back some buyers who had been reluctant to buy while prices were falling.

Mike Larson, real estate analyst at Weiss Research, said he's concerned that much of the increase is being driven by investors flooding into some markets to buy homes in order to rent them out, outbidding the potential homeowners who want to live in a home.

"Prices are not at bubblicious levels, but you're talking about a trend that can be destabilizing," he said.

Mark Vitner, senior economist with Wells Fargo Securities, said part of the reason for the sharp rise in prices is the comparison to depressed prices a year earlier. He said comparisons will become more difficult later this year. and the pace of increase should slow.

Home price increases boost the overall economy. Besides the jobs created by a pick-up in construction and home sales, rising prices mean fewer homeowners are underwater on their mortgages, owing more than the home is worth. That allows more homeowners to refinance, saving money they can spend on other things.

Related: Builders hold lotteries for eager new homebuyers

The Case-Shiller index showed the improvement in home prices is broad based, as every market posted an increase for the second straight month. The biggest increases came in Phoenix, a market hit hard by the bursting of the housing bubble, where prices were 23% higher than a year earlier.

But prices were up more than 10% in half of the markets -- San Francisco, Las Vegas, Atlanta, Detroit, Los Angeles, Minneapolis, Miami, San Diego and Tampa all posted double-digit percentage gains, and Denver just missed that mark. New York posted the smallest gain, with only a 1.9% rise in prices.

Dean Baker, co-director of the Center for Economic and Policy Research, said some neighborhoods in Phoenix are actually seeing a 40% increase in prices over the last year, driven once again by property speculators. He said in many markets that were most hurt by the bursting of the housing bubble, there is a danger of new bubbles forming.

"The end of this round of speculation is not likely to be much prettier for the areas affected than the end of the last round," he said.

Even with the strong improvement in prices over the last 12 months, the index is still down 28% from the 2006 peak.