Apple's landmark deal with China Mobile gives it access to more than 700 million new cell phone customers -- a staggering number. But it still has a long way to go before it's a power player in the world's biggest market for smartphones.

That's because Apple (AAPL) continues to fight the smartphone battle in China with one hand tied behind its back. The problem is its expensive products.

The iPhone 5C, which many analysts had expected would be a cheaper iPhone for China, turned out to be an expensive version with a plastic shell. In China, where wireless carriers don't subsidize phones, the iPhone 5C costs 4,488 yuan ($733). That prices out a large part of China's population.

Apple also lacks the app store advantage in China that it holds in most other countries around the world. The government censors many of the offerings on Apple's iTunes App Store, and Chinese customers haven't proven willing to spend money on top-tier apps when they can get free knockoffs.

Related: Apple inks China Mobile deal

All that said, the deal with China Mobile (CHL) is expected be a lucrative one for Apple.

Until now, Apple had sold the iPhone there through China Mobile's much-smaller competitors, China Unicom (CHU)and China Telecom (CHA), which have about 425 million subscribers between them.

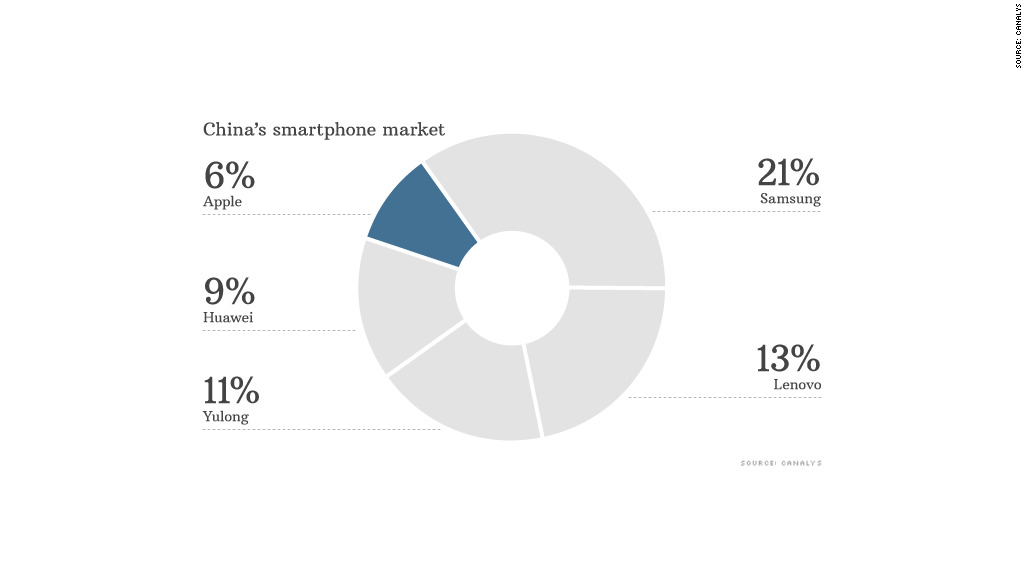

Apple is in a distant fifth place, trailing Samsung, Lenovo, Yulong and Huawei, according to Canalys. It has just a 6% share of the Chinese smartphone market.

Unlike many rival phones, the iPhone 5S and 5C are 4G devices, giving China Mobile customers their first chance to use the company's brand new 4G network.

And the iPhone is already a somewhat proven commodity on China's biggest cell network: As many as 40 million China Mobile customers are using an unlocked iPhone on the network, according to Brian White, an Apple analyst at Cantor Fitzgerald.

Wall Street analysts expect Apple to sell an additional 20 million to 30 million iPhones next year as a result of the deal. That's still a sliver of the Chinese smartphone market of 200 million phones -- but it's no small number either. Apple sold 150.2 million iPhones last year, and analysts expect it to sell between 165 million and 180 million next year.

So the deal could give Apple as much as a 20% boost in iPhone sales.

Another way to look at it: Many analysts expect China Mobile to be the only source of iPhone sales growth next year.

Apple CEO Tim Cook has discussed gaining a stronger foothold in China as a major priority for the company. The China Mobile deal will help Apple accomplish that.

But unless Apple changes its strategy and offers a low-cost iPhone for the Chinese market -- something the company has proven unwilling to do -- it's unlikely that Apple would become a top Chinese smartphone player.