Expectations for J.C. Penney's second quarter were bleak. But the troubled retailer's performance was even worse than those forecasts.

J.C. Penney reported a loss of $586 million, or $2.66 per share. on Tuesday. That was more than twice as bad as the $1.06 per share loss analysts were expecting, according to Thomson Reuters.

Sales declined for a ninth straight quarter, coming in at just $2.7 billion. That was down 12% from a year ago, and lower than analysts' estimates.

But despite the weak performance, J.C. Penney noted that its same store sales, a key measure for retailers, were slightly better than they were during the first quarter of 2013. Sales improved each month in the second quarter, a trend the company expects to continue through the second half of the year.

In particular, the Plano, Texas-based retailer said that the early weeks of the crucial back to school shopping season "were encouraging."

However, Mike Ullman, who returned to the CEO position earlier this year following a previous seven year stint, was a bit more guarded during a conference call with analysts. He only gave vague guidance that the company expects to "exit the [third] quarter with positive" same store sales.

"We have a lot of work to do to regain the trust of our customers," said Ullman. "To bet the ranch on a wild return to growth in a specific and short time period wouldn't be prudent."

But overall, the CEO was upbeat and hopeful, highlighting that since he returned four months ago, the company has "moved quickly to stabilize our business - both financially and operationally - and we have made meaningful progress in important areas of the business."

That glimmer of hope boosted shares of J.C. Penney (JCP) after the market opened. The stock briefly dipped into the red by late morning but closed up almost 6%.

Related: J.C. Penney: A buy or sell?

Brian Sozzi, chief equities strategist at Belus Capital Advisors, said that Ullman "did a great job of selling the turnaround story."

"They have a lot more to do, but they threw us a couple bones that confirm they're not going out of business tomorrow," Sozzi added.'

Ullman also stressed that online sales were a "bright spot" last quarter, coming in higher than the first three months of the year. July online sales were up 14% compared to a year earlier, and Ullman expects ongoing improvement.

Related: J.C. Penney: The reality show

The retailer also took a shot at former CEO Ron Johnson, who was ousted earlier this year in the middle of a failed attempt to turn the company around.

In its earnings statement, J.C. Penney said its performance was "negatively impacted by the company's failed prior merchandising and promotional strategies, which resulted in unusually high markdowns and clearance levels."

Johnson, a former head of Apple's retailing unit, was brought in by activist investor Bill Ackman to try and turn J.C. Penney around. But even Ackman supported the move to fire Johnson when it was clear his strategy was not working.

However, Ackman grew increasingly impatient with the retailer lately and called earlier this month for the company to replace Ullman.

Ackman did not get his way and abruptly quit J.C. Penney's board last week. He also reached an agreement with the retailer that will allow him to start selling his 18% stake in the company.

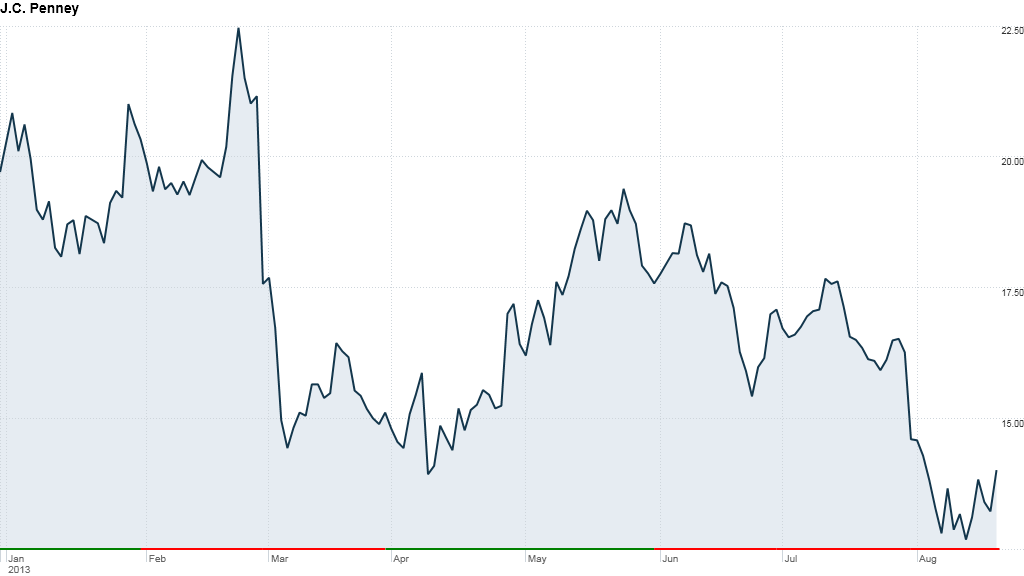

Shares of J.C. Penney have been one of the worst performers on the stock market for the past two years.

Meanwhile, the company also tried to alleviate worries about the health of its balance sheet, ending the quarter with $1.54 billion in cash, and forecasting that it would end the year with more than $1.5 billion in liquidity without having to borrow additional money.

Nonetheless, Sozzi expects the company will have to borrow more in 2014.