One investor wants to put TheStreet in play and is setting itself up as one of the bidders.

Private equity firm Spear Point, which holds a 2% stake in the company, wants TheStreet (TST)to hire an outside financial adviser to weigh a number of options. Spear Point, based in New Orleans, also said it will make a bid for the company, though it declined to say how much it would be willing to pay.

TheStreet declined to comment.

Spear Point's biggest gripe with the company is its ownership structure.

Venture capital firm Technology Crossover Ventures owns 11.5% of TheStreet in the form of preferred shares. TCV received these shares when it invested $55 million in TheStreet in late 2007 as part of a deal to give the company a war chest for acquisitions.

TheStreet's shares currently trade at less than $2 but TCV has the right to sell its shares at $14.26. Spear Point argues that these shares effectively prevent the company from receiving buyout offers, because any buyer must first spend $55 million to make TCV whole.

"The company's capital structure creates an overhang that makes it difficult for the company to execute," said Spear Point co-CEO Nicolas Perkin.

TCV, a firm with investments in Facebook (FB), Groupon (GRPN), and Netflix (NFLX), declined to comment. One of TCV's partners, Woody Marshall, formerly served as chairman of TheStreet's board of directors.

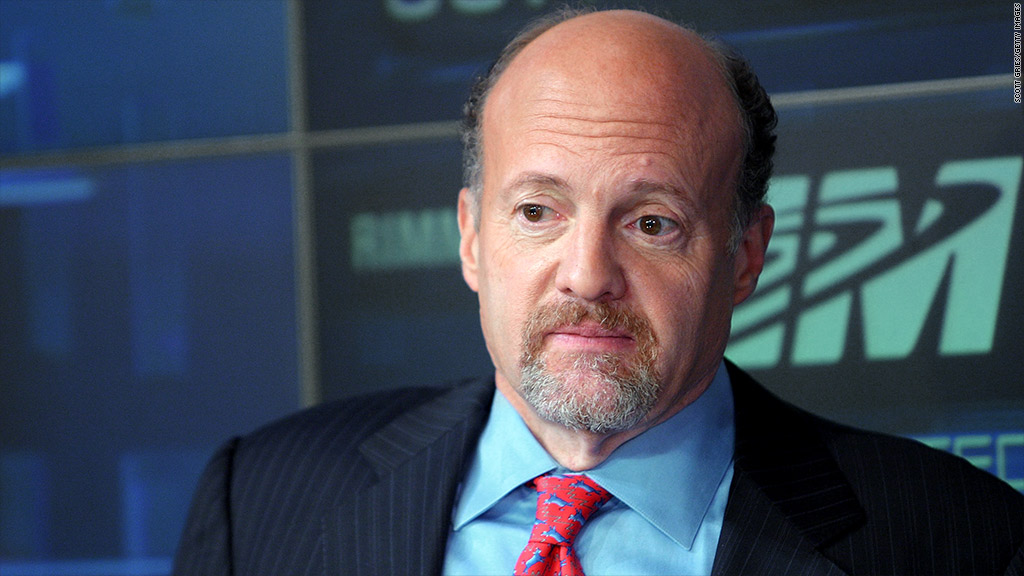

CNBC personality Jim Cramer, who helped launch TheStreet in 1996, is its most notable face, but he's been quietly cutting back his stake. Cramer owns roughly 4.3%, or 1.3 million shares, worth $2.7 million. His charitable trust, Cramer Partners, owns 556,000 shares worth $1.2 million, according to LionShare.

Cramer's continuing involvement as a contributor is a big wild card for TheStreet. His three-year contract is set to expire at the end of the year. Cramer did not return requests for comment.

TheStreet's stock has largely been a losing bet since the company tapped the public markets in 1999, at the height of the dotcom boom. Going public at $19, shares tripled on the first day, but have mostly been in decline since then. Today, TheStreet's stock is down more than 97% from its opening day.

Related: The man behind @GSElevator

TheStreet had a little $50 million in revenue last year. It generates roughly 80% of that from subscriptions, but it hasn't managed to turn a profit since 2008.

And revenues are down nearly 30% since 2008, despite recent acquisitions. Last year, TheStreet bought online M&A publication The Deal for $5.8 million.

Still, Spear Point thinks there's untapped value, and that it can ultimately be profitable. Spear Point thinks it can reinvigorate the brand by cutting costs and by taking the company out of the public markets.

"Wall Street says grow at all costs," said Spear Point's other co-CEO, Rodney Bienvenu. "This is a fine business with name-brand products, reliable recurring revenues and an elastic cost structure."

Spear Point has been in operation since late 2012. If successful, this would be its first acquisition.