The IRS has cut small businesses a break.

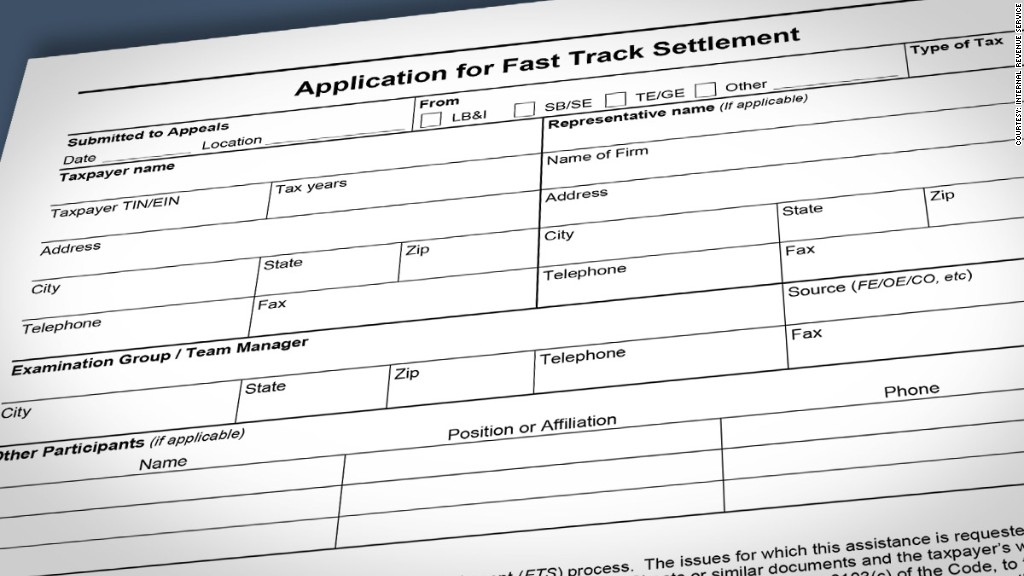

Those being audited by the agency can now file for a fast-track settlement, just like large and midsize companies. This could shorten the process so that it's resolved within 60 days instead of years, according to the IRS.

The rule change could save small business owners time and the cost of a formal appeal. Now, instead of having to wait until the end of an audit process to appeal, they can do so during the preliminary stages.

The fast-track process has long been available to businesses that have more than $10 million in assets. But the process should be the same regardless of the size of the company, said John Lieberman, a CPA at Perelson Weiner LLP.

Lieberman said it's a great step forward in treating small businesses just like larger companies. But he estimated only 20% of audited small businesses -- mainly in industries like construction, film and software -- would be filing the type of appeal impacted by this rule change.

This could also mean fewer headaches for the IRS, which has been dealing with extensive budget cuts and furloughs over the past year. Audits have already been on the decline, dropping 5% last year.