Who says investors are afraid of risk? Biotechnology stocks, typically among the more speculative companies out there, are full of life this year.

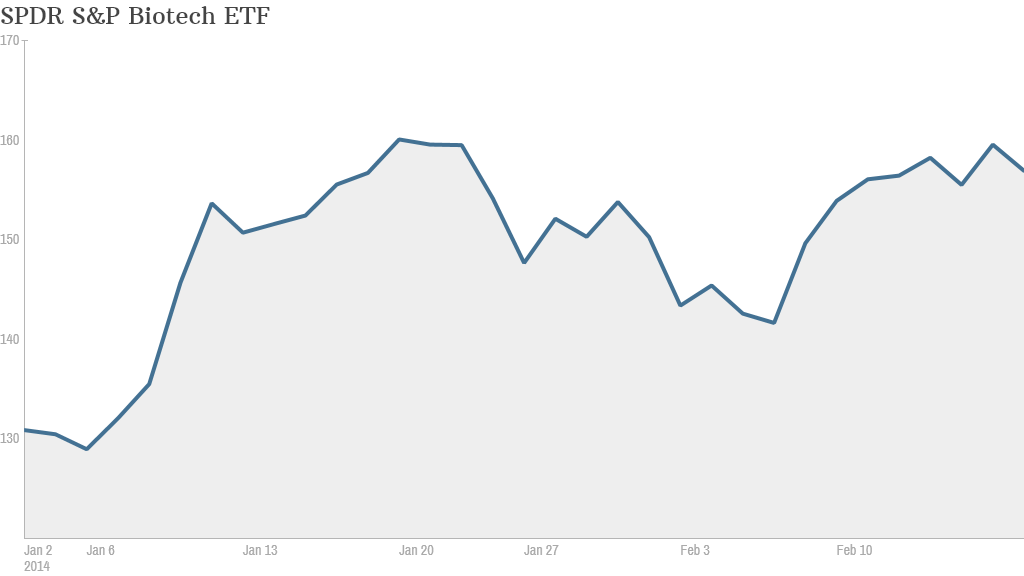

The SPDR S&P Biotech ETF (XBI) is up roughly 21%. And of the companies that have gone public so far in 2014, almost half have been development-stage biotechnology firms, according to Renaissance Capital.

One of those companies, Dicerna Pharmaceuticals (DRNA), soared over 200% from its IPO price on its first day of trading in late January.

So why do investors have such a healthy appetite for biotech?

It's the combination of innovation and a period of greater leniency from the Food and Drug Administration, according to Alan Carr, a biotech analyst with Needham and Company.

Biotechs have become successful at targeting rare diseases, Carr said. Instead of going after more common ailments like high cholesterol and diabetes with already established medications, many biotech firms are developing drugs for less common disorders whose treatments cost a lot more than most prescription medications.

NPS Pharmaceuticals (NPSP), for example, created a drug for treating short bowel syndrome. And Hyperion Therapeutics (HPTX) is developing a drug for hepatic encephalopathy, a decline of brain function that according to the National Institute of Health occurs when the liver is no longer able to remove toxins from the blood. Those stocks are up 20% and 40%, respectively, this year.

Related: Wall Street's next big bet? Cures for rare diseases

On the regulatory side, Carr said the FDA has helped shepherd a streamlined approval process for promising drugs, allowing for a simpler and quicker path to the market. "We've had a pretty flexible FDA recently," he said.

But the heavy investor interest in biotech also reflects that many of the larger companies are now mature and extremely profitable. The industry is not as risky as it used to be.

Carr said smaller biotechs typically would begin to develop new products and then partner with large pharmaceutical companies to get the drugs to market.

But now, biotechnology firms often do it all themselves.

"They're not dependent on big pharma for resources," Carr said. "Biotechs have discovered an alternative path that's successful."

To that end, Amgen (AMGN), Gilead Sciences (GILD) and Celgene (CELG) were all once small biotechs. But each company is now worth more than pharma giants such as Eli Lilly (LLY) and Abbott Labs (ABT) for example.

And changes in the traditional drug industry is also helping the biotechs. There has been a lot of speculation about more mergers, according to Boris Peaker, an analyst Oppenheimer.

That's because pharmaceutical companies are grappling with expiring patents and are losing ground to generic drugmakers. And with a lot of cash on hand, it makes more sense for pharmaceutical giants to go hunting for biotech firms so they can acquire more promising drugs for their pipelines, Peaker claims.

Related: Can drugmakers find profit in collaboration?

A flurry of acquisitions has already occurred in the past few years. Most recently, the Irish pharmaceutical conglomerate Shire (SHPG) bought Pennsylvania-based ViroPharma for $4.2 billion late last year. The deal gave Shire access to Cinryze, medicine for a rare blood disorder.

Still, investors have to realize that biotechs can be very volatile stocks. Many biotechs specialize in drugs that are still being tested, so failure is always a looming possibility.

Peaker added that some biotechnology stocks sport lofty valuations. Hyperion trades at nearly 50 times 2014 earnings forecasts for example, while NPS is valued at more than 100 times 2014 earnings estimates.

But Phil Nadeau, an analyst at Cowen and Company, thinks valuations are still reasonable. He said biotechs have showed solid earnings growth while the broader economy -- and growth in Big Pharma -- has been sluggish.

Gilead trades for 22 times earnings estimates and analysts are predicting earnings growth of more than 30% annually for the next few years. Celgene is also trading at around 22 times this year's forecasts and Wall Street is expecting long-term earnings growth of nearly 25% a year on average.

Good luck finding a big drug stock that exciting. The projected growth rates for Pfize (PFE)r, Merck (MRK) and J&J (JNJ) are all in the single-digits. So it's no wonder why investors are crazy for biotech.