After a year-long campaign by an activist shareholder, BMC Software finally announced Monday that it sold itself -- for $6.9 billion.

The struggling IT services and cloud computing company is being acquired by a consortium of private equity groups, including Bain Capital and Golden Gate Capital, for $46.25 per share.

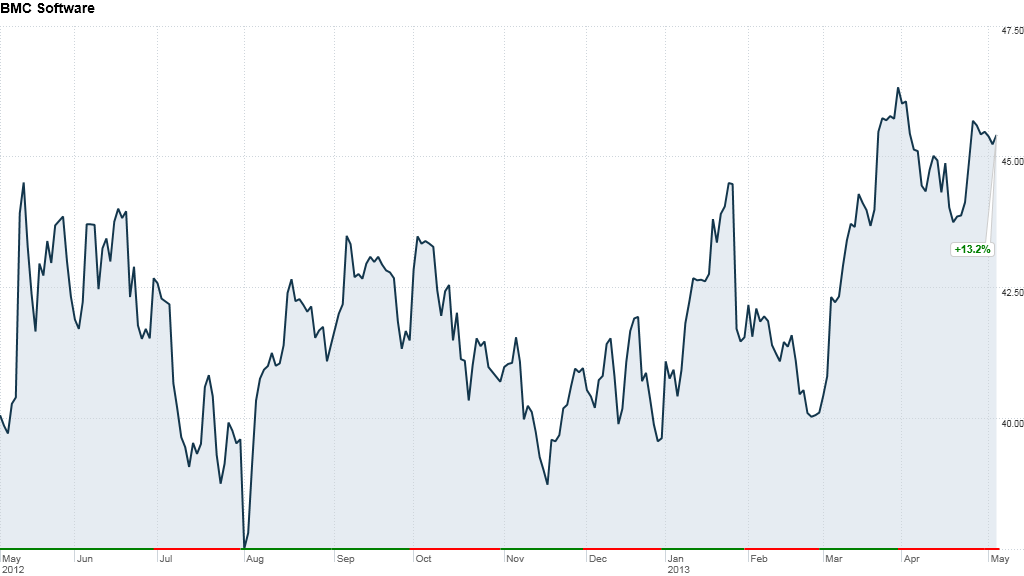

That represents just a measly 2% premium over Friday's closing price -- an unusually small markup and a sign of how badly BMC (BMC) has fallen behind larger competitors IBM (IBM) and Hewlett-Packard (HPQ).

"BMC believes the opportunity to become a private company will provide additional flexibility and position us to invest more strategically to drive powerful innovation and deliver cutting edge customer solutions," BMC CEO Bob Beauchamp said in a statement.

The move follows an effort begun last summer by hedge fund Elliott Management to push the software company into taking action. Elliott Management bought a 9.6% stake in the company and added two directors to the company's board.

The hedge fund applauded the sale, saying the offer price represents "a substantial premium to BMC's unaffected stock price." That price is hard to determine, but the private equity firms' offer is about 11% higher than BMC's share price on Sept. 28, 2012, the day before news reports first circulated that BMC would pursue a sale.

Related: Buffett's Berkshire Hathaway buying Heinz

The deal serves as yet another sign that the private equity industry is returning after a long hiatus that began during the Great Recession. In addition to BMC, other high profile PE deals include moves to take Heinz (HNZ) and Dell (DELL) private.