Investors don't want to connect with LinkedIn.

Shares of the professional networking site plunged 11% in after-hours trading Thursday after the company posted solid fourth-quarter earnings and sales but offered a disappointing outlook.

LinkedIn (LNKD) said it expects sales to rise only slightly in the current quarter, to between $455 million and $460 million. Analysts surveyed by Thomson Reuters had expected sales of $470 million this quarter.

The rest of 2014 won't be too much stronger, with LinkedIn predicting total sales of between $2.02 billion and $2.05 billion for 2014. That's far below analysts' forecast of $2.2 billion.

Related: Tweet yourself to a new job

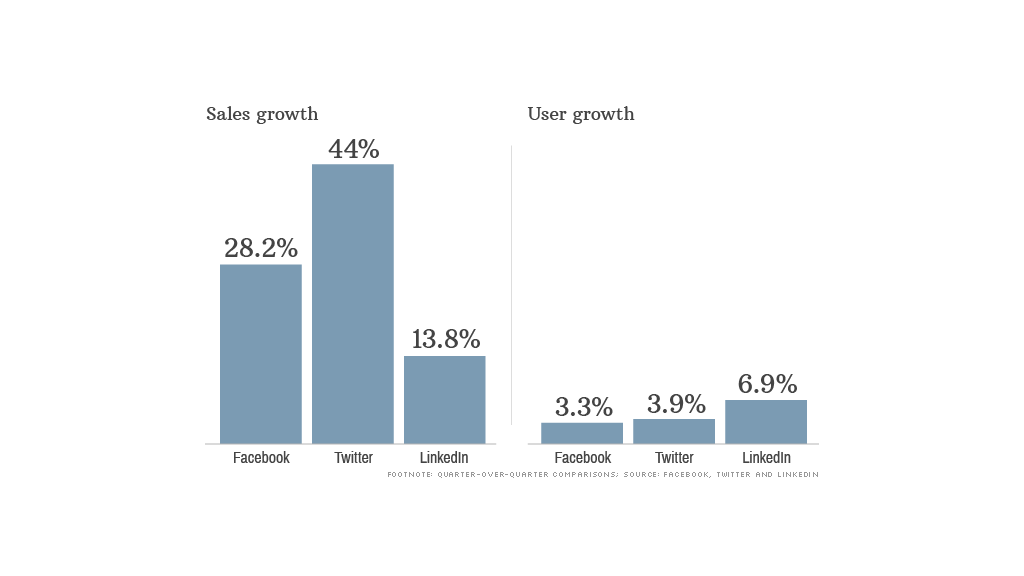

LinkedIn's sales are also growing at a slower clip than its competitors. The company reported fourth-quarter sales of $447 million, up just 13.8% versus the quarter prior.

Facebook (FB), by contrast, posted strong fourth-quarter sales of $2.6 billion, driven by its success on mobile devices. Facebook's revenue rose 28% versus the third quarter. Twitter (TWTR) brought in a solid $243 million in fourth-quarter sales, up 44% versus the third quarter.

But LinkedIn's membership is growing faster than its rivals. In the fourth quarter, LinkedIn said membership rose to 277 million, up 6.9% from the prior quarter.

Investors punished Twitter earlier this week following its first quarterly report as a public company, after its monthly user base grew just 3.9% quarter-over-quarter to 241 million. Facebook also reported tepid fourth-quarter user growth, with its monthly user base rising 3.4% versus the quarter prior to 1.2 billion.

Of course, the comparisons between the three companies aren't exact.

LinkedIn relies less on advertising than Twitter and Facebook, for example, and earns a significant portion of its revenue from premium subscriptions -- 20% in the fourth quarter, to be exact. That equated to $88.1 million, up 10% versus the three months prior.

The company also relies heavily on its "talent solutions" business, which provides corporate recruiters with tools to promote jobs and search for candidates. That unit generated $245.6 million in fourth-quarter sales, more than half of LinkedIn's overall revenue and a gain of 9% versus the quarter prior.