The British pound has been on a tear and analysts predict it will push even higher this year.

That could create an uncomfortable reality for the U.K. as a high currency threatens to dampen one of Europe's most impressive recovery stories.

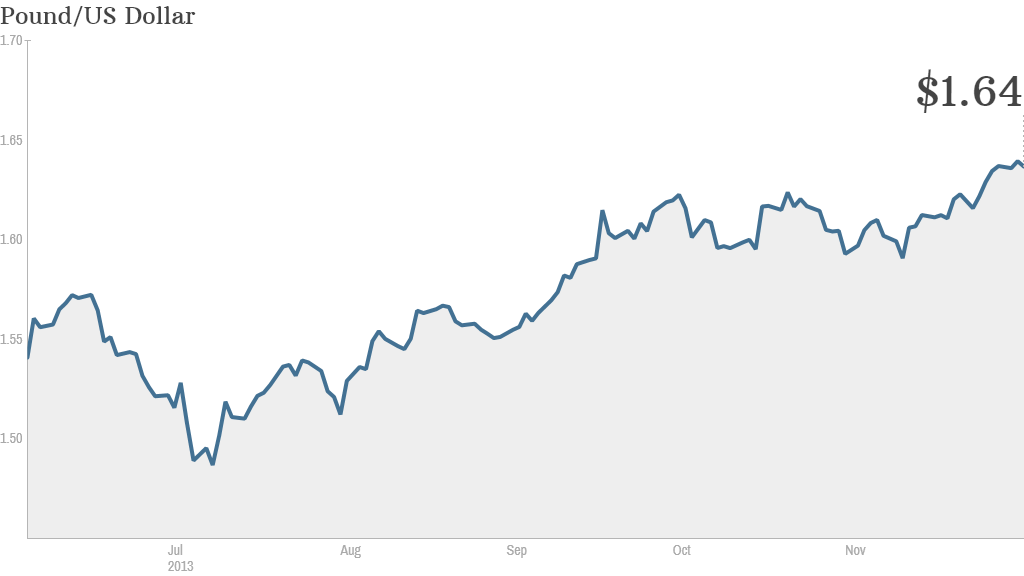

This week sterling streaked past a two-year high against the U.S. dollar to trade at nearly $1.64. It has also risen against the euro and is now worth €1.2.

DailyFX currency analyst Christopher Vecchio says the pound could trade as high as $1.68 in the next three months.

Growing confidence in the U.K. economy, which pulled back from the brink of a triple-dip recession earlier this year, has helped boost sterling's appeal.

The world's sixth largest economy has been one of the best performers in Europe.

But a sustained rush to sterling may stoke concern over the impact of a stronger currency on the broader recovery.

A high currency tends to weigh on exporters as foreign buyers have to pay more for their goods.

So far a stronger pound hasn't hurt Britain's consumer-led rebound. Spending is rising and manufacturing and construction activity is improving. Recovery in housing markets prompted the Bank of England to end cheap bank funding for new mortgages last week.

Related: UK moves to cool property market

The rosier picture is likely to prompt a rise in official growth forecasts when the government gives its bi-annual economic update on Thursday.

Back in March, the Office for Budget Responsibility forecast annual growth of 1.8% in 2014, and 2.3% in 2015 for the U.K. IHS chief U.K. economist Howard Archer expects the OBR to hike its estimate for 2014 to 2.5%.

Thursday's statement will coincide with the Bank of England's monetary policy meeting.

Despite adopting a more upbeat growth outlook in recent months, analysts anticipate the central bank will maintain current interest rate settings.

Under the Bank's policy of forward guidance the benchmark rate will be frozen until unemployment drops to 7% from its current level of 7.6%.

Related: Surging economy surprises central bank

Market watchers will rake the statement for any signs of unease with sterling's elevated level.

Western Union Business Solutions analyst Nawaz Ali said he expects Governor Mark Carney to respond to sterling strength "sooner rather than later."

"Carney is a big communicator to markets and a signal that sterling is overvalued is a strong possibility over the coming months," Ali said.

Ali said other central banks have acted to insulate exporters from overheated currencies. At the same time, the Bank of England is getting ahead of its European, Japanese and U.S. counterparts in its shift toward tighter monetary policy.

Global policy action will continue to be a key factor in determining sterling's future course, most significantly, a decision by the Federal Reserve on when to begin scaling back its $85 billion monthly bond purchases -- or quantitative easing.

As long as the Fed continues buying at its current pace, the U.K. currency is likely to benefit.

"If QE stays in place then the pound is the top candidate to continue to gain steadily," DailyFX's Vecchio said.