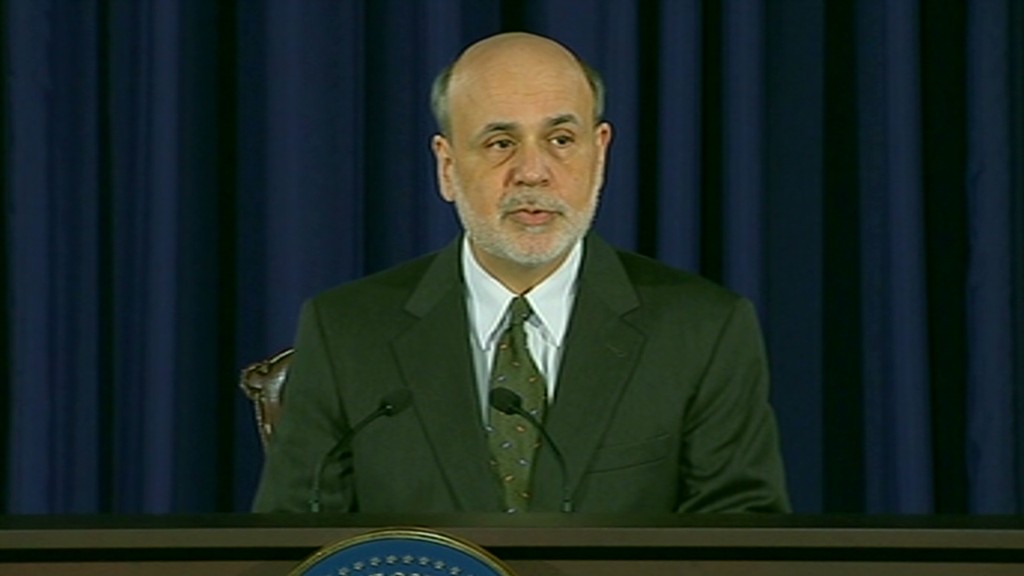

Federal Reserve chief Ben Bernanke on Wednesday laid out his most specific plan yet for when the central bank will start easing up on its controversial stimulus program, which is pumping $85 billion a month into the economy.

The Fed will start cutting back later this year and may stop entirely by the middle of 2014 if the economy continues to improve, Bernanke said at a news conference on Wednesday afternoon.

Earlier, the Fed unveiled a set of revised economic projections that were slightly more optimistic than its previous estimates. If those projection pan out, the Fed will "ease the pressure on the accelerator," Bernanke said.

If unemployment falls to 7% by mid-2014, the Federal Reserve will stop buying U.S. bonds and mortgage backed securities, he said. That's the first hard number the Fed has given for when it may end its stimulus policy, known as quantitative easing.

For now, though, the Fed's policy and pace of asset purchases remains unchanged.

"The fundamentals look a little better to us, in particular the housing sector," Bernanke said. "State and local governments are now coming to a position where they don't have to lay off a lot of workers. The economy is improving."

Markets freaked out on the news. The Dow Jones industrial average closed down by more than 200 points, or 1.3%. The S&P 500 dropped 1.4% and the Nasdaq sank 1.1%. Stocks had been in the red all day, but were hovering near the breakeven line before the Fed chairman began speaking.

The Federal Reserve has been buying large quantities of U.S. bonds and mortgage-backed securities in an effort to keep interest rates low and stimulate the economy.

Related: Bernanke won't blow up bond market

The agency's updated economic projections, released Wednesday, showed for the first time that unemployment may hit 6.5% in 2014. That's a milestone number: It's the rate at which the Fed has indicated that it may begin raising interest rates.

The unemployment rate currently stands at 7.6%, down from 10% during the worst of the recession.

The Fed lowered the high end of its projections for GDP growth in 2013, cutting it from 2.8% to 2.6%. But it also lowered its unemployment rate projections for this year -- down from 7.5% to 7.3% -- and its projections for inflation in 2013.

The inflation numbers are particularly tame. The Fed is now calling for an inflation rate of about 1% this year, verses its previous forecast of around 1.5%.

Bernanke stressed that the Fed's actions could change if the economy changes.

"Our policies will depend on this scenario coming true," he said. "If it doesn't come true, we'll adjust our policies."

Bernanke was also asked, twice, if he plans on stepping down from his position as chairman. He dodged the question both times.

Last month, Bernanke suggested that the Fed may start phasing out its asset purchases in a "few meetings." That news sent jitters through the markets, with prices for U.S. bonds falling and interest rates rising, including those for consumer products like mortgages and auto loans.

The Federal Reserve has injected $2.5 trillion into the U.S. economy since 2008, mainly through these purchases, in an effort to keep interest rates low and spur economic growth.

The policy has many supporters, including most economists and President Obama. They point to growth in the U.S. economy over the last few years, which has generally outpaced that of Europe or Japan.

Critics contend the Fed is putting too much debt on its balance sheet, and believe that the massive amount of cash injected into the economy will ultimately lead to runaway inflation.