The Obama administration says the Affordable Care Act will provide cheaper health insurance for millions of Americans.

But some people, particularly young men who aren't insured through their employers, could see their premiums go up once coverage in the state-based insurance exchanges begins in January.

Many groups have come out with reports forecasting what will happen to premiums, on average, next year. But just what folks will pay for insurance on the individual market depends on a variety of factors. They include the enrollee's income, age, gender, current coverage level and state of residence.

"The average isn't very relevant to any particular person," said Jim O'Connor, principal at consulting firm Milliman, who authored a report on how "Obamacare" will affect premiums.

The exact cost of plans likely won't be known until the summer, at the earliest -- and possibly not until the exchanges open for enrollment in October. Insurers have already submitted their proposals to state officials, and regulators are now reviewing them. But it is up to each state to decide when to release the plan specifics.

Few insurers have disclosed their individual market plan prices for next year, but several have warned that they're likely to rise significantly. In Maryland, for instance, Blue Cross has said its premiums could go up 25%.

Participants will have the opportunity to pick from a variety of plans offered by several different insurers. They range from "bronze" plans with low premiums but higher out-of-pocket costs to platinum plans that carry higher premiums but cover more expenses.

One key provision is that those with pre-existing conditions cannot be excluded or charged more for coverage. Until now, many cancer survivors, heart attack sufferers and those with other ailments have found it tough to get insurance. The new rule is great for those who have been sick, since they can now obtain more affordable plans, but it is likely to make things more expensive for the healthy people who get insurance by raising the overall cost of coverage.

Related story: I'm signing up for Obamacare

Here's what could affect your coverage cost. This breakdown is only for those who buy plans on the individual market through the exchanges, and doesn't apply to those with employer-sponsored plans.

Income: One of the top factors determining how much you'll pay next year is your income. That's because subsidies are available to those with incomes of up to 400% of the poverty line -- roughly $45,000 for an individual or $92,000 for a family of four. Some 57% of enrollees will receive subsidies, and those subsidies will cover nearly two-thirds of the premium, on average, according to the Congressional Budget Office's estimates.

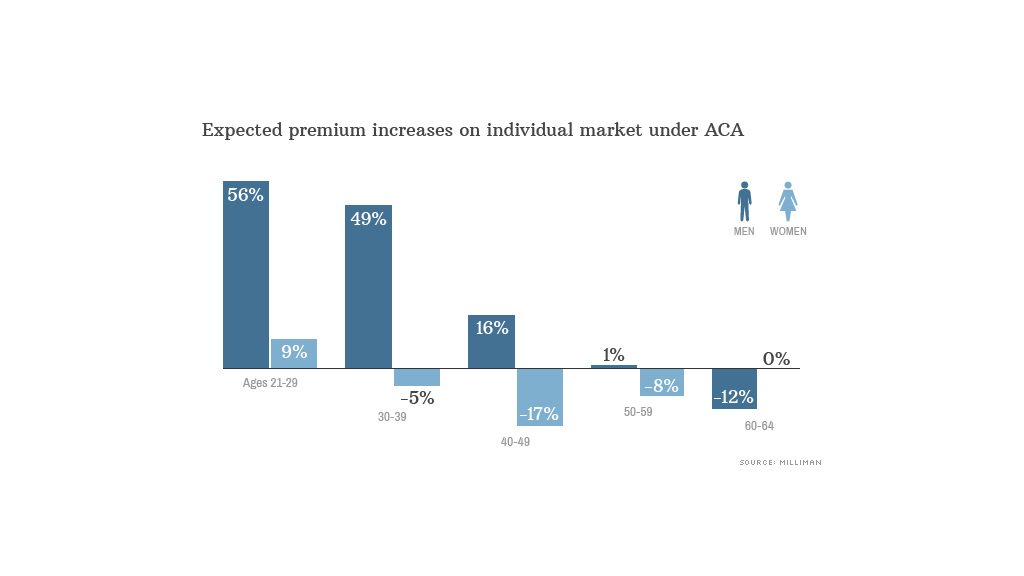

Age: Older Americans, who tend to be sicker, will likely see their premiums go down, because they will now be mixed into a risk pool with younger, healthier people. Also, Obamacare limits the amount insurers can charge older enrollees to three times the amount charged for younger participants. It's now common to see older folks charged five times that of their younger peers.

"Younger people will have to offset costs of those who are older," said Robert Zirkelbach, spokesman for America's Health Insurance Plans, a lobbying group for insurers.

Gender: Currently insurers can charge premiums based on gender. Men usually pay less than women, since they typically visit the doctor less frequently. The Affordable Care Act, however, doesn't allow insurers to charge different rates to men and women.

Taken together, men ages 25 to 36 could see rate increases greater than 50%, according to Milliman's O'Connor, but women of the same age will only see their premiums creep up 4%. Meanwhile, men age 60 to 64 could see their premiums drop by 12%.

Coverage level: The uninsured will see their coverage costs go up, of course, since they currently pay nothing. And those who have high-deductible plans or catastrophic coverage, which only pays out in case of major illness or hospitalization, may see their premiums go up.

Supporters of the law point out that while monthly premiums may rise, the overall coverage those premiums are buying is more comprehensive. That means that those who actually use medical services could save money overall, thanks to lower out-of-pocket charges.

Under the ACA, insurers must provide a suite of "essential benefits," including maternity care, mental health and medications. Also, even if enrollees pick the cheapest plan, they will not have to cover more than 40%, on average, of the cost of their services. They will also not be subject to annual or lifetime limits on coverage.

"If illness strikes, they'll pay less out of pocket," said Larry Levitt, senior vice president at Kaiser Family Foundation.

State of residence: Some states currently require some of the same protections as Obamacare, which pushes up the cost of individual market coverage for residents today. These spots include Maine, Massachusetts, New York, New Jersey and Vermont. Premiums could go down in those states, since more younger, healthier people are likely to join the market.

At this point, everyone -- including the insurers -- is just guessing at what premiums should be. That makes next year a giant experiment. Will younger, healthier people purchase coverage, or will they skip it and simply pay the fine? Next year, the fine starts at $95 per adult -- a rate likely to be cheaper than any individual plan available on the state exchanges.

"There is a lot of uncertainty here," Levitt said.