Now that the once-dreaded taper is on the calendar, Wall Street experts say that investors should begin preparing for the end of the Federal Reserve's bond buying program.

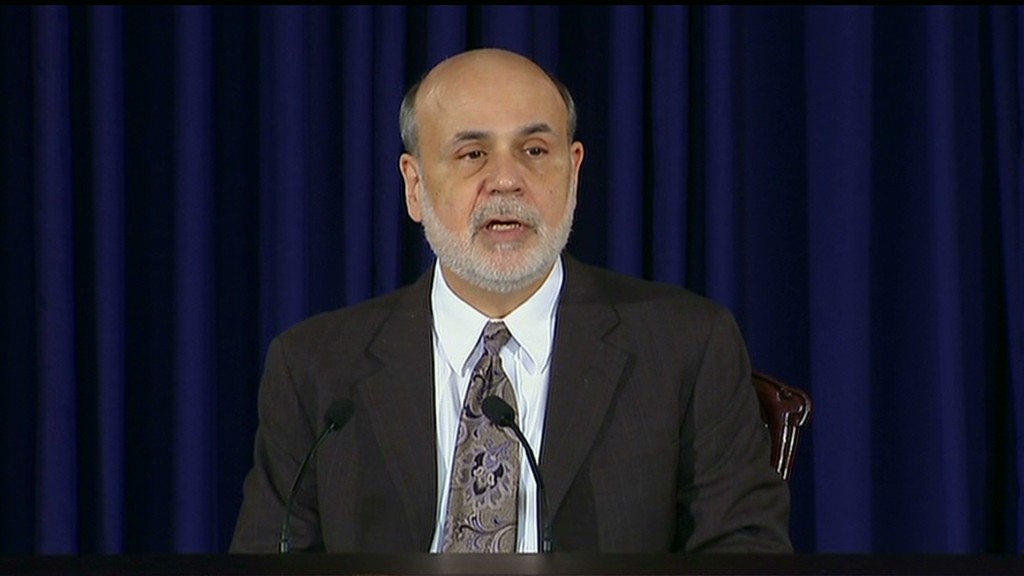

Fed chair Ben Bernanke first suggested that the central bank was considering cutting back the amount it buys in Treasuries and mortgage-backed securities last May, but the Fed didn't officially announce the tapering until last month. Instead of buying $85 billion a month in bonds, as it has been since September 2012, the Fed said that beginning in January it will from now on buy $75 billion in bonds each month.

Nearly 60% of the 30 investment strategists and money managers surveyed by CNNMoney believe the central bank will continue to gradually cut back on the bond purchases throughout this year so it can completely wind down its quantitative easing (QE) stimulus program by the end of 2014.

Brian Jacobsen, Wells Fargo's chief portfolio strategist, expects the Fed will cut purchases by $10 billion at each meeting this year until it gets down to $25 billion per month in the fall. At that point the Fed could decide to "tear off the bandage and say, 'enough is enough'" with QE.

But whatever the Fed does is likely to be highly telegraphed and predictable, Jacobsen added. Few expect a major change in the Fed's communication strategy now with Janet Yellen leading the Fed. Yellen was approved by the Senate on Monday to become the next Fed chair.

Full CNNMoney market survey results

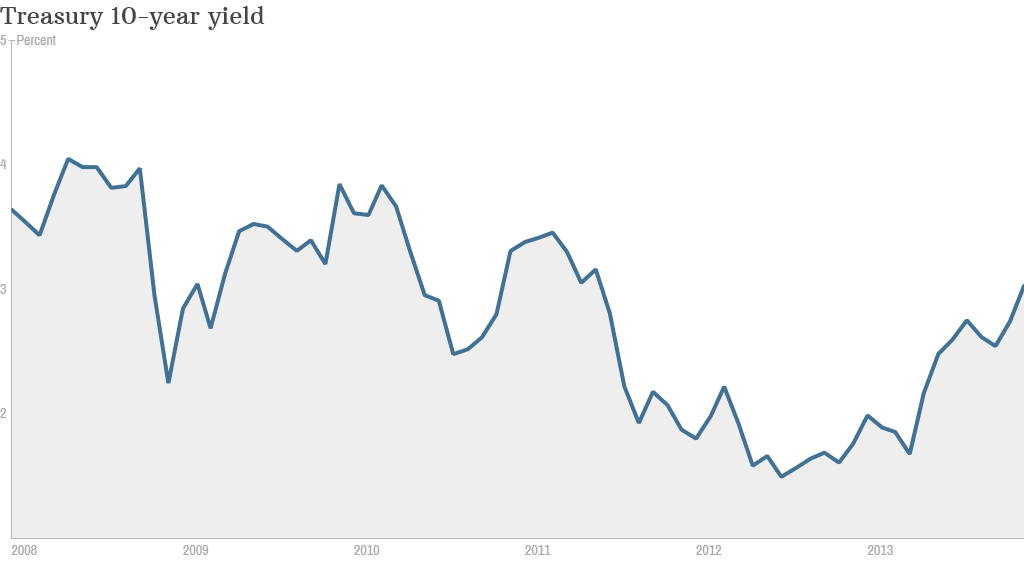

Interest rates expected to rise: With the Fed expected to continue tapering, more than 90% of the strategists surveyed anticipate that bond yields will continue to tick higher in 2014. But none are expecting as big of a move as last year's.

The average estimate for the 10-year Treasury yield is that it will end 2014 around 3.4%. The 10-year yield finished 2013 just below 3%, rising more than a full percentage point from about 1.75% at the start of the year.

"The bull run on bonds over the last thirty years is over," said Frank Fantozzi, president of Planned Financial Services. As investors loaded up on bonds, the 10-year Treasury yield declined from a peak of almost 20% in the early 1980s to below 2%.

But this may not mean that the bond market is a bubble that's now popping. Most strategists said that they merely expect interest rates to normalize from their all-time lows because the U.S. and global economies are continuing to recover.

The rise in rates will likely pick up pace when the Fed finally raises its key overnight lending rate, which has been near zero since late 2008. But a rate hike probably won't happen until 2015.

Still, any increase in interest rates will make it a tough year for bond investors, said Jim Kee, chief economist and president of South Texas Money Management. Last year, many bond investors lost money for the first time in over a decade. Following a 13-year streak of gains, the Barclay's Capital Aggregate Bond Index fell about 2% on a total return basis in 2013.

Related: Experts: Stocks will go up, but not by much

Bitcoin is "too wild to forecast": Though most Wall Street experts agree that bond yields will likely rise, there was no consensus on what will happen to the price of the last year's breakout asset: Bitcoin.

The digital currency had a stunning and volatile 2013, starting out around $13, rising as high as $1,242 in November, and ending the year around $1,000.

Of the 30 Wall Street experts surveyed by CNNMoney, more than 70% said they don't follow or analyze Bitcoin.

D.A. Davidson's Fred H. Dickson said it's "too wild to forecast," while Bell Investment Advisor's Matt King and Becker Capital Management's Mike McGarr admitted they had "no clue."

Predictions from the brave few that were willing to make an estimate were all over the map.

Chase Investment Counsel president Peter Tuz expects Bitcoin will be worth nothing at the end of year, and Gary Goldberg Financial Services president Oliver Pursche also agrees the price of the digital currency will implode.

A few strategists expect Bitcoin will be worth something next year, but nobody thought the price of Bitcoin would go sharply higher again. The most bullish estimates ranged from $500 to $1,000.