Lockheed Martin doesn't seem to be feeling the effects of the government shutdown.

The defense company and top government contractor said Tuesday that earnings jumped 16% to $2.57 per share in the third quarter. Analysts had forecast earnings of $2.26 per share, according to Thomson Reuters.

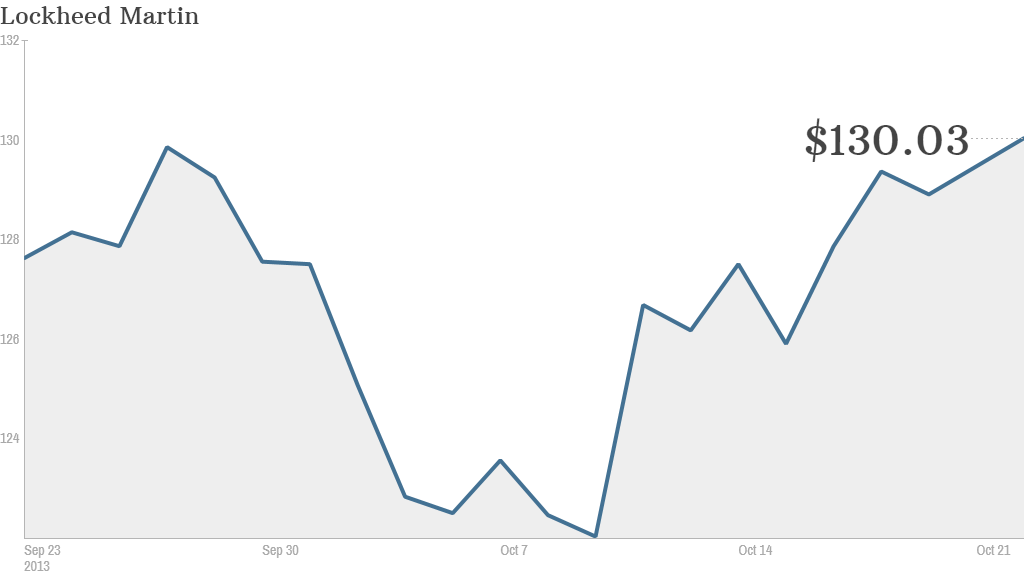

The results sent Lockheed (LMT)shares up 3% in early trading. Shares of rival aerospace and defense company Boeing (BA), which reports results Wednesday, were also higher.

Another company with big government contracts, United Technologies (UTX), also reported better-than-anticipated results on Tuesday. Its stock rose on the news as well.

Shares of defense contractors were among the hardest hit during the government shutdown. Lockheed and United Technologies each announced furloughs of some employees as a result of the shutdown.

Looking ahead, Lockheed now expects to earn between $9.40 and $9.70 per share in 2013, up from a previous estimate of between $9.20 and $9.50 per share.

Related: Lockheed Martin CEO talks about painful cost of government shutdown

However, Lockheed said sales were down 4% in the third quarter. The company has been hit by recent cuts in defense spending.

The outlook for 2014 is also less optimistic. Lockheed expects sales to decline a bit next year, although margins should hold steady.

The company's outlook is based on three assumptions: the government continues to fund the "key programs" where Lockheed has contracts, that Congress passes a budget "on a timely basis," and that forced cuts in federal spending known as "sequestration" are not worse than expected.