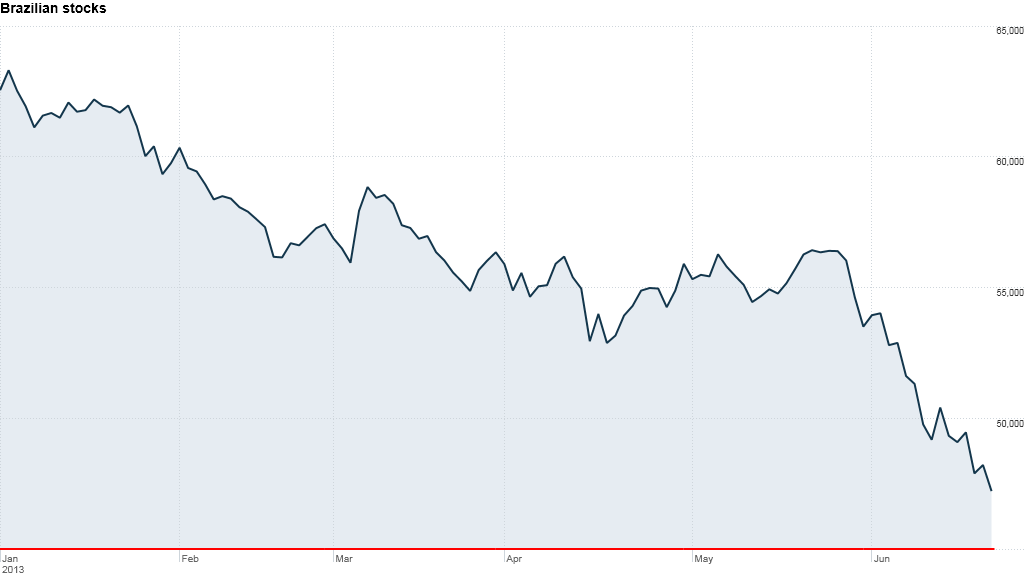

Emerging markets have been hit hard lately, but Brazil has suffered more than most.

The Bovespa Stock Index (IBOV) is down more than 20% so far this year, making it the worst performer among the major emerging markets.

Investors have been pulling out of emerging markets in anticipation of tighter monetary policy in the United States. The sell-off in Brazil accelerated last month after Federal Reserve chairman Ben Bernanke told U.S. lawmakers that the central bank could begin to slow the pace of its asset purchases later this year.

The Fed has bought some $3 trillion worth of assets since it launched quantitative easing in 2008. Much of that money has found its way into stocks in developing economies as investors ventured into more risky assets.

Brazilian stocks have also been hurt this year by a lackluster growth outlook for Latin America's largest economy as global demand for natural resources wanes.

Related: Emerging markets in turmoil

The Brazilian real has come under pressure as investors pull money out of the country. That's prompted Brazil's central bank to take steps to prop up the currency. Despite such intervention, the real tumbled to a four-year low against the dollar Friday.

The recent political unrest in Brazil has also put the country in the headlines for the wrong reasons. But analysts say the political turmoil has not yet impacted the nation's economy.

Following large-scale protests in Sao Paulo and Rio de Janeiro, the government agreed to roll back controversial fare hikes on bus and metro tickets.

"The protests are having very little impact on sentiment towards Brazil at this stage," said Robert Wood, Brazil analyst for The Economist Intelligence Unit. "It's mostly driven by external factors."

However, the protests have highlighted the significant gap between the rich and poor in Brazil.

Brazil has 12 to 13 million households in extreme poverty, which translates to roughly 40 million people, said Rafael Amiel, director of Latin American economics at IHS Global Insight.

"Brazil has made substantial progress, but they still have a lot of people in poverty," said Amiel.

Nevertheless, he said the recent political unrest is not comparable to the Arab spring uprisings over the past few years.

"They don't want to bring down the government," he said. "They just want more services and less corruption."

Related: Meet the new emerging markets

So why have Brazilian stocks fallen even more than shares of Indian and Chinese companies? A global slowdown in the demand for oil and other commodities is the big reason.

Brazil's economy has cooled off from a torrid pace in the past few years as domestic consumption has not made up for the decline in demand for natural resources. The International Monetary Fund cut its outlook for Brazilian growth this year to 3% in April, down from 3.5% in January.

"Brazil was one of the investment darlings of the emerging world over past ten years," said Paul Christopher, chief international strategist Wells Fargo Advisors. "Now, it has fallen out of favor with a big thud."

Shares of Brazilian oil company Petrobras (PBR) has fallen nearly 30% this year while mining company Vale (VALE) has plummeted 35%.

Christopher noted that the Bovespa has underperformed the benchmark MSCI (MSCI) index of emerging market stocks since mid-2012.

The government has ramped up infrastructure spending in the past few years as Brazil prepares to host the 2014 World Cup and the 2016 Olympic Games. But that hasn't been enough to offset the impact of the slowdown in commodity prices and is putting a strain on the government's finances.

Related: China's credit squeeze spooks markets

Amiel said the political unrest could discourage some people from traveling to Brazil for the World Cup. But given the nation's limited capacity to host such a large event "it might be a good thing if some people are discouraged," he added.

While Brazil has invested heavily in public works, progress has been slow on key projects such as airports, railways and roads.

Meanwhile, inflation remains a problem. The Brazilian central bank has been hiking interest rates in an effort to bring inflation back down to its target level of 4.5%. The bank announced a surprise interest rate hike in April, and increased the benchmark rate again in May to 8%.

The central bank has also been busy trying to prevent the Brazilian real from falling further. Brazil's currency had appreciated significantly from 2009 to 2011 as investors poured money into the country, which held up better during the credit crisis than the United States, Europe and other developed markets

Brazil declared a currency war in 2012 and started hiking interest rates in an attempt to discourage excessive speculation by foreign investors. The real had been drifting in a range for the past year, but it recently fell through the low end.

"The central bank will try to keep the real in that range," said Christopher. "But it's an open question as to whether they will succeed."