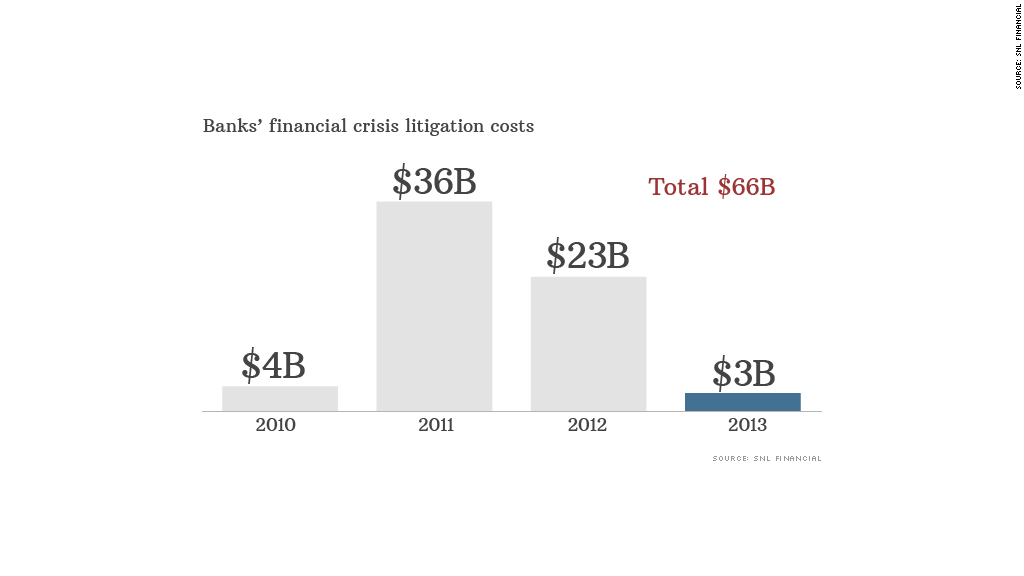

Big banks have spent an estimated $66 billion on litigation in the past three and a half years, according to SNL Financial. And those numbers are expected to keep swelling, as federal prosecutors and the SEC continue to look at wrongdoings tied to the 2008 financial meltdown.

The government needs to move swiftly to prosecute crimes leading up to the credit crisis and extract more penalties from big banks. That's because the statute of limitations for prosecuting many of these crimes is five years.

And with the five-year anniversary of the demise of Lehman Brothers just a month away, there is likely to be a lot more discussion about what the government has done to compensate victims of the financial crisis.

Related: Feds say JPMorgan broke securities laws in mortgage deals

The Obama administration has been continually criticized for not doing enough to prosecute the large financial institutions. While $66 billion in litigation costs is a staggering number, it's a small portion of the $207 billion that the six largest financial institutions -- Bank of America, Citigroup (C), Goldman Sachs (GS), JPMorgan Chase (JPM), Morgan Stanley and Wells Fargo (WFC) -- have earned in profits over the past three and a half years, according to FactSet.

But the government appears to be stepping up its efforts lately. There has already been a barrage of new cases against the big banks. Some are related to the financial crisis and the housing market collapse from a few years ago. Earlier this month, the Justice Department sued Bank of America (BAC), accusing the bank of defrauding investors about investments backed by troubled mortgages.

Other cases, however, are tied to newer allegations of misconduct regarding the trading activities of the big banks.

The Justice Department is investigating JPMorgan Chase's possible manipulation of energy markets. The bank settled a similar case with the SEC for $410 million in July.

Related: JPMorgan's legal problems continue to mount

The Justice Department also recently announced indictments against two JPMorgan Chase traders for their role in the bank's London Whale trades, which led to billions in losses.

And it looks like the government is just getting started.

Attorney General Eric Holder told the Wall Street Journal Tuesday that the Justice Department expects to announce more new cases against big banks in the next few months. At a CNBC conference in July, Preet Bharara, the U.S. Attorney for the Southern District of New York, said more indictments could be handed down for problems related to the financial crisis.

The big banks are prepping for this. In their most recent quarterly filings, the six largest financial institutions all estimated the potential cost of looming litigation. The total: $19.2 billion.

Still, several analysts said these banks have routinely low-balled such projections and that the real costs have been much higher.

The estimates from the big banks are all over the map too. Morgan Stanley (MS), which has only paid out roughly $300 million for financial crisis era problems, said in its most recent SEC filing that it doesn't expect litigation to be material.

Analysts are most concerned about Bank of America's exposure to litigation, but it used $2.8 billion as the upper end of its estimates for pending litigation. JPMorgan Chase's estimate goes as high as $6.8 billion.

Of course, it's impossible to predict what new lawsuits might still come up and how the existing ones will be settled.

But one thing is clear. The banks won't be putting the financial crisis behind them anytime soon.

"This will linger." says Credit Suisse bank analyst Moshe Orenbuch. "The banks will be paying out money to attorneys and for settlements for several years."