Most British workers under 50 will have to work longer than expected after the government unveiled plans to introduce the highest retirement age in the developed world.

Under the reforms, which were presented as part of a bi-annual economic update on Thursday, the pension age will be linked to rising life expectancy and reflect the U.K. government's belief that workers should spend no more than a third of their adult life in retirement.

The state pension age of 68 will now be enforced in the mid 2030s, about 10 years earlier than planned. And by the late 2040s it will rise to 69.

Related: Millenials may not be able to afford retirement

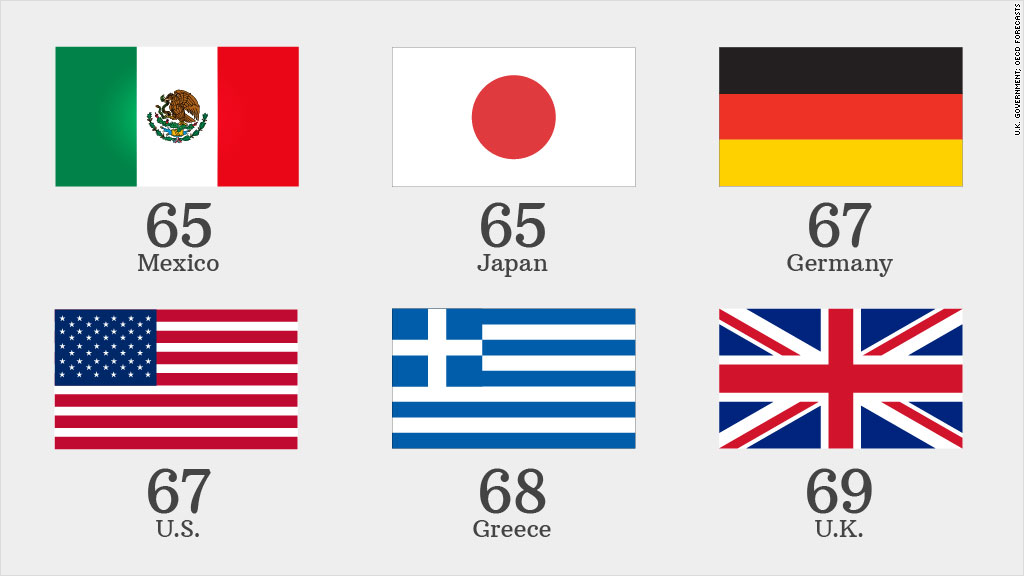

The new regime will give the U.K. one of the highest pension ages in the world by the middle of the century, according to the Organization for Economic Co-operation and Development.

In the United States and Germany, the retirement limit will hit 67 by 2050, compared to a more generous 65 for workers in Japan and Mexico. Only two other countries -- Italy and Denmark -- are expected to have a normal pension age as high as 69 by then, the OECD said.

Many countries are linking pensions to life expectancy as aging populations place increasing burdens on the state and government struggle to bring their borrowing under control.

By raising its pension age, the U.K. government said it will save £500 billion over 50 years.

The bitter news for young workers was delivered alongside an upbeat assessment of the U.K. economy.

Related: Germans get pensions boost

Chancellor George Osborne told lawmakers Britain is growing faster than any other major advanced economy and issued upgraded official GDP forecasts.

The Office for Budget Responsibility raised its estimates for U.K. growth in 2013 to 1.4%, from 0.6% predicted in March.

Forecasts for 2014 were raised to 2.4% from 1.8%. Faster growth should allow the government to generate a budget surplus by 2018/19.

The U.K. averted a triple-dip recession earlier this year to become one of Europe's best performing economies.

Yet the government, which faces an election in 2015, is facing growing criticism over a decline in living standards for many as wages fail to keep pace with the cost of living.