Facebook has a new friend: the S&P 500.

Standard & Poor's announced Wednesday that the social networking giant will be added to the benchmark index after the market closes on December 20, and will also be added to the S&P 100. The news sent Facebook (FB) shares higher in after-hours trading. That trend continued into premarket trading, with the stock up 4%.

Facebook will replace testing equipment company Teradyne Inc. (TER)in the S&P 500 and energy infrastructure firm The Williams Companies (WMB) in the S&P 100.

For Facebook, the benefits of joining the S&P 500 club are clear: an expanded investor base and validation that the company is one of the most important in the country.

For the average investor, the move will make it easier to own a small piece of Facebook. According to Morningstar, there are 1,300 mutual funds and 13 exchange-traded funds that use the S&P 500 as their primary benchmark. They will all add Facebook shares to their holdings once it is included in the index.

Related: Tech firms call on U.S. to reform spying activities

Facebook had been the largest public company not in the S&P 500, according to FactSet. Its current market capitalization of around $123 billion will place it among the 50 largest companies in the index.

MetLife (MET) was the fastest company to join the S&P 500, just eight months after its initial public offering.

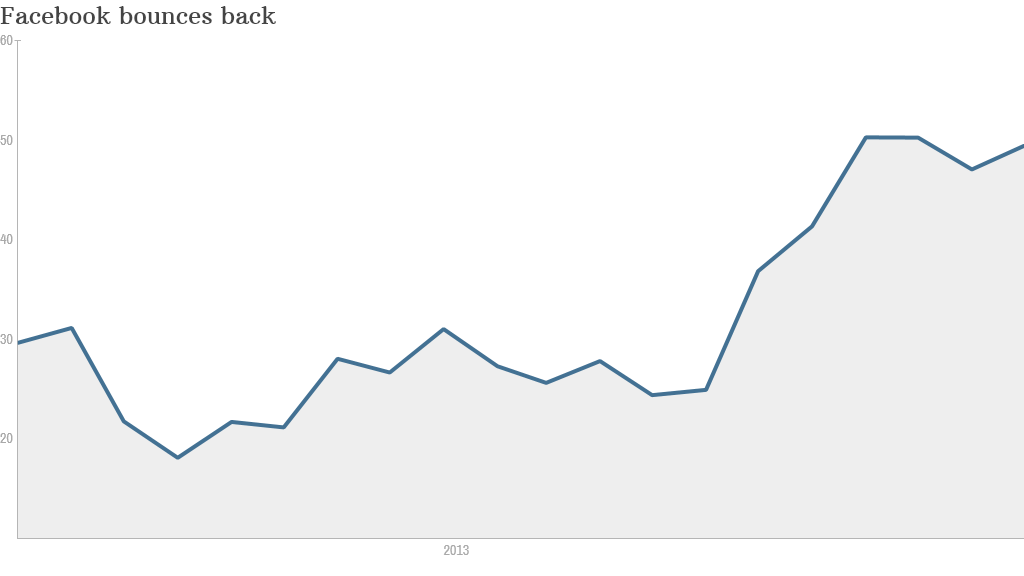

It's been 19 months since Facebook's rocky debut on the public market. Shares initially fell following an IPO marred by technical errors, but have since bounced back, rallying more than 80% so far this year.

Google (GOOG) was added to the S&P 500 after about 19 months as a public company as well -- it went public in August 2004 and didn't join the index until March 2006.

S&P also announced Wednesday that clothing retailer Abercrombie & Fitch (ANF) and communication technology firm JDS Uniphase Corp. (JDSU) will be leaving the index, to be replaced by Alliance Data Systems (ADS) and floor-covering producer Mohawk Industries (MHK).

CNNMoney's Hibah Yousuf contributed reporting.