Herbalife addressed the concerns of one of its loudest critics on a conference call, following what the company deemed its best quarter ever.

Shares of Herbalife (HLF) were up 1.5% Tuesday after earlier surging more than 6%.

The company surprised investors by surpassing even the most bullish forecasts, reporting a 29% jump in profits compared to a year earlier. Herbalife also raised its guidance for the rest of the year and said the company could consider buying back its stock later this year.

Herbalife lost two of its top salespeople in 2013, but said these departures did not have a material impact on its business.

Related: Icahn: I want to run Dell

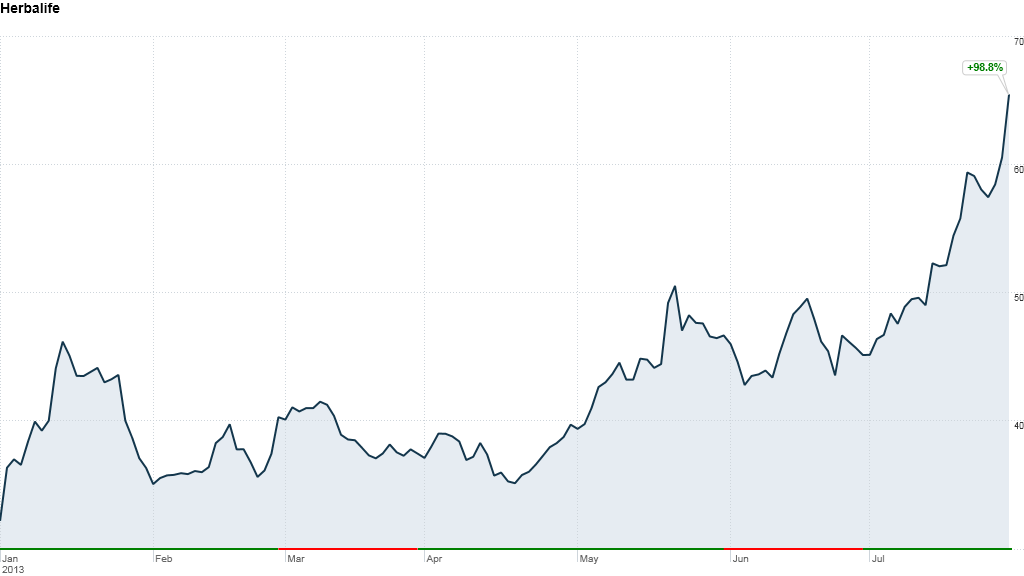

Herbalife's stock has nearly doubled this year, but that rise has been marked by extreme volatility. The company has been at the epicenter of a battle among hedge fund titans.

In late 2012, hedge fund manager Bill Ackman accused Herbalife of being a "massive pyramid scheme," a charge the company vehemently denied.

Ackman questioned the company's accounting and business practices and said that he had made a billion dollar bet against Herbalife. His accusation initially spooked investors, causing a sell-off that has since reversed course.

Ackman has not dropped his case, and Herbalife continues to address his concerns. Ackman released a 5-page list of questions for Herbalife late Monday, shortly after the company released its second-quarter results.

One key issue repeatedly raised by the hedge fund manager has been who the actual buyers of Herbalife's products are. Operating as a multi-level marketing company, Herbalife sells its products through a network of 3.4 million distributors.

On a conference call with analysts Tuesday, the company admitted that the bulk of its distributors are merely seeking to buy Herbalife's products at the discount they receive as distributors.

Going forward, Herbalife said it will distinguish between these customers, calling them "members."Actual salespeople will continue to be referred to as "distributors."

Related: Ackman wins, P&G dumps CEO

The company also said its financial reports for the past three years should be re-audited by its new accounting firm, PricewaterhouseCoopers, by the end of the year. Herbalife's previous auditors, KPMG, resigned after the accounting firm discovered that one of its partners was providing illegal stock tips about Herbalife.

In the opposite corner of the Herbalife battle is Carl Icahn, whose fund owns roughly 4.3%, or nearly 17 million shares, of Herbalife.

At a recent CNBC hedge fund conference, Icahn said he started looking at Herbalife following Ackman's public take-down of the company. Since buying into Herbalife, he said he has not sold any shares.

Third Point's Dan Loeb also purchased a stake in the company, but has since exited his position.