Microsoft on Tuesday raised its dividend by 22% and announced a $40 billion share repurchase program.

The software company will now pay a competitive 3.4% dividend yield. That compares favorably to the 2.85% yield investors can get on 10-year U.S. Treasuries and the 2.7% yield Apple (AAPL) pays.

Activist investor Carl Icahn is pushing Apple CEO Tim Cook to take a page from Microsoft's book by upping its dividend and returning more of its sizable cash hoard to shareholders.

Microsoft's share repurchase program replaces a previous $40 billion repurchase program that was set to expire at the end of the month. This new buyback program does not have an expiration date.

At the end of the most recent quarter, Microsoft reported it had $77 billion in cash on its balance sheet. It also reported nearly $5 billion in net income in what was considered a disappointing quarter, bringing its full fiscal year earnings to $21.9 billion.

The strength of its balance sheet and its earnings stream are among the reasons that the company is one of only four U.S. companies with the top AAA credit rating.

Related: Is Stephen Elop the next Microsoft CEO?

Microsoft has also announced a $7.2 billion cash purchase of Nokia's (NOK) mobile phone business earlier this month.

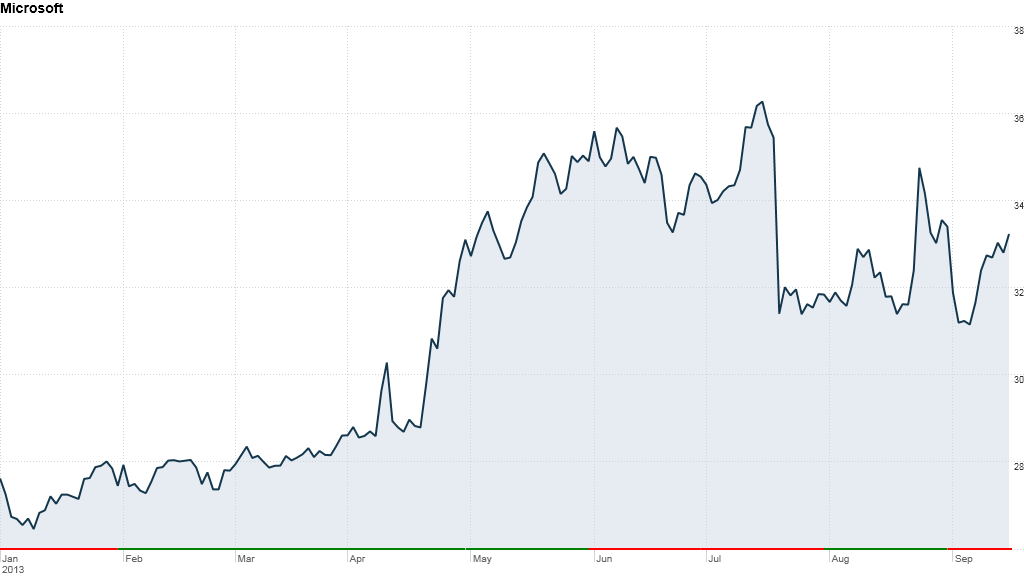

Shares of Microsoft (MSFT) rose slightly in early trading.